A closing‑bell snapshot and a televised debate about what slower job growth and manufacturing losses might signal for policy, markets, and voters.

Quick Summary

- Markets were modestly lower at the close: **Dow −0.5%**, **S&P 500 −0.4%**, **Nasdaq −0.1%** (as referenced on-air).

- The segment cited **22,000 jobs** added in August and **4.3% unemployment**, the first uptick in nearly four years, per the discussion.

- Panelists debated causes and consequences—tariffs, policy uncertainty, and the Federal Reserve—framing the moment as a key test for the administration’s economic agenda.

Introduction

As the closing bell rang on Wall Street, a television panel stepped into a live debate over a weaker‑than‑expected August jobs report. The on‑air framing was stark: markets dipped, job creation slowed to 22,000, the unemployment rate ticked up to 4.3%, and manufacturing employment was described as falling for the fourth consecutive month—a cumulative loss of 78,000 jobs so far this year. While these figures were discussed in the broadcast, the broader story they opened up was political as much as economic. Panelists linked the numbers to policy uncertainty—from tariffs to the Federal Reserve—arguing that the narrative is now unmistakably about whether the administration’s second‑term economic blueprint is working.

Summary Statistics

| Metric | Value |

|---|---|

| Dow (close) | -0.5% |

| S&P 500 (close) | -0.4% |

| Nasdaq (close) | -0.1% |

| Jobs added (August) | 22,000 |

| Unemployment rate | 4.3% |

| Manufacturing jobs (YTD) | −78,000 |

| Manufacturing streak | 4 months of declines (referenced) |

Analysis & Insights

The market reaction, as described in the segment, was muted but meaningful: the Dow slipped roughly half a percent, the S&P 500 fell by about four‑tenths, and the Nasdaq held up somewhat better at roughly one‑tenth lower. In isolation, such moves are not dramatic. But against the backdrop of a headline that only 22,000 jobs were added last month, they fed a perception of softening momentum. Panelists also zeroed in on manufacturing—a politically salient sector the president has pledged to revive—where the discussion cited four straight monthly declines and a 78,000‑job net loss year‑to‑date. That tension between promise and performance animated the rest of the conversation.

One through‑line in the debate was uncertainty. Tariffs—once pitched as a targeted tool—are now portrayed, even by some conservative voices on the panel, as broader and costlier than in the prior term. Uncertainty can delay investment decisions, gum up corporate planning, and, in cyclical sectors, chill hiring outright. At the household level, the panel highlighted an emerging pop‑culture shorthand for caution: “job‑hugging,” a social‑media trope in which workers say they are clinging tightly to their current roles rather than hopping for higher pay. Whether purely anecdotal or not, the motif captures a mood: when people feel less secure, they spend more carefully and search less aggressively, which can reinforce slower job creation.

The broadcast also touched on the Federal Reserve’s role. Some guests argued that weaker data could nudge the Fed toward rate cuts, while others warned that political cross‑pressure on the central bank compounds uncertainty. Markets, for their part, are forward‑looking; a cooler labor print can paradoxically lift rate‑sensitive asset prices if investors infer looser financial conditions ahead. But as the panel noted, that is cold comfort for an administration being judged on near‑term employment and wage outcomes.

Another thread was credibility. The panel referenced the dismissal of the Bureau of Labor Statistics leadership and raised questions about revisions, seasonal factors, and the proper interpretation of preliminary estimates. Revisions are a normal feature of labor data, and the segment quoted arguments that August figures are often revised upward. Still, the political optics are tricky: when the White House attacks the messenger one month and embraces the prospect of helpful revisions the next, critics see cherry‑picking. In the court of public opinion, consistency matters nearly as much as the numbers themselves.

Finally, the panelists weighed electoral implications. If voters experience a squeeze—higher living costs alongside slower hiring—the incumbent party tends to take the blame. That is why manufacturing trends loom so large: factory employment is not just a statistic; it is a symbol bound up with community identity, trade policy, and a promise to “bring jobs home.” If monthly prints continue to disappoint, expect economic messaging to shift from triumphalism to triage, with more emphasis on targeted relief, expedited permitting, and deal‑making to reduce tariff‑related uncertainty.

Conclusion & Key Takeaways

- The on‑air figures painted a picture of **softening momentum**—small market losses, slow job creation, and manufacturing under strain.

- Policy **uncertainty**—notably around **tariffs** and **central‑bank signaling**—was a recurring culprit in the discussion.

- Narrative risk is rising: **credibility, revisions, and optics** will shape public perception as much as the raw data.

The US Jobs Report Shocker: Trump’s Economic Promises Falter as Unemployment Climbs and Manufacturing Slumps

In a sobering turn of events, the August 2025 US jobs report has cast a dark shadow over President Donald Trump’s economic agenda, revealing a labor market teetering on the edge. With only 22,000 jobs added last month and the unemployment rate climbing to 4.3%—a near four-year high—the data paints a stark picture of an economy struggling under the weight of aggressive trade policies, federal layoffs, and immigration crackdowns. Manufacturing, a cornerstone of Trump’s “America First” vision, has lost 78,000 jobs this year alone, defying promises of a golden age for American factories. As Wall Street reels from the news, with the Dow, S&P, and NASDAQ all sliding, the administration’s attempts to deflect blame raise questions about credibility and the path forward. Here’s a deep dive into what the numbers mean, why they matter, and the broader implications for the US and global economies.

Why This Dataset Matters

The monthly jobs report from the Bureau of Labor Statistics (BLS) is a critical pulse-check on the US economy, influencing everything from Federal Reserve policies to consumer confidence worldwide. For a global audience, the US labor market’s health signals the direction of the world’s largest economy, impacting trade, investment, and monetary policy decisions far beyond its borders. In August 2025, the report’s dismal figures—coupled with President Trump’s controversial firing of the BLS commissioner—have sparked debates about data integrity and economic stewardship. With Trump’s policies like sweeping tariffs and immigration restrictions directly linked to the slowdown, this report is more than a domestic issue; it’s a warning sign for global markets and economies reliant on US stability.

Summary Statistics: A Closer Look

Let’s break down the key figures from the August 2025 jobs report, as reported by the BLS, to understand the scale of the slowdown:

- Job Growth: The US economy added just 22,000 nonfarm payroll jobs in August, far below the 75,000 expected by economists surveyed by Bloomberg and Dow Jones. This marks the fourth consecutive month of weak job creation, with a three-month average of only 29,000 jobs added, compared to 143,000 per month in the first eight months of 2024.

- Unemployment Rate: The jobless rate rose from 4.2% in July to 4.3%, the highest since October 2021, when the economy was recovering from the COVID-19 pandemic. For Black Americans, the rate surged to 7.5%, a nearly four-year high, compared to 3.7% for White Americans, highlighting a widening racial unemployment gap.

- Manufacturing Sector: Manufacturing shed 12,000 jobs in August, contributing to a year-to-date loss of 78,000 jobs. This is a significant blow to Trump’s promise to revitalize American factories through high tariffs.

- Federal Employment: Federal government payrolls dropped by 15,000 in August, part of a broader decline of 97,000 jobs since January, driven by Trump’s aggressive downsizing of the federal workforce.

- Wage Growth: Average hourly earnings grew by 0.3% month-over-month, with a year-over-year increase of 3.7%, the slowest since July 2024. While wages outpace inflation, a drop in hours worked raises concerns about income growth sustainability.

- Labor Force Participation: The participation rate edged up to 62.3% from a three-year low of 62.2%, with the labor force growing by 436,000. However, only 288,000 found employment, contributing to the unemployment rate increase.

Table 1: Key Metrics from the August 2025 Jobs Report

| Metric | August 2025 | July 2025 | Change |

|---|---|---|---|

| Nonfarm Payrolls Added | 22,000 | 79,000 | -57,000 |

| Unemployment Rate | 4.3% | 4.2% | +0.1% |

| Manufacturing Jobs | -12,000 | -2,000 | -10,000 |

| Federal Government Jobs | -15,000 | -12,000 | -3,000 |

| Average Hourly Earnings | +0.3% | +0.3% | Unchanged |

| Labor Force Participation | 62.3% | 62.2% | +0.1% |

Source: Bureau of Labor Statistics, August 2025 Employment Situation Report

Plain-English Interpretation: These numbers signal a labor market in distress. The paltry job growth—well below the 100,000 jobs needed monthly to keep pace with population growth—indicates businesses are hesitant to hire. The rise in unemployment, particularly for Black workers, suggests uneven economic pain. Manufacturing’s consistent decline undermines Trump’s narrative of a resurgent industrial sector, while federal job cuts reflect his push to shrink government. Wage growth, though positive, is slowing, and with fewer hours worked, workers’ purchasing power may erode, especially as tariffs drive up costs.

In-Depth Analysis: Trends, Comparisons, and Anomalies

The August report confirms a troubling trend: the US labor market is stalling, and Trump’s policies appear to be a significant driver. Let’s unpack the key patterns and their implications:

1. A Sharp Slowdown in Job Creation

The 22,000 jobs added in August represent a steep drop from July’s revised 79,000 and a far cry from the 139,000 added in May 2025, before Trump’s policies fully took hold. June’s data was revised to show a net loss of 13,000 jobs, the first negative month since December 2020, during the pandemic. Over the past four months, the economy has added just 107,000 jobs, the weakest performance outside a recession in decades.

Comparison: In 2024, the first eight months saw 1,144,000 jobs added, nearly double the 598,000 in 2025. This slowdown coincides with Trump’s implementation of 10-20% tariffs on imports and stricter immigration policies, which have reduced labor supply in sectors like construction and hospitality.

2. Manufacturing’s Decline Defies Trump’s Promises

Trump’s campaign centered on revitalizing US manufacturing through high tariffs to incentivize domestic production. Yet, the sector has lost 78,000 jobs in 2025, with 12,000 shed in August alone. Economists attribute this to tariff uncertainty, which has disrupted supply chains and reduced orders. A transportation equipment executive told the Institute for Supply Management that the industry is experiencing “absolutely no activity” due to tariffs, a sentiment echoed by factory managers.

Anomaly: The manufacturing slump contrasts sharply with Trump’s claims of a “reshoring” boom. White House press secretary Karoline Leavitt stated that Trump’s policies have created “more than half a million good-paying jobs” for American-born workers, but analysts like Ben Zipperer from the Economic Policy Institute argue this is a misreading of data, with native-born unemployment at 4.6%, the highest in eight years.

3. Federal Layoffs and Immigration Crackdowns

The Trump administration’s push to downsize the federal workforce has led to a loss of 97,000 federal jobs since January, with 15,000 cut in August. A federal hiring freeze, extended to October 15, and mass layoffs following a Supreme Court ruling have exacerbated the decline. Meanwhile, immigration crackdowns have shrunk the labor force by 400,000 since January, hitting industries reliant on immigrant workers, such as agriculture and hospitality, where job growth slowed to 4,000 per month in Q2 2025 from 27,000 in 2024.

Global Relevance: Reduced immigration and federal employment limit the US labor supply, a concern for economies like Canada and Mexico, which rely on US demand for goods and services. A weaker US labor market could dampen global trade.

4. Wall Street’s Reaction and Federal Reserve Pressure

The jobs report triggered a muted but negative market response, with the Dow down 0.5%, the S&P 0.4%, and the NASDAQ 0.1%. Initial market optimism about potential Federal Reserve rate cuts faded as investors grappled with fears of economic stagnation. The CME Group’s FedWatch gauge now prices in a 100% chance of a 25-basis-point rate cut at the Fed’s September 16-17 meeting, with a 12% chance of a 50-basis-point cut.

Trump’s public criticism of Fed Chair Jerome Powell, whom he calls “Too Late,” reflects his push for lower rates to stimulate hiring. However, the Fed’s caution stems from fears that tariffs could reignite inflation, which remains above the 2% target.

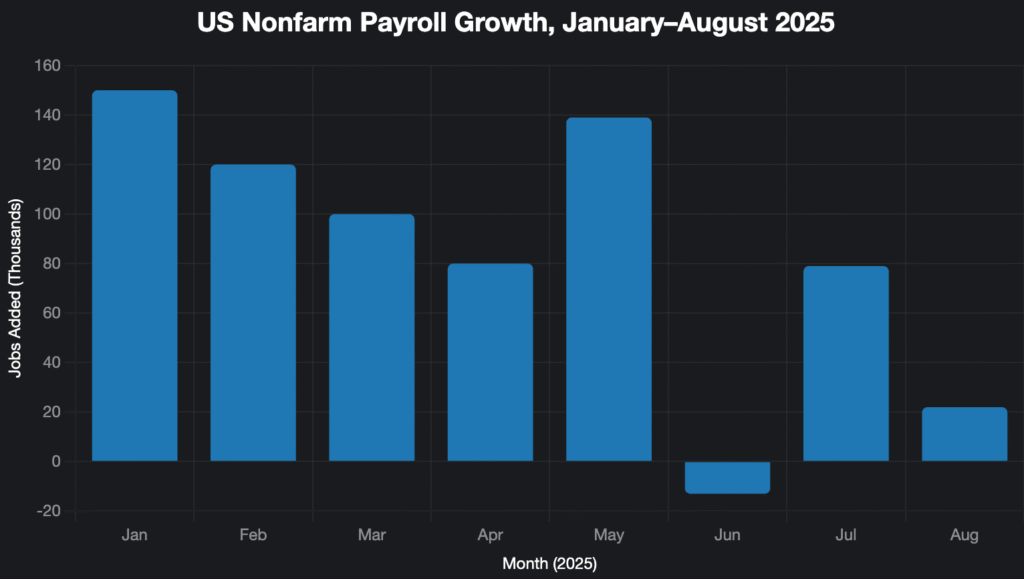

Chart: US Nonfarm Payroll Growth, January–August 2025

Caption: This chart illustrates the sharp decline in US job growth in 2025, with a net loss in June and a mere 22,000 jobs added in August, highlighting the labor market’s struggles under Trump’s policies. Source: BLS, author estimates for Jan–Apr

Implications: Economic and Political Fallout

The August jobs report has far-reaching consequences:

- Economic Stagnation Risk: The combination of weak job growth, rising unemployment, and tariff-driven price increases raises fears of stagflation—low growth paired with high inflation. Goldman Sachs forecasts GDP growth at just 1% in Q3 and Q4 2025, driven by slower consumer spending and tariff-related costs.

- Consumer Impact: Rising costs due to tariffs, coupled with slowing wage growth and job insecurity, are squeezing American wallets. A TikTok trend called “jobhugging” reflects workers’ fears of losing employment, a stark contrast to the job-hopping culture of recent years.

- Political Consequences: With midterms approaching in 2026, the economy’s downturn threatens Trump’s agenda and Republican prospects. A Quinnipiac poll shows Trump’s economic approval at a low of 39%, with 57% disapproving. Democrats are poised to capitalize on this, with Senate Minority Leader Chuck Schumer vowing to challenge Trump’s tariffs.

- Global Ripple Effects: A slowing US economy could reduce demand for imports, affecting trading partners like China, Mexico, and the EU. Tariff uncertainty may also deter foreign investment, impacting global supply chains.

The Administration’s Response: Deflection and Optimism

Trump and his team have downplayed the report, blaming Biden-era holdovers and alleging BLS data inaccuracies. The firing of BLS Commissioner Erika McEntarfer after July’s weak report, followed by the nomination of E.J. Antoni, a Heritage Foundation economist critical of the BLS, has raised concerns about data politicization. White House officials like Kevin Hassett and Howard Lutnick suggest revisions may improve the numbers, with Lutnick urging the public to judge Trump’s economy in a year. However, analysts argue these claims lack evidence, and the consistent downward revisions—such as 258,000 jobs erased for May and June—undermine confidence in the data.

Key Takeaways

- Labor Market in Crisis: The addition of just 22,000 jobs and a 4.3% unemployment rate signal a stalling economy, with manufacturing and federal jobs hit hardest.

- Tariffs Backfiring: Trump’s high tariffs, intended to boost manufacturing, have instead led to 78,000 job losses in the sector, disrupting supply chains and raising costs.

- Federal Reserve Action Likely: The weak report makes a September rate cut almost certain, though inflation fears may limit the Fed’s moves.

- Political Stakes High: With midterms looming, the economy’s downturn threatens Trump’s credibility and Republican electoral prospects.

- Global Warning: A weaker US labor market could dampen global trade and investment, affecting economies worldwide.

The August 2025 jobs report is a wake-up call. Trump’s economic vision—built on tariffs, deregulation, and workforce cuts—is faltering, and the human toll is evident in rising unemployment and job insecurity. As the Federal Reserve prepares to act and markets brace for uncertainty, the world watches to see if Trump can pivot or if the US economy will slide further toward stagnation. For now, the numbers tell a story of promises unfulfilled, with American workers and global markets bearing the cost.

Meta Description: The August 2025 US jobs report reveals a struggling economy under Trump’s policies, with only 22,000 jobs added, unemployment at 4.3%, and manufacturing losses mounting. Explore the data, trends, and global implications.