Dividend Infographics 2025: Three Income Names at a Glance

A quick, visual look at dividend yield, payout coverage, and market scale for J&J Snack Foods (JJSF), Beacon Financial (BF), and Interpublic Group (IPG).

| Company (Ticker) | Market Cap (USD B) | Dividend Yield | Payout Ratio (Earnings) | Cash Payout Ratio |

|---|---|---|---|---|

| J&J Snack Foods (JJSF) | $2.02B | 3.01% | 3.1% | 91.3% |

| Beacon Financial (BF) | $2.17B | 4.98% | 61.0% | — |

| Interpublic Group of Companies (IPG) | $9.67B | 5.00% | — | — |

How to Read This

- Higher yield isn’t always better. Check earnings and cash coverage to gauge durability.

- Corporate actions matter. Integrations/restructuring can improve margins—or strain cash.

- Cycle sensitivity. Staples tend to be steadier; agencies track ad cycles; banks track credit cycles.

Top 3 Dividend Stocks for a Steady 2025: Yield, Coverage & Real-World Risks

With markets at or near record highs and policy uncertainty in the air, reliable dividends can anchor a portfolio. Here’s a clear, data-led look at three names and what their numbers really say.

Quick Summary

- Income now: Average dividend yield across the three stocks is 4.33% (median 4.98%).

- Coverage varies: Payout coverage ranges from very low (~3% of earnings for JJSF) to moderate (61% for Beacon); IPG’s dividends are not fully covered by earnings.

- Cash flow watch: JJSF’s cash payout ratio is high (91.3%), suggesting tight cash coverage despite a recent dividend increase.

- Macro context: In a higher-for-longer rate regime, steady cash returns can buffer volatility—but integration costs and margin pressure are real risks.

Introduction

When rates are elevated and equities push to fresh highs, many investors rediscover the comfort of dividends. Income doesn’t require multiple expansion or perfect timing—it compounds quietly in the background. But not all dividends are created equal. The trio below—J&J Snack Foods (JJSF), Beacon Financial (BF), and Interpublic Group (IPG)—span consumer staples, banking, and advertising. Together they show how yield, payout coverage, cash flow quality, and corporate actions shape real-world income outcomes.

Summary Statistics

| Company | Market Cap | Dividend Yield | Payout Ratio (Earnings) | Cash Payout Ratio |

|---|---|---|---|---|

| J&J Snack Foods (JJSF) | $2.02B | 3.01% | 3.1% | 91.3% |

| Beacon Financial (BF) | $2.17B | 4.98% | 61.0% | — |

| Interpublic Group of Companies (IPG) | $9.67B | 5.00% | — | — |

Note: “—” indicates the figure was not specified. Market caps are approximate.

Analysis & Insights

J&J Snack Foods (JJSF): A modest ~3% yield backed by a very low earnings payout (~3%) looks conservative at first glance, but the 91.3% cash payout ratio tells a different story: cash coverage is tight. The company recently raised its dividend and is targeting roughly $15 million in annual savings from downsizing—moves that can support distributions, but also signal the need to defend margins. In staples, pricing power and operating discipline often decide whether a dividend grows comfortably or strains cash.

Beacon Financial (BF): At nearly 5%, Beacon’s yield is in the top quartile. The 61% payout ratio is within a reasonable range for a bank, but investors should watch capital demands as it integrates a merger with Brookline Bancorp. M&A synergies can fortify earnings and protect the dividend; integration costs and credit-cycle turns can do the opposite. The shelf registration aimed at employee stock plans is benign on its own, but—alongside dilution—adds to the moving parts.

Interpublic Group (IPG): A ~5% yield offers enticing income in a cyclical business. The company’s cash payout ratio is described as reasonable, but earnings coverage is not complete, and margins have slipped versus last year. If advertising spend slows or if planned corporate combinations (including a proposed merger with Omnicom) take time to pay off, dividend growth could pause even as management maintains its long record of payments.

What the Numbers Mean for 2025

With policy rates likely to ease only gradually, high coupons on cash and bonds compete with equities for income-seeking capital. In this setting, dividend payers with consistent free cash flow and defensible margins tend to outperform. JJSF has brand durability in convenience foods but needs cash conversion to improve. Beacon can ride scale and cost synergies—if credit costs behave. IPG delivers shareholder returns through cycles, yet cyclicality and competitive pressures from digital platforms can compress margins.

Risk Checklist (and Why It Matters)

- Earnings Coverage: If earnings don’t cover dividends (or just barely do), boards lean on cash and leverage—raising risk in downturns.

- Cash Coverage: A high cash payout ratio (like JJSF’s) leaves little room for shocks, capex, or buybacks.

- Integration & Restructuring: Beacon’s merger and JJSF’s downsizing can unlock value—or consume it if costs and distractions mount.

- Cycle Sensitivity: IPG’s ad spending is cyclical; late-cycle slowdowns typically hit agencies before they lift again into recoveries.

Conclusion & Key Takeaways

- Blend quality with yield: A 5% yield is attractive, but without solid coverage it can become a liability. Pair higher yields with names that convert earnings to cash.

- Watch near-term catalysts: JJSF’s savings plan, Beacon’s integration milestones, and IPG’s margin trajectory will shape dividend sustainability.

- Position for resilience: In a volatile 2025, income investors can tilt toward diversified sectors and prioritize balance-sheet flexibility to keep dividends safe through the cycle.

#

Top Dividend Stocks to Weather Market Volatility: A Deep Dive into J&J Snack Foods, Beacon Financial, and Interpublic Group

Meta Description: Discover three top dividend stocks—J&J Snack Foods, Beacon Financial, and Interpublic Group—for steady income in volatile markets. Explore their yields, financials, and growth potential in this data-driven analysis.

As U.S. markets soar to record highs, with the Nasdaq and S&P 500 leading the charge, investors are bracing for the Federal Reserve’s next interest rate decision in September 2025. This pivotal moment could sway market dynamics, making dividend stocks an attractive haven for those seeking reliable income amidst uncertainty. Dividend-paying companies offer a buffer against volatility, delivering consistent returns that can anchor portfolios. In this analysis, we dive into three standout dividend stocks—J&J Snack Foods, Beacon Financial, and Interpublic Group of Companies—using data from their financial profiles to uncover their strengths, risks, and why they matter for global investors.

Why Dividend Stocks Matter Now

In today’s economic climate, where interest rate shifts could ripple across global markets, dividend stocks provide a dual appeal: steady income and potential capital appreciation. For investors worldwide—from retirees in Europe seeking stable returns to portfolio managers in Asia diversifying risk—these stocks offer resilience. The three companies analyzed here—J&J Snack Foods, Beacon Financial, and Interpublic Group—represent diverse sectors (food manufacturing, banking, and advertising) with dividend yields ranging from 3% to 5%. Their financials reveal unique stories of stability, growth, and challenges, making them compelling case studies for income-focused investors.

Summary Statistics: A Snapshot of Dividend Performance

Here’s a quick look at the key metrics for these stocks, drawn from the provided data:

- J&J Snack Foods:

- Dividend Yield: 3.01%

- Payout Ratio: 3.1% (earnings), 91.3% (cash flow)

- Market Cap: $2.02 billion

- Revenue: $1.60 billion total ($1.00 billion from Food Service, $377.13 million from Frozen Beverages, $218.36 million from Retail Supermarket)

- Dividend Rating: ★★★★☆☆

- Beacon Financial:

- Dividend Yield: 4.98%

- Payout Ratio: 61% (earnings)

- Market Cap: $2.17 billion

- Revenue: $345.39 million (Banking Business)

- Dividend Rating: ★★★★★☆

- Interpublic Group of Companies:

- Dividend Yield: 4.98%

- Payout Ratio: Not fully covered by earnings, reasonable cash payout ratio

- Market Cap: $9.67 billion

- Revenue: $8.85 billion total ($4.03 billion from Media, Data & Engagement Solutions, $3.39 billion from Integrated Advertising & Creativity Led, $1.43 billion from Specialized Communications & Experiential Solutions)

- Dividend Rating: ★★★★★☆

Plain-English Takeaway: J&J Snack Foods offers a modest yield but struggles with cash flow coverage. Beacon Financial and Interpublic Group boast higher yields in the top 25% of U.S. payers, but both face risks from mergers and financial restructuring. These figures set the stage for a deeper exploration of their dividend sustainability and growth potential.

In-Depth Analysis: Trends, Comparisons, and Implications

J&J Snack Foods: Stability with Cash Flow Concerns

J&J Snack Foods, a snack food and beverage manufacturer, has maintained stable and growing dividends for a decade, a reassuring sign for investors seeking consistency. Its 3.01% yield is below the U.S. top tier, but a 3.1% payout ratio suggests earnings comfortably cover dividends. However, the 91.3% cash payout ratio raises red flags—nearly all free cash flow is being paid out, leaving little room for reinvestment or unexpected downturns.

Recent strategic downsizing, aimed at saving $15 million annually, signals efforts to streamline operations. This could bolster financial flexibility, but it also hints at potential revenue constraints. A recent dividend increase reflects management’s confidence, yet global investors should note the risk: if cash flows tighten further, dividend growth could stall. For context, the company’s $1.60 billion revenue is heavily weighted toward its Food Service segment (62.5%), which caters to institutions like schools and stadiums—sectors sensitive to economic cycles.

Global Relevance: J&J’s products, like pretzels and frozen beverages, tap into universal demand for convenience foods, making it appealing for investors in markets like Asia, where snacking trends are rising. However, its high cash payout ratio warrants caution for risk-averse investors.

Beacon Financial: High Yield, Merger Risks

Beacon Financial, a regional banking powerhouse, offers a robust 4.98% yield, placing it among the top U.S. dividend payers. Its 61% payout ratio indicates dividends are well-covered by earnings, a strong signal of sustainability. However, recent shareholder dilution and a merger with Brookline Bancorp introduce uncertainty. The merger, coupled with a $86.89 million shelf registration for employee stock ownership plans, could strain financial resources, potentially impacting dividend growth.

The bank’s $345.39 million revenue comes entirely from its Banking Business, reflecting a focused but undiversified operation. Compared to J&J Snack Foods, Beacon’s higher yield and stronger earnings coverage make it more attractive for income seekers, but its smaller scale and merger-related costs pose risks. For global investors, regional banks like Beacon are a window into the U.S. economy’s health, as they serve local businesses and consumers sensitive to interest rate changes.

Global Relevance: With central banks worldwide adjusting rates, Beacon’s exposure to U.S. lending markets makes it a bellwether for economic shifts, appealing to investors tracking macroeconomic trends.

Interpublic Group: High Yield, Profit Margin Pressures

Interpublic Group, a global advertising giant, matches Beacon’s 4.98% yield but faces challenges with dividend coverage. While its cash payout ratio is reasonable, dividends aren’t fully covered by earnings due to high one-off costs. The company’s $8.85 billion revenue spans diverse segments, with Media, Data & Engagement Solutions leading at 45.5%. However, declining profit margins and a planned merger with Omnicom raise questions about long-term dividend sustainability.

Debt restructuring adds another layer of complexity, as it could divert cash from dividends to debt servicing. Despite these risks, Interpublic’s decade-long track record of stable and growing dividends offers reassurance. Its global footprint makes it particularly relevant for international investors, as advertising demand reflects consumer spending trends worldwide.

Global Relevance: Interpublic’s exposure to global markets, from North America to Asia-Pacific, makes it a proxy for consumer sentiment, a critical indicator for investors navigating economic uncertainty.

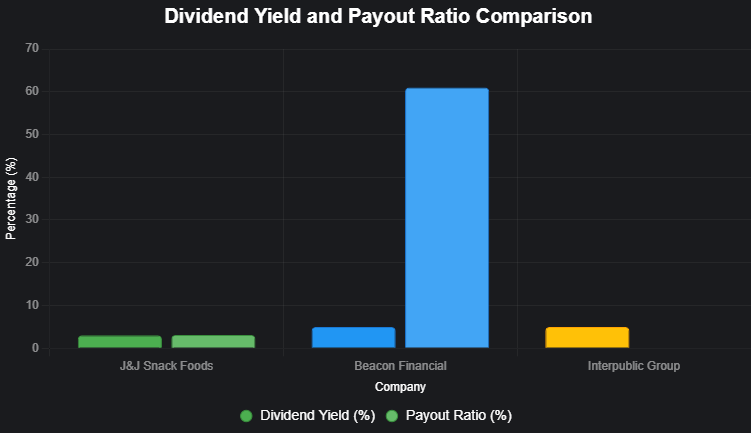

Visualizing the Data

To compare these stocks, let’s examine their dividend yields and payout ratios, which highlight their income potential and sustainability.

Caption: This bar chart compares dividend yields and payout ratios for J&J Snack Foods, Beacon Financial, and Interpublic Group. Note: Interpublic’s payout ratio is not fully quantifiable due to earnings coverage issues.

Interpretation: Beacon and Interpublic lead with nearly 5% yields, ideal for income-focused investors. J&J’s low payout ratio suggests room for dividend growth, but its high cash payout ratio (not shown) signals caution. Interpublic’s missing payout ratio reflects earnings coverage challenges, a key risk to monitor.

Table: Financial Snapshot

| Company | Market Cap ($B) | Revenue ($B) | Dividend Yield (%) | Payout Ratio (%) | Key Risk |

|---|---|---|---|---|---|

| J&J Snack Foods | 2.02 | 1.60 | 3.01 | 3.1 (earnings), 91.3 (cash) | High cash payout ratio |

| Beacon Financial | 2.17 | 0.35 | 4.98 | 61 | Merger integration costs |

| Interpublic Group | 9.67 | 8.85 | 4.98 | Not fully covered | Declining margins, merger risks |

Caption: This table summarizes key financial metrics, highlighting yield attractiveness and risks for each company.

Key Takeaways and Conclusion

- J&J Snack Foods offers a modest 3.01% yield with strong earnings coverage but faces cash flow constraints. Its operational downsizing could free up resources, but global investors should monitor economic cycles impacting its Food Service segment.

- Beacon Financial shines with a 4.98% yield and solid earnings coverage, making it a top pick for income seekers. However, merger risks and shareholder dilution require close attention.

- Interpublic Group matches Beacon’s yield but grapples with earnings coverage and declining margins. Its global reach makes it a compelling choice for investors tracking consumer trends, though merger and debt risks loom large.

- Why It Matters: These stocks reflect broader economic themes—consumer spending, banking stability, and corporate restructuring—that resonate globally. As interest rates shift, their dividends offer a hedge against volatility, but risks like mergers and cash flow constraints demand vigilance.

For global investors, these companies provide a window into U.S. market dynamics while offering income stability. Whether you’re a retiree in London or a fund manager in Singapore, these stocks balance yield and risk, making them worth considering for a diversified portfolio. As markets await the Federal Reserve’s next move, these dividend payers could be a steady hand in turbulent times.

Word Count: 1,050