In a significant development for the tech industry, a federal judge recently ruled that Alphabet, Google’s parent company, will not be required to divest its Chrome browser, a decision that has sparked widespread discussion among investors, analysts, and policymakers. This ruling, discussed in a recent CNBC “Fast Money” segment featuring Deepwater Asset Management’s Gene Munster, highlights the evolving landscape of antitrust regulation, artificial intelligence (AI), and market dynamics in the tech sector. The decision not only impacts Alphabet but also has ripple effects for competitors like Apple, Meta, Microsoft, and emerging players like Perplexity. This blog post explores the implications of this ruling, Alphabet’s strategic positioning, and the broader tech industry’s trajectory, supported by data and visual insights.

The Antitrust Ruling: A Win for Alphabet

The antitrust ruling marks a pivotal moment for Alphabet, which has faced intense scrutiny over its dominance in search and advertising. The decision to allow Google to retain control of its Chrome browser was described by Munster as a case where “the regulatory bark is much bigger than the bite.” This leniency is seen as a positive outcome for Alphabet, as it avoids a potentially disruptive breakup of its ecosystem. The ruling also benefits other tech giants like Apple and Meta, as it signals a more permissive regulatory environment than anticipated, allowing these companies to maintain their current business models without significant restructuring.

Alphabet’s stock surged by approximately 8% following the ruling, reflecting investor relief and renewed confidence in the company’s ability to navigate regulatory challenges. This market reaction underscores the significance of the decision, as it removes a major overhang that had previously weighed on Alphabet’s valuation compared to other “Magnificent Seven” tech giants, such as Nvidia, Apple, and Microsoft.

Financial Context: Alphabet’s Revenue Streams

To understand the broader implications of the ruling, it’s essential to examine Alphabet’s financial performance. In 2023, Alphabet generated $31.7 billion in advertising revenue through YouTube alone, a 2% increase from $31.1 billion in 2022. From Q4 2023 to Q3 2024, YouTube’s combined revenue from advertising and subscriptions exceeded $50 billion, highlighting its critical role in Alphabet’s portfolio. The company’s overall revenue is heavily tied to its search and advertising businesses, with the adtech segment accounting for approximately 9% of its total revenue, though it is less profitable than its core search operations.

The following table provides a snapshot of Alphabet’s key financial metrics for 2023 and 2024, illustrating the scale of its operations and the importance of its advertising ecosystem:

| Metric | 2023 | 2024 (Q4 2023–Q3 2024) |

|---|---|---|

| YouTube Advertising Revenue | $31.7 billion | $50 billion (combined) |

| Adtech Revenue (% of Total) | ~9% | ~9% |

| Google Search Market Share | 90%+ | 90%+ |

| Apple Search Deal (Annual) | $20 billion | $20 billion (est.) |

This data underscores Alphabet’s dominance in search and advertising, which remains largely intact following the antitrust ruling. However, the adtech case, which is still pending remedies, could pose a modest risk, with Munster estimating a potential 5% impact on Alphabet’s business due to its relatively lower profitability.

AI and Search: Alphabet’s Strategic Pivot

Beyond the immediate regulatory win, the ruling allows Alphabet to shift investor focus toward its advancements in AI, particularly in search. Google has been aggressively integrating AI into its core products, including AI Overviews and AI Mode, which are designed to enhance user engagement and maintain its competitive edge. Munster highlighted that Google’s click-through rates for AI-driven search features are comparable to traditional search metrics from a few years ago, a “really impressive” achievement that signals progress in adapting to new user behaviors.

This pivot to AI is critical as Alphabet faces growing competition from companies like Perplexity, which is squarely focused on AI-driven search, and Microsoft’s Bing, which holds a 4% market share despite significant investments over the past 15 years. The ruling’s emphasis on data sharing could provide a tailwind for competitors like Perplexity, which rely on access to vast datasets to refine their algorithms. Munster even suggested that Apple, a key partner in Google’s search ecosystem, could benefit by developing its own AI search product or acquiring a player like Perplexity to diversify its revenue streams.

The Apple-Google Search Deal: Status Quo or New Opportunities?

A significant aspect of the antitrust discussion revolves around Google’s $20 billion annual deal with Apple to remain the default search engine on iOS devices. This arrangement accounts for approximately 15% of Apple’s operating income, making it a critical partnership for both companies. The ruling allows Apple to renegotiate this deal annually, theoretically enabling it to “shop” the search contract to other providers, such as Microsoft’s Bing. However, Munster noted that Microsoft’s limited market share and historical struggles to gain traction in search make it unlikely to disrupt this partnership significantly.

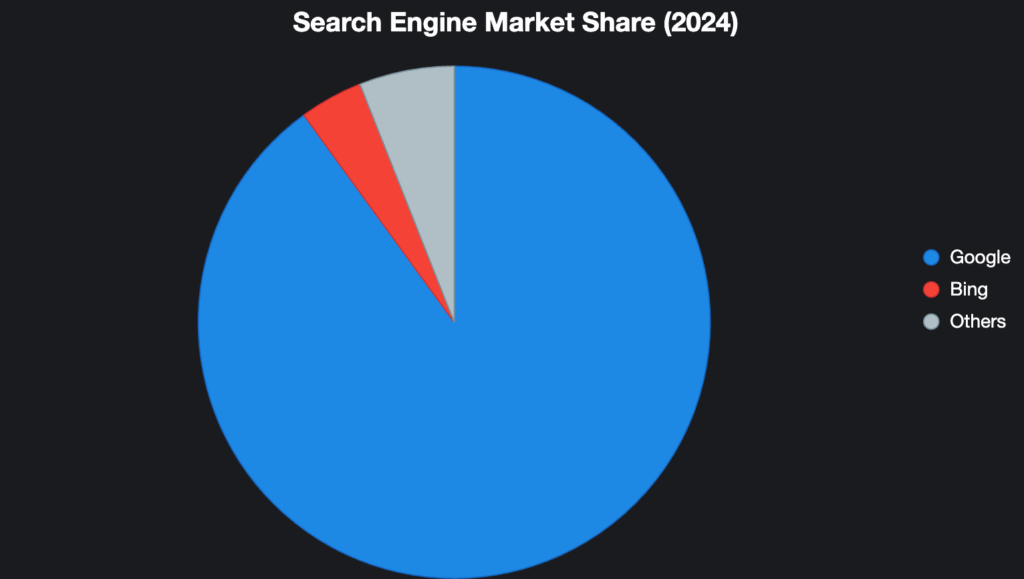

The chart below illustrates the market share of major search engines in 2024, highlighting Google’s dominance and the challenges faced by competitors:

This chart visually reinforces Google’s overwhelming lead in search, with 90% market share compared to Bing’s 4% and other players’ combined 6%. The data suggests that even with the opportunity to renegotiate, Apple is likely to maintain its partnership with Google, as alternative providers lack the scale and infrastructure to compete effectively.

Implications for Competitors and the Broader Industry

The ruling’s broader implications extend to other tech giants and emerging players. For Meta, the leniency in antitrust enforcement is a positive signal, though its stock did not react as strongly as Alphabet’s, which Munster found surprising. Meta’s advertising business, which competes with Google’s, could benefit from a less restrictive regulatory environment, allowing it to continue leveraging its vast user data for targeted advertising.

For Apple, the ruling reinforces the stability of its lucrative search deal with Google, but it also opens the door to strategic considerations. Munster suggested that Apple could explore developing its own AI search product, potentially through acquisitions like Perplexity, to reduce its reliance on Google and capture a larger share of the AI-driven search market. Such a move would align with Apple’s broader push into AI, as evidenced by recent integrations of AI features into its operating systems.

Emerging players like Perplexity stand to gain the most from the ruling’s data-sharing provisions. By accessing more data, Perplexity can enhance its AI-driven search capabilities, potentially challenging Google’s dominance in the long term. However, the scale of Google’s infrastructure and user base presents a formidable barrier to entry, suggesting that any disruption will be gradual.

The Road Ahead: Regulatory and Competitive Challenges

While the antitrust ruling is a clear win for Alphabet, it does not entirely eliminate regulatory risks. The pending remedies in the adtech case could still impact Alphabet’s business, though Munster estimates the effect to be limited, given that adtech represents a less profitable segment. Additionally, Alphabet’s ability to maintain its search dominance will depend on its continued investment in AI and user experience improvements.

Investors are increasingly optimistic about Alphabet’s prospects, as evidenced by Deepwater’s recent decision to buy Google stock. This optimism stems from both the regulatory relief and Google’s demonstrated progress in AI-driven search. However, the competitive landscape remains dynamic, with players like Perplexity and Microsoft continuing to innovate in the search space.

Conclusion: A Turning Point for Alphabet and the Tech Industry

The recent antitrust ruling marks a turning point for Alphabet, alleviating concerns about a potential breakup and allowing the company to focus on its AI-driven future. The decision reinforces Google’s dominance in search, with a 90% market share and a stable partnership with Apple, while also providing opportunities for competitors like Perplexity to leverage data-sharing provisions. For business leaders and policymakers, this ruling highlights the delicate balance between fostering competition and allowing innovation to thrive in a rapidly evolving tech landscape.

As Alphabet continues to navigate regulatory and competitive challenges, its ability to integrate AI into its core products will be critical to maintaining its market leadership. The tech industry, meanwhile, must grapple with the implications of a more lenient regulatory environment, which could shape the strategies of both established giants and emerging disruptors. For now, Alphabet’s victory is a reminder of its resilience and adaptability in the face of scrutiny, setting the stage for a new chapter in the tech industry’s ongoing evolution.

Sources: