Mid‑Year Dividend Income Playbook 2025 — Infographic Report

- Stage entries: begin half‑size, use volatility to average in.

- Barbell income: pair defensives (utilities/REITs/telco) with cyclical yield (logistics, chemicals, midstream, regional bank).

- Valuation setup: value cohort still trades at a discount while growth screens rich—tilt toward value plus quality.

- Tariff & earnings calendar: cluster of mid‑July and mid‑August catalysts likely to create add‑windows.

- Tax note: MLPs (e.g., ET) usually belong in taxable accounts, not tax‑deferred.

Headline Yields — Selected Picks

UPS Wide Moat

Kraft Heinz Deep Value

Health‑Care REIT Defensive

Eversource (ES) Utility

KeyCorp (KEY) Regional Bank

Energy Transfer (ET) MLP

LyondellBasell (LYB) Contrarian Yield

Core Income Holders Stability

- Entry discipline: start 50%, add on tariff/earnings volatility.

- Rebalance: trim as discounts close; recycle into fresh 4‑/5‑star income.

- Risk controls: size by balance sheet strength and payout coverage.

| Name | Type | Indicative Yield | Valuation View | Primary Catalyst | Key Risk |

|---|---|---|---|---|---|

| UPS | Logistics | ~6.5% | Wide‑moat value | Mix/margin; macro stabilization | Deeper slowdown |

| Kraft Heinz | Consumer Defensive | ~6.2% | ~50% below FV | Margin mean‑reversion | Elasticity misread |

| Health‑Care REIT | REIT | ~7.1% | ~40% discount | Leasing, NOI growth | Rate sensitivity |

| Eversource | Utility | ~4.7% | ~14% discount | Rate base expansion | Regulatory lag |

| KeyCorp | Regional Bank | ~5.2% | ~17% discount | NIM/NII improvement | Credit cycle |

| Energy Transfer | MLP | 7%+ | ~15% discount | Debt reduction; coverage | Commodity adj. vols |

| LyondellBasell | Chemicals | ~9% | 40%+ discount | Spread recovery | Late‑cycle demand |

Mid-Year Dividend Playbook 2025: Turning Short-Term Noise Into Long-Term Income

Quick Takeaways

- UPS now yields ~6.5%** with a wide moat**; Amazon exit trims low-margin volume but not long-run earnings power.

- Kraft Heinz trades near __50% below** fair value with a **6.2%__** yield**; margin repair and GLP-1 fears look over-discounted.

- Health-care REIT (medical offices/life science) screens at ~40% discount** with a __7.1%__ yield**; assets priced like “mid-tier” despite higher quality.

- Eversource swap-in: __4.7%** yield, ~**14%** discount, ~**20%** relative P/E upside, **6%__** LT EPS growth**—among the best total-return setups in utilities.

- KeyCorp (regional bank): __5.2%** yield at ~**17%__** discount**, with NIM/NII improvement as cyclical tailwinds.

- Energy Transfer (MLP): __7%+** yield at ~**15%** discount**; **LyondellBasell: **~9%** yield at **40%+__** discount**—cyclical, but balance-sheet and cash flow support payouts.

The Setup: Why Six Months Feels Bad—and Why That Can Be Good

If your horizon is six months, you probably shouldn’t be in equities. Yet mid-year check-ins are useful when they highlight valuation gaps and position-sizing tactics that build long-term income streams. That’s exactly where we are in 2025: a market that sprinted, stumbled (tariffs, AI hangover), then stabilized—leaving pockets of high yield with real margin of safety.

The portfolio scorecard is mixed—about half of the January picks are in the green, half in the red—but the investment theses remain intact. Where prices fell, business quality and dividend coverage generally did not. That creates the rare opportunity to layer in: start with a half-position, then dollar-cost average on weakness as the thesis plays out.

UPS: The Highest Wide-Moat Yield—And Why the Market’s Wrong

Why it’s down: Two headlines spooked investors—(1) ending low-margin Amazon volume and (2) fears of slower economic growth. The first is earnings-neutral to positive over time (less revenue, more profitability). The second is overestimated; parcel networks tend to recover faster than macro sentiment.

Why it works: At ~6.5% yield and a wide moat, UPS is the highest-yielding wide-moat name on the undervalued screen. The market priced the top-line hit, but ignored mix, margin, and capital discipline. For long-term dividend investors, that’s precisely the window to add on weakness.

Positioning tip: Initiate at half size. If macro or tariff headlines take the stock lower, average down toward your full target weight.

Kraft Heinz: Margin Repair Meets Over-Discounted GLP-1 Fears

What the market missed: Food manufacturers couldn’t pass through input inflation fast enough in 2022–23, compressing margins. As input costs normalize and price/mix catches up, operating margins should mean-revert. Meanwhile, investors extrapolated GLP-1 appetite suppression into a secular collapse for snacks/desserts. That looks excessive.

The math: ~6.2% yield, five-star rating, and the stock at ~50% of fair value. Even modest margin recovery drives a powerful earnings and FCF rebound, improving dividend safety and optionality (debt paydown, buybacks, selective M&A).

Risk control: Expect noise. But at half of the intrinsic value, the risk/reward skews in your favor.

Health-Care REITs: Defensive Cash Flows the Market Mispriced

A leading health-care REIT focused on medical office buildings and life sciences trades at a ~40% discount to fair value with a ~7.1% yield. Rent growth has lagged flashier REITs, but the underlying asset quality is better than “mid-tier” pricing implies. With demographic tailwinds (aging boomers) and a path to steady dividend growth (~4%/yr), this is classic defensive income the market sidelined for the wrong reasons.

Watchlist catalyst: Any uptick in same-property NOI or leasing velocity could re-rate shares toward peer multiples.

Rotations: Why J&J, Bristol Myers, Devon, and FirstEnergy Came Off

- Johnson & Johnson: A core holding, but the valuation cushion narrowed after outperformance. Yield and margin of safety are now less compelling than alternatives.

- Bristol Myers: Recent selloff aside, headline risk around U.S. drug pricing (e.g., most-favored-nation rhetoric) clouds sentiment. The thesis is not “broken,” but the risk-adjusted payoff is better elsewhere for now.

- Devon Energy: We’ve seen two fair-value trims as cost/barrel math and productivity reset. With shares up ~6% YTD and fair value down, the discount narrowed—not broken, just less asymmetric.

- FirstEnergy: Nothing “wrong”—still 4-star, ~10% discount, ~4.5% yield—but Eversource screens more attractive today.

New/Add Baskets: Utility, Bank, Midstream, Chemicals

Eversource (Utility)

- Why now: Utilities rallied as an AI power-load derivative, leaving few genuine bargains. Eversource is the exception: ~4.7% yield, ~14% discount, ~20% P/E upside vs. sector, and ~6% long-term EPS growth.

- What to watch: Rate cases, capex execution, grid modernization tied to electrification, and data-center load—steady, compounding drivers.

KeyCorp (Regional Bank)

- Setup: Post-SVB, regionals cratered, then re-rated. Select value remains—and Key stands out: ~5.2% yield and ~17% discount with room for NIM/NII improvement as deposit costs stabilize and asset yields reset.

- Risk: Credit normalization; offset by conservative underwriting and capital planning.

Energy Transfer (MLP)

- Income machine: 7%+ yield, ~15% discount, YTD down ~8%—just enough dislocation to get paid to wait.

- Why it works: Midstream cash flows are volume-driven, not commodity-price-driven. Debt reduction plus disciplined capex supports distribution durability and coverage.

- Note: MLPs often don’t fit tax-deferred accounts; more appropriate for taxable portfolios.

LyondellBasell (Chemicals)

- High yield, high discount: ~9% yield at 40%+ discount to fair value. Cyclical, yes, but balance sheet and free cash flow covered last year’s payout with room to spare; analysts see dividend sustainability this year as well.

- What flips the switch: Industrial production, spreads, and downstream demand. When cycles turn, equities move first—owning it before the data inflects is how you capture both yield and re-rating.

Returning Names: Verizon, Realty Income, Portland General

- Verizon: Industry behaving more like an oligopoly; less price competition supports margin expansion. Dividend remains the draw while operating leverage works through the P&L.

- Realty Income: The monthly dividend bellwether at ~5.6% yield with unchanged fundamentals; scale, cost of capital, and diversified tenants remain enduring edges.

- Portland General: A straightforward regulated utility income story; a ballast in a portfolio that’s adding selective cyclicality elsewhere.

Macro Backdrop: Tariffs, Timelines, and Valuation Math

We began 2025 with markets rich to fair value, then took a tariff-shock air pocket, and have recovered toward intrinsic levels. The next catalysts cluster in mid-July (EU/Japan/India/Canada negotiation deadlines), earnings season (big banks around July 15), and mid-August (China deadline pause). Expect headline-driven caution as dates approach.

Allocation lens: In April, broad U.S. equities traded at a ~17% discount to a composite fair value—prompting an overweight call. Today, the blanket bargain is gone, but value stocks still sit ~14% below fair value, while growth trades ~11% above. That argues for tilting to value/defensives and being choosy within sectors (e.g., consumer defensive is “expensive” because of Walmart/Costco/PG concentration, but many food names are cheap).

Portfolio Construction: How to Put This to Work

- Stage entries: Start half-size, then average in on catalysts or volatility (tariff headlines, earnings).

- Barbell income: Pair defensive yield (health-care REIT, Verizon, Realty Income, Eversource) with cyclical yield (UPS, LyondellBasell, Energy Transfer, KeyCorp).

- Mind taxes: Keep MLPs in taxable accounts; in tax-deferred, prefer C-corporations/REITs.

- Rebalance rules: Trim when discounts close (e.g., J&J scenario), recycle into fresh 4- and 5-star income.

- Risk hygiene: Position sizes reflect business quality, balance sheet, and payout coverage—higher for utilities/REITs/oligopoly telco; smaller for cyclicals/chemicals.

Near-Term Catalysts & Watch Items

- Tariff milestone dates (July/August): Expect volatility spikes; prepare limit orders for staged adds.

- Q2 Earnings: Look for margin repair at food names, NIM stability at regionals, coverage ratios at MLPs, leasing/NOI in health-care REITs, and AI-load commentary in utilities.

- Rate path: A shallow easing cycle supports duration-sensitive assets (utilities/REITs) and refinancing math for cyclicals.

- Credit: Keep an eye on delinquencies and reserve builds—confirmation of benign trends is a tailwind for KeyCorp and peers.

Bottom Line: Get Paid to Wait—And Paid Again When Value Closes

This is a classic dividend investor’s market: visible cash yields plus wide valuation gaps in pockets where business quality hasn’t changed, only sentiment has. The playbook is deliberate accumulation, not hero trades. Favor Eversource for rare utility value, KeyCorp for improving bank spreads, Energy Transfer for steady midstream distributions, LyondellBasell for contrarian cyclical yield, and UPS/Kraft Heinz, where mispriced narratives meet resilient cash flow.

If the headline storm passes quickly, these names re-rate, and you collect above-market income while you wait. If volatility lingers, your entry discipline and margin of safety do the heavy lifting. Either way, the math of dividends—cash now, compounding forever—remains the best ally in a noisy year.

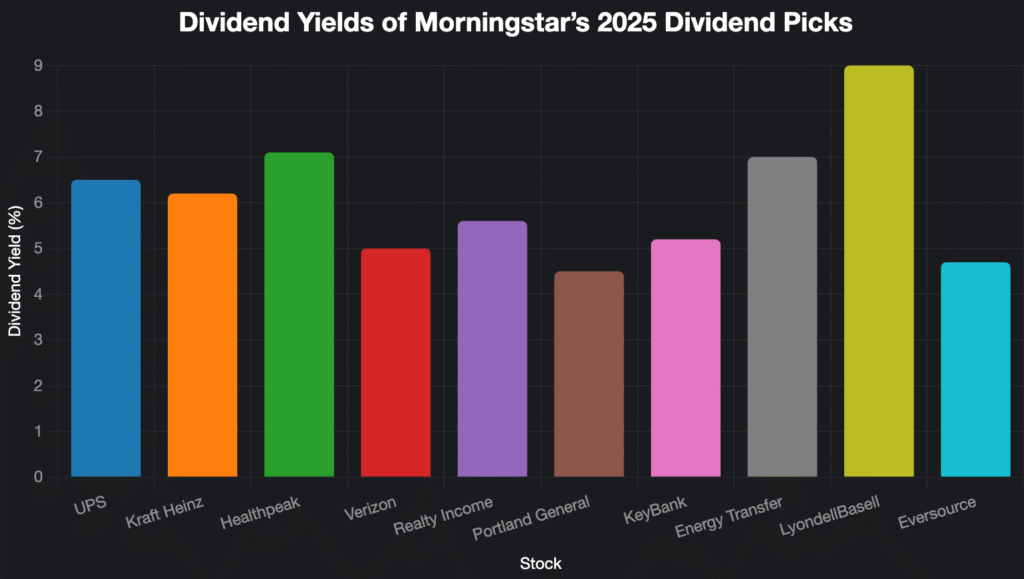

Dividend Stocks in 2025: A Midyear Performance Review and Strategic Outlook

As we reach the midpoint of 2025, it’s an opportune moment to evaluate the performance of dividend-paying stocks, particularly those highlighted by Morningstar’s Chief Market Strategist, Dave Sakara, in his January 2025 dividend picks. In a recent discussion with David Herrell, editor of Morningstar’s Dividend Investor newsletter, Sakara provided a comprehensive update on his ten dividend stock recommendations, reflecting on their year-to-date performance, the underlying reasons for their movements, and strategic adjustments for the second half of the year. This analysis delves into the performance of these picks, the macroeconomic factors influencing dividend stocks, and the implications for investors, particularly in light of potential tariff impacts and market volatility.

Midyear Performance: A Mixed Bag with Long-Term Optimism

Sakara’s ten dividend picks for 2025, announced in January, have experienced a mixed performance, with half in positive territory and half in negative territory year-to-date. This outcome, while somewhat disappointing in the short term, aligns with the inherent volatility of equity markets and underscores the importance of a long-term investment horizon. Sakara emphasized that equities, particularly dividend stocks, are not suited for investors with a six-month time frame, advocating instead for a strategy that prioritizes long-term value and income generation.

The standout underperformer among the picks is United Parcel Service (UPS), a four-star rated stock with a current dividend yield of 6.5%. UPS has faced headwinds due to its decision to discontinue its low-margin business with Amazon, which has reduced topline revenue, and market concerns about slowing economic growth impacting cyclical stocks. However, Sakara remains confident in UPS’s long-term prospects, noting that the market may be overestimating the impact of these factors. The stock’s high dividend yield and wide economic moat make it one of the most attractive undervalued opportunities among Morningstar’s screened stocks.

Another underperformer, Kraft Heinz, a five-star rated stock, is trading at approximately half of Morningstar’s long-term fair value estimate, offering a 6.2% dividend yield. The food sector, including Kraft Heinz, has been pressured by compressed operating margins due to inflation-driven cost increases outpacing price hikes. Additionally, market concerns about the impact of GLP-1 weight loss drugs on snack and dessert categories have weighed on the stock. Sakara believes these concerns are overstated, and the stock’s significant undervaluation presents a compelling opportunity for patient investors.

In the real estate investment trust (REIT) category, Healthpeak Properties (DOC), a five-star rated stock, is down year-to-date but trades at a 40% discount to fair value with a 7.1% dividend yield. Healthpeak’s portfolio, focused on medical office buildings and life sciences, is considered defensive, yet the market has been disappointed by slower rent increases compared to other REITs. Morningstar’s equity analyst Kevin Brown asserts that the portfolio’s high-quality assets are undervalued, trading below mid-tier quality valuations, and the dividend is well-covered with expected annual increases of 4%.

On the positive side, Johnson & Johnson has outperformed, delivering double the market’s return. However, its strong performance has reduced its margin of safety, prompting Sakara to remove it from the list. Similarly, Bristol Myers Squibb was removed due to negative market sentiment surrounding potential pharmaceutical price regulations under the Trump administration. Devon Energy, an energy stock, was also dropped after a 6% year-to-date gain, as its fair value estimate was revised downward due to lower-than-expected oil production efficiency. Lastly, FirstEnergy, a utility, was replaced with Eversource, which offers a more attractive 4.7% dividend yield and a 14% discount to fair value.

New Additions: Strategic Shifts for Value and Yield

Sakara introduced three new stocks to the list, each offering compelling value and income potential:

- KeyBank, a four-star-rated regional bank, trades at a 17% discount to fair value with a 5.2% dividend yield. Despite the recovery of the regional banking sector post-Silicon Valley Bank collapse, KeyBank remains undervalued with expected improvements in net interest income and margins.

- Energy Transfer, a master limited partnership (MLP), is a four-star rated stock with a 7% dividend yield and a 15% discount to fair value. Its defensive characteristics and attractive yield make it a strong addition, though Sakara cautioned that MLPs are better suited for taxable accounts.

- LyondellBasell Industries (LYB), a five-star rated chemical producer, offers a 9% dividend yield and trades at over a 40% discount to fair value. Despite its cyclical nature, the stock’s significant margin of safety and strong cash flow generation support the sustainability of its dividend.

The three returning names—Verizon, Realty Income, and Portland General Electric—continue to exhibit strong fundamentals. Verizon, with a 4-star rating, benefits from an oligopolistic wireless industry with expanding margins. Realty Income, a five-star rated REIT, maintains a 5.6% dividend yield with no change in its operational outlook. Portland General Electric, also four-star rated, remains a stable utility investment.

Table: Performance and Characteristics of Sakara’s 2025 Dividend Picks (Midyear Update)

| Stock | Morningstar Rating | Year-to-Date Performance | Dividend Yield | Discount to Fair Value | Sector |

|---|---|---|---|---|---|

| UPS | 4-star | Negative | 6.5% | Undervalued | Industrials |

| Kraft Heinz | 5-star | Negative | 6.2% | ~50% | Consumer Defensive |

| Healthpeak (DOC) | 5-star | Negative | 7.1% | 40% | REIT (Healthcare) |

| Verizon | 4-star | Positive | ~5.0% | Undervalued | Communication Services |

| Realty Income | 5-star | Positive | 5.6% | Undervalued | REIT (Commercial) |

| Portland General | 4-star | Positive | ~4.5% | Undervalued | Utilities |

| KeyBank | 4-star | N/A (New) | 5.2% | 17% | Financials (Regional Bank) |

| Energy Transfer | 4-star | Negative (~8%) | 7.0% | 15% | Energy (MLP) |

| LyondellBasell (LYB) | 5-star | N/A (New) | 9.0% | >40% | Materials (Chemicals) |

| Eversource | 4-star | N/A (New) | 4.7% | 14% | Utilities |

Macroeconomic Context: Tariffs and Market Volatility

The broader market environment in 2025 is marked by significant uncertainty, particularly surrounding tariffs. Morningstar’s recent analysis outlined a bear case with substantially higher tariffs and a bull case with moderately higher tariffs compared to pre-April 2025 levels. Defensive sectors such as utilities, consumer defensive, and healthcare are expected to be least impacted by tariffs, making them attractive for dividend investors. Sakara noted that the market’s reaction to tariff negotiations, particularly with major trading partners like the EU, Japan, India, Canada, and China, could drive volatility in the coming months. Deadlines in mid-July and August, coupled with the start of earnings season, may amplify market caution.

The equity market, which started 2025 at a premium valuation, experienced a sharp correction following tariff-related headlines and concerns about overvalued AI stocks. By April 7, 2025, U.S. equities were trading at a 17% discount to Morningstar’s fair value composite, prompting an overweight recommendation. While markets have since recovered, Sakara remains cautious, emphasizing the value in defensive, high-dividend stocks trading at significant discounts.

Chart: Dividend Yields of Sakara’s 2025 Picks

Strategic Implications for Dividend Investors

Sakara’s midyear review underscores the resilience of dividend stocks in navigating market uncertainties. The defensive sectors—utilities, consumer defensive, and healthcare—offer a buffer against tariff-related volatility, with many stocks in these sectors trading at attractive valuations. For instance, consumer defensive stocks like Kraft Heinz are undervalued despite sector-wide overvaluation driven by giants like Walmart and Costco. Similarly, the healthcare sector is broadly undervalued, except for outliers like Eli Lilly.

Investors should focus on stocks with wide margins of safety, as these provide a cushion against market downturns and potential revisions in fair value estimates. Sakara’s strategy of starting with smaller positions and dollar-cost averaging into undervalued stocks can mitigate risks while capitalizing on opportunities. The high dividend yields of stocks like LyondellBasell (9%) and Healthpeak (7.1%) offer income stability, while their significant discounts to fair value suggest potential for capital appreciation.

Looking ahead, the uncertainty surrounding tariffs and earnings season calls for a cautious yet opportunistic approach. Dividend investors can benefit from overweighting value stocks in defensive sectors, which are likely to outperform growth stocks trading at an 11% premium to fair value. By focusing on individual stock selection within overvalued sectors, investors can uncover hidden gems like Kraft Heinz and KeyBank.

Conclusion

The midyear performance of Sakara’s 2025 dividend picks reflects the challenges and opportunities in today’s market. While short-term volatility has impacted stocks like UPS and Kraft Heinz, their undervaluation and high dividend yields make them compelling for long-term investors. New additions like LyondellBasell and Energy Transfer enhance the portfolio’s income potential, while defensive sectors offer resilience against tariff-driven uncertainty. As Sakara aptly noted, positioning in high-dividend, undervalued stocks provides a robust strategy for navigating the “hurricane” of market volatility, ensuring both income and potential capital gains over the long term.