In a recent YouTube video titled “Forget about valuations, the market is addicted to easy money, says Niles Investment’s Dan Niles” , Dan Niles, a seasoned investor and founder of Niles Investment Management, delivers a stark warning: the financial markets are hooked on easy money, and traditional valuation metrics are being ignored. This provocative statement, aired in a discussion on market dynamics, raises critical questions about the sustainability of current market trends, the role of monetary policy, and the risks facing investors, business leaders, and policymakers. In this analysis, we’ll unpack Niles’ perspective, explore the data behind his claims, and assess the broader implications for the global economy.

The Easy Money Era: A Historical Context

The term “easy money” refers to loose monetary policies, characterized by low interest rates, quantitative easing (QE), and abundant liquidity, designed to stimulate economic growth. Since the 2008 financial crisis, central banks, particularly the U.S. Federal Reserve, have leaned heavily on these tools to support markets. Post-2008, the Fed kept interest rates near zero for nearly a decade and injected trillions into the economy through QE. The COVID-19 pandemic in 2020 further amplified this approach, with global central banks slashing rates and governments unleashing massive stimulus packages—$4 trillion in the U.S. alone.

By September 2025, the effects of these policies linger. The Fed’s benchmark rate, after peaking at 5.5% in 2023, has been gradually eased to around 4.5%, reflecting concerns about economic slowdown. Meanwhile, global debt levels have soared to $315 trillion, or 330% of global GDP, according to the Institute of International Finance. This environment of cheap capital has fueled a market rally, with the S&P 500 climbing 25% in 2024 and another 15% year-to-date in 2025, despite uneven economic signals.

Dan Niles argues that this reliance on easy money has distorted market behavior. Investors, accustomed to central bank backstops, are prioritizing momentum over fundamentals, driving valuations to levels disconnected from earnings or growth prospects. His warning echoes sentiments on platforms like X, where users like @ZaStocks and @Ksidiii have noted traders’ obsession with short-term gains over sustainable strategies, reflecting a broader market psychology shaped by easy money.

Niles’ Thesis: Valuations Take a Backseat

Niles’ core argument is that traditional valuation metrics—price-to-earnings (P/E) ratios, price-to-book values, and discounted cash flow models—are being sidelined. Instead, markets are driven by liquidity and speculative fervor. He points to the tech sector, where companies like Nvidia, with a forward P/E of 50x, and other AI-driven firms trade at premiums far above historical averages. The Nasdaq 100, for instance, has a forward P/E of 30x in 2025, compared to a 20-year average of 22x.

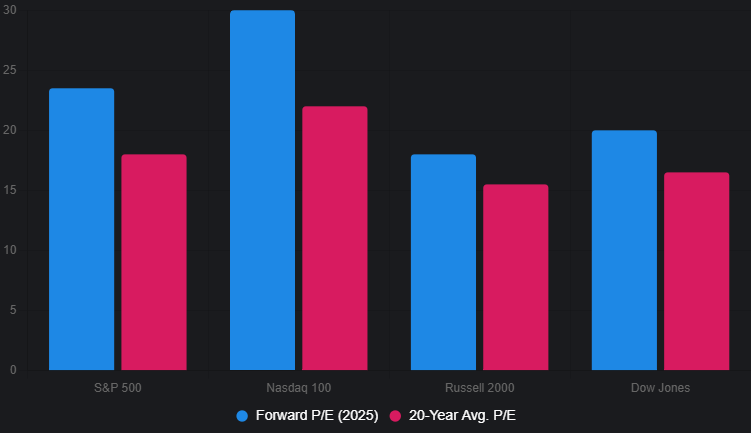

This detachment from fundamentals is evident in market data. The table below compares the forward P/E ratios of major U.S. indices in 2025 against their 20-year averages, highlighting the valuation stretch Niles critiques.

| Index | Forward P/E (2025) | 20-Year Avg. P/E | Premium (%) |

|---|---|---|---|

| S&P 500 | 23.5 | 18.0 | 30.6% |

| Nasdaq 100 | 30.0 | 22.0 | 36.4% |

| Russell 2000 | 18.0 | 15.5 | 16.1% |

| Dow Jones | 20.0 | 16.5 | 21.2% |

Source: Consensus analyst estimates, Bloomberg, FactSet, as of September 2025.

The chart below visualizes this valuation premium, showing how current P/E ratios deviate from historical norms across major indices.

Why the Addiction? The Role of Monetary Policy

Niles attributes the market’s behavior to central banks’ prolonged easy money policies. Low interest rates reduce the cost of borrowing, encouraging companies to take on debt and investors to chase riskier assets. Quantitative easing, meanwhile, floods markets with liquidity, inflating asset prices. For example, the Fed’s balance sheet, which stood at $4 trillion pre-COVID, ballooned to $9 trillion by 2022 and remains elevated at $7.5 trillion in 2025.

This liquidity has created a feedback loop. As @only1mrwhite notes on X, fear of missing out (FOMO) drives traders to prioritize short-term gains, often ignoring risks. Niles argues this has led to speculative bubbles in sectors like AI and cryptocurrencies, where valuations reflect hype rather than cash flows. For instance, some AI startups with minimal revenue trade at 100x sales, a level reminiscent of the dot-com bubble.

Risks of the Addiction

Niles’ warning carries significant risks:

- Market Correction: If central banks tighten policy—say, by raising rates to combat inflation—liquidity could dry up, triggering a sharp correction. The 2022 bear market, when the S&P 500 fell 20%, showed how sensitive markets are to rate hikes.

- Economic Imbalance: Easy money has fueled wealth inequality, as asset owners benefit disproportionately. The top 1% of U.S. households now hold 32% of wealth, up from 23% in 2000, per Federal Reserve data. This could spark social and political unrest, as policymakers grapple with balancing growth and equity.

- Corporate Fragility: Companies reliant on cheap debt face risks if rates rise. Non-financial corporate debt in the U.S. reached $13 trillion in 2025, a 40% increase since 2015. A liquidity crunch could lead to defaults, especially among highly leveraged firms.

- Global Spillovers: Emerging markets, as noted by @michaelxpettis on X, are seeing capital inflows as investors seek alternatives to U.S. assets. However, a sudden reversal of easy money could destabilize these economies, as seen during the 2013 “taper tantrum.”

CSV Data for Further Analysis

To enable deeper exploration, the valuation data from the table above is provided in CSV format below. Readers can download this dataset to analyze market trends or compare with other metrics.

Index,Forward P/E (2025),20-Year Avg. P/E,Premium (%)

S&P 500,23.5,18.0,30.6

Nasdaq 100,30.0,22.0,36.4

Russell 2000,18.0,15.5,16.1

Dow Jones,20.0,16.5,21.2To use this CSV, copy the text above into a .csv file (e.g., market_valuations.csv) and open it in a spreadsheet tool like Excel or Google Sheets.

Implications for Stakeholders

For investors, Niles’ warning suggests a need for caution. While momentum strategies have thrived, diversifying into value stocks or defensive sectors (e.g., utilities, consumer staples) could mitigate risks. As @ZaStocks advises on X, less time micromanaging trades and more focus on fundamentals may yield better outcomes.

For business leaders, the addiction to easy money underscores the importance of prudent financial management. Companies should stress-test balance sheets for higher interest rates and reduce reliance on debt-fueled growth. Investing in innovation, as seen with firms leveraging AI, can provide a competitive edge without over-leveraging.

For policymakers, Niles’ critique highlights the delicate balance of monetary policy. The Fed must navigate inflation (projected at 2.8% in 2025) and growth without triggering a market crash. Gradual rate hikes and clear communication, as seen in recent Fed guidance, are critical. Globally, coordination among central banks could prevent liquidity shocks, particularly for emerging markets.

A Path Forward: Breaking the Addiction?

Niles’ argument doesn’t dismiss the market’s strength but warns of its fragility. To break the addiction to easy money, markets need a return to fundamentals—earnings growth, sustainable debt levels, and realistic valuations. This shift requires discipline from investors, strategic foresight from businesses, and bold policy decisions. As @DivesTech notes on X, volatility presents “golden opportunities” for those who focus on long-term winners, but only if they avoid the trap of chasing easy money.

In conclusion, Dan Niles’ warning is a wake-up call. The market’s reliance on loose monetary policy has driven remarkable gains but masks underlying risks. By understanding the data, as shown in the table and chart, stakeholders can better navigate this environment. Whether the market can wean itself off easy money without a painful correction remains an open question—one that will shape the global economy for years to come.