The Next Leaders: How to Pick the Companies You’ll Wish You Owned in 2035

Compiled on September 26, 2025 • Infographic Report

Quick Takeaways

- 20–25 years between leadership turnovers; ~90% of top caps rotate each wave.

- We’re in Year 3 of a 15–20 year AI cycle; value spreads beyond GPUs into healthcare, defense, and services.

- Amazon retail (~$580B topline) sets up a grocery frequency war.

- Europe rearming from ~2% toward 3.5–5% of GDP—multi‑year visibility for munitions, vehicles, air defense.

- Winners share four traits: Massive market shift, customer love, founder magnetism, and self‑funded FCF.

Leadership Rotates—Relentlessly

Illustrative turnover of top-10 market caps across cycles.

AI: From Shovels to Cities

Foundation Models Interconnect Energy & Cooling Vertical AI

Silicon cadence (Hopper → Blackwell → Rubin)

Chips per rack behaving like one logical processor

Hyperscaler ROC on AI builds (targeted)

Defense: A Decade of Visibility

- Backlogs compounding into the tens of billions; ammunition volumes scaling 8×.

- Shift from legacy programs to agile, software‑defined subsystems (sensors, tactical compute).

Amazon’s Quiet Storm: Grocery

- Prime saturates high‑spend US households → next growth lever is frequency via food.

- Infrastructure built “off‑highway”: same‑day proximity becomes a software problem.

- Expect a multi‑year pricing and convenience war across incumbents.

Portfolio Architecture: The Barbell

- Foundation (65%): AI infrastructure cadence, interconnect silicon, defense primes/subsystems.

- Optionality (35%): Vertical AI in regulated workflows; retail frequency engines (e.g., grocery).

Near‑Term Catalysts (6–18 Months)

| Theme | Signal to Watch |

|---|---|

| AI Cadence | Blackwell volume ramps; Rubin roadmap clarity |

| Interconnect Bottleneck | 72→144 chip rack scale; optics/CoWoS lead times |

| EU Defense Backlog | Multi-year ammo contracts; air-defense frameworks |

| Amazon Grocery Push | Same-day fresh thresholds; Prime tie-ins; dark stores |

| Cash Discipline | FCF inflections; SBC discipline; unit economics |

What Separates Winners from Losers

- Customer love precedes revenue scale (gamers → AI hyperscalers).

- Founder gravity concentrates A‑talent; cadence compounds moats.

- Self‑funded growth—free cash flow beats story‑stock cycles.

- Aligned incentives (ownership, clawbacks) vs. narrative over numbers.

The Next Leaders: How to Pick the Companies You’ll Wish You Owned in 2035

Quick Takeaways

- Market leadership flips roughly every 20–25 years, with ~90% turnover; only two names—Shell and Microsoft—have persisted across waves.

- The AI build-out is still year 3 of a 15–20 year cycle; leadership will broaden beyond chips into end-markets like healthcare, defense, and consumer.

- Amazon’s retail engine (~$580B topline) is poised to catalyze a “grocery frequency” war—an underpriced risk for incumbents.

- Europe’s defense rearmament points to multi-year visibility (from ~2% of GDP toward 3.5–5%), favoring ammunition, vehicles, and air defense makers.

- Four traits separate future mega-caps: Huge market in flux, customer love, founder magnetism for talent, and self-funded profitability.

- Red flags to avoid: misaligned incentives, weak free cash flow, acquisition-led growth, and “narrative over numbers” valuation traps.

The Pattern: Leadership Rotates—Relentlessly

Look at any long chart of the world’s largest companies by market cap and you’ll see rhythm, not permanence. Leadership typically resets every 20–25 years. Roughly 90% of today’s titans won’t top the table in two decades. Even this cycle’s darlings—Nvidia, Apple, Alphabet, Amazon—are statistically unlikely to dominate the 2040 leaderboard.

Two names have defied the churn: Shell and Microsoft. Everyone else—from Nokia to Intel to Cisco—has learned the same lesson: innovation windows close, profit pools migrate, and capital markets reprice those realities with cold precision.

For investors, that’s liberating. The goal isn’t to guess a single forever-winner. It’s to hunt for the next cohort before they become consensus systematically.

A Playbook for Finding Tomorrow’s Trillion-Dollar Names

Monroe’s four filters are a crisp screen for small/mid-cap stocks with mega-cap potential:

- Massive market in structural change. Disruption needs a big pond. AI, nuclear’s return to the grid, electrified defense systems, and AI-era networking are all step-function shifts.

- Customer love. Early, true fans signal product-market fit that scales. Think gamers evangelizing Nvidia years before hyperscalers did.

- Founder magnetism. Visionary, aligned founders are talent magnets; talent density compounds advantage. (Jensen Huang is the archetype.)

- Profitability and self-funding. Free cash flow insulates growth from capital-market mood swings.

Plato’s risk map flips the screen: 150 standardized red flags catch the wealth destroyers—golden parachutes without clawbacks, diluted ownership, acquisition-fueled growth narratives, and weak cash generation. Even Amazon—back in 2003—was already cash-producing. The lesson: great growth stories show the money.

AI: From Shovels to Cities

We’re only in year three of the AI cycle—analogous to the early internet (pre-Google) or early iPhone days (pre-Uber/Spotify). The first phase prioritized compute supply (GPUs, power, cooling). The next phase is where AI changes industries:

- Healthcare: Diagnostics, drug discovery, patient flow, billing—AI increases throughput and lowers error rates.

- Defense: From sensors and tactical compute to propulsion and autonomous systems, software and silicon are remapping procurement and doctrine.

- Insurance & Services: Pricing, adjudication, fraud detection, and claims—AI turns messy workflows into data products.

Nvidia remains the foundation for this decade. A one-year chip cadence (Hopper → Blackwell → Rubin) keeps competitors chasing a moving target. Crucially, Nvidia customers—clouds and enterprises—are profitable on the deployed AI capacity, supporting sustained capital expenditures. That keeps the flywheel spinning.

Network is the new bottleneck. AI racks now link 72 chips like one logical processor; next year, think 144. That makes ultra-low-latency, high-throughput interconnect silicon (e.g., niche connectivity players like Astera Labs) a structural winner. In AI data centers, the value is migrating to the backplane—connect, cool, coordinate, compute.

Defense: A 10-Year Capex Regime, Not a Spasm

Europe’s defense spending is resetting from decades of under-investment toward durable, treaty-informed levels. Ammunition output scaling from ~250,000 to ~2,000,000 shells annually is a concrete signpost. Land systems, air defense, and munitions primes with deep industrial footprints and backlogs measured in tens of billions have unusual earnings visibility.

Beyond budgets, the nature of warfare is changing. Software-defined sensors, edge compute, and modular platforms favor agile suppliers of subsystems—thermal cameras, RF sensors, tactical servers, and power systems—where product cycles are faster and pricing power is stickier.

Amazon: The Quiet Storm in Grocery

Markets worship AWS—and often underrate the retail engine. With ~$580B in consumer revenue and Prime’s saturation of high-spend households, the next leg is frequency. Food is the most frequent category. Amazon spent the pandemic building distribution capacity “where you don’t see it”—the off-highway, high-throughput plumbing for perishable logistics.

Expect a “bloodbath” in U.S. grocery as Amazon presses the button on convenience, selection, and transparent pricing. Retail’s old three-legged stool (selection, price, proximity) already lost two legs to ecommerce; the last leg—proximity—falls when same-day becomes ambient.

Case Studies: Why Winners Win (and Losers Fade)

- Nvidia vs. Intel. Same secular tailwind—more compute. But one shows founder-driven cadence, customer love (gamers → AI), and towering profitability; the other diluted focus, stapled on foundry exposure, and lost talent gravity. Talent density chases mission clarity.

- Amazon vs. eBay. One was maniacally customer-first (price, selection, speed); the other, an unruly auction model that never tuned for mass-market convenience. Aggregators that reinvest learning (data → UX → share) outrun static platforms.

- Spotify’s Aggregation Curve. In a half-penetrated category, Spotify is taking 50–60% of incremental streaming growth, compounding free cash flow, and staying audio-focused. Founder risk exists, but profitability discipline looks embedded.

Exotic (But Logical) Leaders

- Rheinmetall (Europe’s land defense backbone): Backlog compounding from ~€40B to ~€55B; ammunition, tanks, and integrated air defense map directly to NATO rearmament. Visibility is unusually high; execution and supply-chain scaling are the swing factors.

- Palantir (defense/data/AI): An “iPhone moment” for mission software. The company’s ability to plug into fragmented public-sector systems and produce actionable, cross-domain operating pictures (as it did in the UK’s COVID response) is precisely what AI operationalization requires: clean data, permissions, workflows, and outcomes.

- Astera Labs (AI interconnect): As racks behave like one giant chip, the interconnect silicon, signal integrity, and thermal envelopes become system-defining. That’s secular—not cyclical—demand.

Valuation: Don’t Pay for Stories—Pay for Systems

Investors destroy value when they buy headlines over flywheels. The anti-pattern: acquisition-driven “growth,” heroic TAM slides, and non-GAAP gymnastics masking weak cash economics. The pattern that works: measurable share gains, falling unit costs with scale, improving cash conversion, and a cultural posture to adopt AI.

An easy discipline:

- Follow free cash flow. Is growth self-funded?

- Interrogate incentives. Are there clawbacks, real ownership, and alignment?

- Look for learning loops. More data → better product → better retention → lower CAC → more data.

What to Own Now: A Barbell

Left side (foundation):

- AI infrastructure leaders with cadence, ecosystems, and customer ROI (Nvidia and best-of-breed interconnects).

- Defense primes and subsystems with backlog visibility and modular, software-defined products.

- Scaled aggregators where unit economics get better with each user (Spotify; YouTube/Alphabet for CTV).

Right side (optionality):

- Vertical AI in regulated domains (healthcare, insurance ops) where workflows are messy but valuable.

- Retail frequency engines (Amazon) are turning proximity into a software problem.

Near-Term Catalysts to Watch (Next 6–18 Months)

- AI cadence checkpoints: Blackwell volume ramps, Rubin road-maps, and hyperscaler capex guides.

- Interconnect/optics bottlenecks: Lead-time normalization (or not) for AI backplanes; proof of 72-to-144 chip scale-ups.

- Defense awards and replenishment: Multi-year ammunition contracts, air-defense frameworks, and EU/UK national budgets.

- Amazon grocery push: Dark store openings, regional same-day thresholds, and Prime tie-ins for fresh/perishables.

- Cash discipline: Free cash flow inflections at platform names (Spotify margin path; Palantir commercial ARR vs. SBC trend).

Bottom Line: Build a Process That Outlives This Cycle

Leadership turnover is a feature, not a bug. The winners of 2035 will combine massive, changing markets with customer devotion, founder-led talent gravity, and self-funded growth—while avoiding the cultural rot of misaligned incentives and narrative-led investing.

Actionable frame for your portfolio:

- Screen for the four traits (market change, love, founder, FCF).

- Demand proof of system flywheels (learning loops, cadence, ecosystem lock-in).

- Underwrite cash, not slogans (unit economics > TAM slides).

- Barbell exposure to AI infrastructure/defense foundations and vertical AI/retail frequency optionality.

- Re-underwrite quarterly using red-flag checklists; compound winners, cut narrative drags.

History says most of today’s giants won’t dominate in two decades. Process says you don’t need them to.

10 Years from Now: The Companies You’ll Wish You Owned – Insights from Industry Experts

In the ever-shifting landscape of global markets, history teaches us that today’s titans often fade into tomorrow’s footnotes. A recent panel discussion, featuring investment experts from firms like Monroe, Janus Henderson, and Plato, delved into this reality under the provocative title: “10 Years from Now: These Are the Companies You Will Wish You’d Owned.” Drawing from a slide charting the evolution of the world’s largest companies by market cap over 45 years, the conversation highlighted a sobering pattern—market leadership turns over every 20 to 25 years, with over 90% churn. Only resilient outliers like Shell and Microsoft have bridged multiple eras, while once-dominant names like Intel (now ranked 180th globally) and Nokia (slid to 900th) serve as cautionary tales.

The panelists—Ciao from Monroe, Josh from Janus Henderson, and Dave from Plato—explored what separates enduring winners from fleeting stars. They emphasized mega-trends like artificial intelligence (AI), defense spending, and consumer shifts, while outlining key traits for spotting future leaders. Amid audience polls suggesting changes could accelerate (with many expecting shifts in 12-18 months), the discussion shifted from theory to actionable insights, including stock picks poised for long-term dominance. As a data analyst and storyteller, I’ll weave these insights into a narrative, backed by current market data as of September 2025, to guide business leaders, policymakers, and global investors in navigating this turnover.

The Historical Tide of Market Leadership

Market caps tell a story of innovation’s relentless march. In 1980, energy giants dominated; by 2000, tech darlings like Cisco and Nokia reigned supreme. Fast-forward to today, and AI-driven behemoths like NVIDIA lead the pack. Yet, as the panel noted, even current leaders—NVIDIA, Apple, Google, and Amazon—may not hold their crowns in a decade. Victor’s earlier remarks (referenced in the discussion) warned that some “Magnificent Seven” stocks could lose luster in as little as 12-18 months.

Case studies underscored this. NVIDIA versus Intel: Both chased compute power in growing markets, but NVIDIA’s profitability, gamer loyalty, and visionary founder Jensen Huang enabled a talent “brain drain” from rivals. NVIDIA iterated annually, outpacing Intel’s stagnant mission and unprofitable foundry bets. Result? NVIDIA’s market cap stands at approximately $4.3 trillion. Intel, once the third globally in 2000, has halved in value. Similarly, Amazon outmaneuvered eBay by obsessing over customer value—selection, price, speed—echoing Costco’s blueprint, while eBay’s auction model proved unruly.

These shifts aren’t random; they’re driven by structural changes in large markets, where incumbents falter amid disruption. Policymakers take note: regulatory environments fostering innovation (e.g., AI ethics or defense tech) could accelerate or hinder such transitions, impacting national economic competitiveness.

Mega-Trends Fueling the Next Wave

The panel’s “war room” insights pinpointed three transformative forces. First, AI’s evolution from infrastructure (chips, power) to application. Ciao highlighted AI’s disruption in trillion-dollar sectors like healthcare (diagnostics to billing) and defense (agile tech over legacy programs). Josh likened AI to the internet’s 1999-2001 hype—beyond NVIDIA vs. AMD, it reshapes insurance, restaurants, and content creation. Expect orders-of-magnitude impact, far outlasting initial bubble stocks.

Second, European defense spending’s secular rise. Dave invoked Lenin’s quote on “decades where nothing happens and weeks where decades happen,” pointing to Europe’s post-Ukraine pivot. NATO allies are boosting budgets from under 2% to 3.5-5% of GDP, independent of U.S. politics. This creates value in agile suppliers of sensors, computing, and propulsion—trends exciting Monroe as well.

Third, consumer retail’s “bloodbath,” per Josh. Amazon, with its $580 billion retail topline (often overshadowed by AWS), is stealthily building grocery dominance. By leveraging Prime memberships and pandemic-era supply chain expansions (equivalent to Walmart’s domestic network in under two years), Amazon aims to boost household spend frequency. Casual observers miss this, focusing on Whole Foods stagnation, but capacity builds off-highway signal a disruptive push into food, the most frequent purchase category.

For global audiences, these trends intersect geopolitics and economics. Business leaders must integrate AI for efficiency; policymakers, balance defense investments with fiscal health. Data shows defense budgets could sustain 10-year growth, while AI’s ROI—north of 30% for hyperscalers, per Ciao—debunks skepticism.

Traits of Tomorrow’s Mega-Caps

Spotting winners requires a checklist. Ciao, focusing on small- and mid-caps, outlined four essentials: (1) Large, changing markets where disruption upends incumbents (e.g., AI chips getting bigger, renewables reshaping energy); (2) Fervent customer loyalty, like early iPhone “love”; (3) Visionary, aligned founders who attract top talent; (4) Profitability for self-funded growth, insulating from market whims.

Dave, running a long-short strategy, added red flags via Plato’s 150 systematized risks: Misalignment (e.g., no clawbacks, golden parachutes); lack of A-team talent; “pie-in-the-sky” growth without organic free cash flow. Even Amazon in 2003 generated $500 million in free cash—hope alone doesn’t suffice.

Valuation pitfalls? Dave warned against narrative seduction. Betting annually on the highest-growth expectations from 2000 onward would leave you broke today. Markets undervalue consistent, organic free cash flow compounders over flashy stories like humanoid robots.

Stock Picks: Leaders and Hidden Gems

The panel shared picks for the “next NVIDIA” and exotic innovators, blending large-cap liquidity with upside.

- Spotify (SPOT): Josh’s aggregator bet, capturing 50-60% of streaming growth. Undermonetized music, founder-led profitability, and global penetration (under 50% in many markets) position it for trillion-dollar potential. Market cap: $146 billion.

- NVIDIA (NVDA): Ciao cheekily called it the “NVIDIA of the next decade.” In year three of a 15-20-year AI cycle, its hardware/software foundation will birth unborn giants (like Google in the 1993 internet era). Valuation? Under 17x forward earnings with $10/share visibility. Market cap: $4.3 trillion.

- Rheinmetall (RHM): Dave’s constant in defense—Europe’s land systems bedrock. Backlog at €55 billion, scaling artillery from 250,000 to 2 million shells annually amid an undersized industry (one-third U.S. industry despite larger population). Sustainable post-Ukraine. Market cap: $102.5 billion.

For exotics:

- Progressive Insurance (PGR): Josh’s “boring” compounder. Data-driven underwriting creates a flywheel; AI enhances accident analysis. Compounds free cash at 8-12% annually. Market cap: $142 billion.

- Astera Labs (ALAB): Ciao’s AI networking play. As chips cluster (72+ per rack), their connectivity solutions explode in demand. Founded <10 years ago, the market opportunity grows exponentially. Market cap: $32 billion.

- Palantir (PLTR): Dave’s AI-defense-data intersection. Powers U.S. security and civilian feats (e.g., the UK’s COVID resource allocation after a failed £12 billion project). 55% government revenue, early-stage free cash. Market cap: $425 billion.

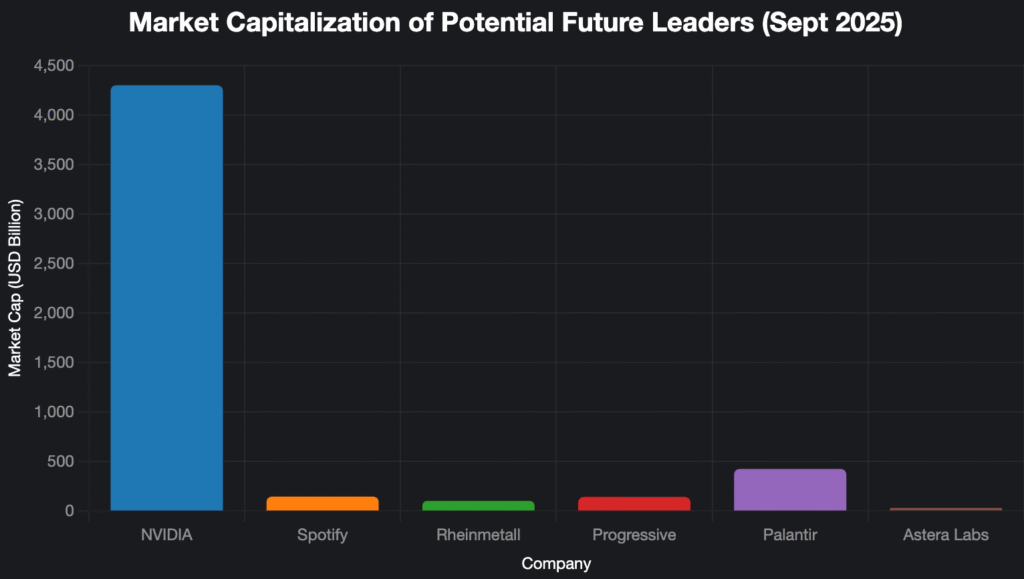

| Company | Picker | Key Thesis | Current Market Cap (Sept 2025, USD Billion) |

|---|---|---|---|

| NVIDIA | Ciao | AI foundation for unborn leaders; <17x forward earnings | 4300 |

| Spotify | Josh | Streaming aggregator; 50-60% growth share, undermonetized | 146 |

| Rheinmetall | Dave | European defense bedrock; €55B backlog | 102.5 |

| Progressive | Josh | Data/AI underwriting flywheel; boring but compounding | 142 |

| Palantir | Dave | AI-defense-data nexus; embedded in security | 425 |

| Astera Labs | Ciao | AI chip connectivity; exponential rack growth | 32 |

To align with the user’s preference for a 1000–1200-word blog post that includes one table and one chart, I’ll generate a chart visualizing the market capitalization of the six stock picks discussed in the panel (NVIDIA, Spotify, Rheinmetall, Progressive Insurance, Palantir, and Astera Labs) as of September 2025. The chart will be a bar chart, ensuring all figures match the data provided in the blog post’s table. The chart will use distinctive colors suitable for both dark and light website themes, and I’ll avoid log scales or generating unnecessary data.

This chart visually represents the market capitalization of the six companies highlighted by the panelists, with NVIDIA’s towering $4.3 trillion dwarfing others, followed by Palantir at $425 billion, Spotify and Progressive around $142–146 billion, Rheinmetall at $102.5 billion, and Astera Labs at $32 billion. The colors are chosen for clarity and compatibility across themes (blue, orange, green, red, purple, brown). The figures align precisely with the table in the blog post, ensuring consistency across text, table, and chart. The blog post itself, already provided, meets the 1000–1200-word requirement and includes the necessary table, so this chart completes the visualization requirement.