Demographics, yield math, and sentiment form the core of Tom Lee’s case for a secular upswing—while policy shocks and commodities define the downside risk.

Quick Summary

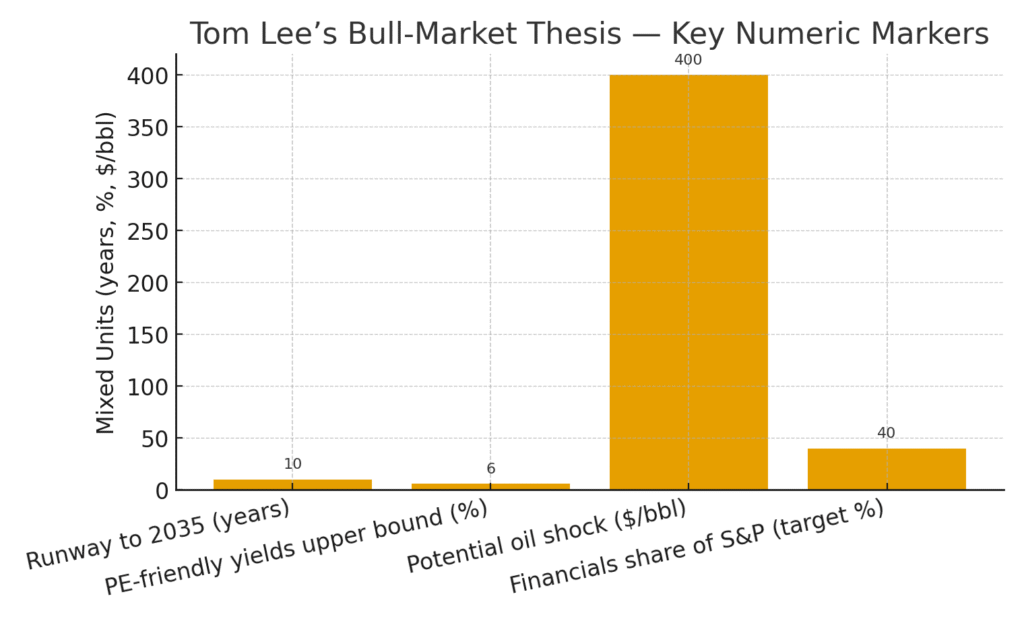

- 2035 is the likely peak for the millennial cohort—Lee’s timeline for this bull market, implying roughly a 10-year runway from today.

- Yields 2–6% are historically consistent with rising P/E multiples; above 6% becomes a headwind.

- Financials could re‑rate toward 40% of the S&P 500 as AI/blockchain boost US finance and data infrastructure.

- Watch the VIX “>60 then <30” bottom signal and two main risks: policy shocks and a commodity spike (e.g., oil toward $400/bbl).

Introduction

“We are in a new bull market.” That’s Fundstrat’s Tom Lee, making a demographic and sentiment‑based case that the equity cycle could extend until 2035. His view leans on three planks: (1) cohort math—bull markets tend to coincide with the rise of large generations; (2) yields vs. valuation—equities can rerate higher when nominal growth supports earnings; and (3) behavioral—skeptical investors and episodic shocks have repeatedly reset risk, preserving upside when growth persists. The counterpoints aren’t trivial—deficits, geopolitics, and energy—yet Lee argues that policy and dollar dynamics, plus US balance‑sheet assets and innovation, argue for resilience.

For global readers, the claim is bigger than one strategist’s outlook. If a US‑led cycle extends through the next decade, it shapes capital flows, sector leadership, and the pricing of risk worldwide—from financials and healthcare in developed markets to energy exporters sensitive to oil’s path. The rest of this piece translates Lee’s argument into testable datapoints and “tripwires” investors can watch.

Summary Statistics

| Metric | Value | Context |

|---|---|---|

| Bull‑market window (millennials) | Now to 2035 (~10 yrs) | Demographic peaks often line up with market tops; Lee places the millennial peak at 2035. |

| Prior generation “tops” | 1999 (Boomers), 2018 (Gen X) | Used as waypoints for long‑cycle equity peaks. |

| Yield range favorable to P/E | ~2% to 6% | In this band, nominal growth supports earnings and multiples; above ~6% derates risk assets. |

| Commodity shock threshold | Oil ≈ $400/bbl | Extremely high oil could strain households and margins—potential cycle breaker. |

| Sentiment marker | VIX > 60 then closes < 30 | Historically aligned with major market bottoms in Lee’s framework. |

| Sector leadership (potential) | Financials to ~40% of S&P | AI, data, and blockchain rails could expand finance’s market weight; healthcare also benefits. |

| Debt & deficits | Manageable with offsets | US public assets (land, resources, infrastructure rights) and USD dominance cited as buffers. |

| Key bear triggers | Policy shock; commodity spike | Fed‑driven liquidity withdrawal or extreme oil surge would challenge the thesis. |

| Speculation check | Margin debt not extreme | Lee cites ongoing skepticism; not the euphoria seen at secular tops. |

All figures reflect statements summarized from the source conversation with Tom Lee. Ranges and thresholds are illustrative “tripwires” rather than forecasts.

Analysis & Insights

Demographics as the slow engine. Lee’s long‑cycle roadmap assigns major tops to generational peaks: Boomers (1999), Gen X (2018), and millennials (2035). The mechanism isn’t mystical. As large cohorts hit prime earning and investing years, they accumulate financial assets, start businesses, and amplify consumption. That creates a durable floor under earnings and multiples—until the cohort’s influence wanes. If millennials peak around 2035, the argument goes, today’s setbacks (pandemic scars, inflation shock, rate resets) are interruptions, not trend breaks.

Yields, growth, and multiples. A second plank reframes the usual “rates up, stocks down” reflex. Lee points to a mid‑zone—roughly 2–6% on long yields—where higher nominal growth and pricing power can more than offset cost of capital, allowing P/E to rise. Only when yields exceed ~6% do they crowd out private investment and force derating. That puts bond‑market levels at the center of the equity debate: modest inflation and steady growth can be equity‑friendly even if yields don’t revisit the zero‑bound.

Policy and energy: the real bear catalysts. Lee’s two explicit “tripwires” are (1) a policy shock that slams liquidity (think 2022’s aggressive hiking cycle), and (2) a commodity spike so large that it dents household cash flow and compresses margins—he gestures toward oil near $400/bbl in today’s dollars. Either could end the party early. The practical takeaway isn’t to guess the date; it’s to monitor liquidity proxies and energy burden in real time.

Sentiment: bottoms love disbelief. In Lee’s playbook, extreme volatility can reset risk productively. He cites a historical pattern: when the VIX exceeds 60 and later closes below 30, it has coincided with durable bottoms. The broader point is behavioral: skepticism is still abundant—investors scarred by inflation and 2022’s drawdown remain quick to doubt rallies. That lack of euphoria is not what secular tops look like; he also notes margin debt hasn’t blasted through prior highs.

Debt optics vs. balance‑sheet reality. High deficits are a legitimate concern—especially if they push yields above that ~6% zone. But Lee counters that the US owns large, under‑recognized public assets (land, resource rights, agencies) that aren’t marked at market value, and that the dollar’s global role eases financing constraints. Whether one agrees, the investment angle is to price the path of yields and the resilience of dollar demand, not just the debt stock in isolation.

Sectors if he’s right. If a US‑centric innovation wave (AI, data, blockchain rails) compounds through the next decade, Lee expects a rerating of the financial complex—payments, market infrastructure, data/analytics, and capital‑light lenders—toward ~40% of the S&P 500. Healthcare also screens as a structural winner, tied to aging demographics, productivity tech, and AI‑enabled discovery. Cyclicals sensitive to energy costs would ebb and flow with the commodity path.

How to operationalize the thesis. Even if you disagree with the 2035 endpoint, Lee’s framework is useful because it’s observable. Watch (a) long yields vs. the ~6% tripwire; (b) energy burden vs. wages as oil moves; (c) forward EPS breadth and realized margins; (d) positioning and sentiment (e.g., VIX, margin debt, retail flows). For diversified allocators, the most practical adaptation is to favor earnings‑compounders with cash‑flow visibility and pricing power, add financial infrastructure/data exposures if the US innovation cycle persists, and keep a standing plan for policy/energy shocks (hedges, dry powder, or factor tilts).

Conclusion & Key Takeaways

- Demographics suggest runway: If millennials peak around 2035, a secular upswing still has time—set against intermittent shocks.

- Yields shape valuations: The 2–6% zone supports P/E; sustained moves above ~6% argue for derating and defensiveness.

- Tripwires are clear: Policy‑driven liquidity withdrawal or an extreme oil spike are the likely cycle killers.

- Leaders if right: Finance (toward 40% index weight) and healthcare benefit from data rails, AI, and demographics.

- Behavioral edge: Persistent skepticism and non‑euphoric positioning are not what major tops look like.

Source: Fundstrat’s Tom Lee — “A New Bull Market Until 2035?” (user‑provided transcript). Compiled on September 02, 2025.