How Cadillac Is Beating Audi, Mercedes & BMW in EVs — A Data-Driven Look (2025)

Cadillac’s luxury EV strategy is attracting new customers, increasing market share, and testing whether an American icon can lead the segment in a more competitive, post-incentive landscape.

Quick Summary

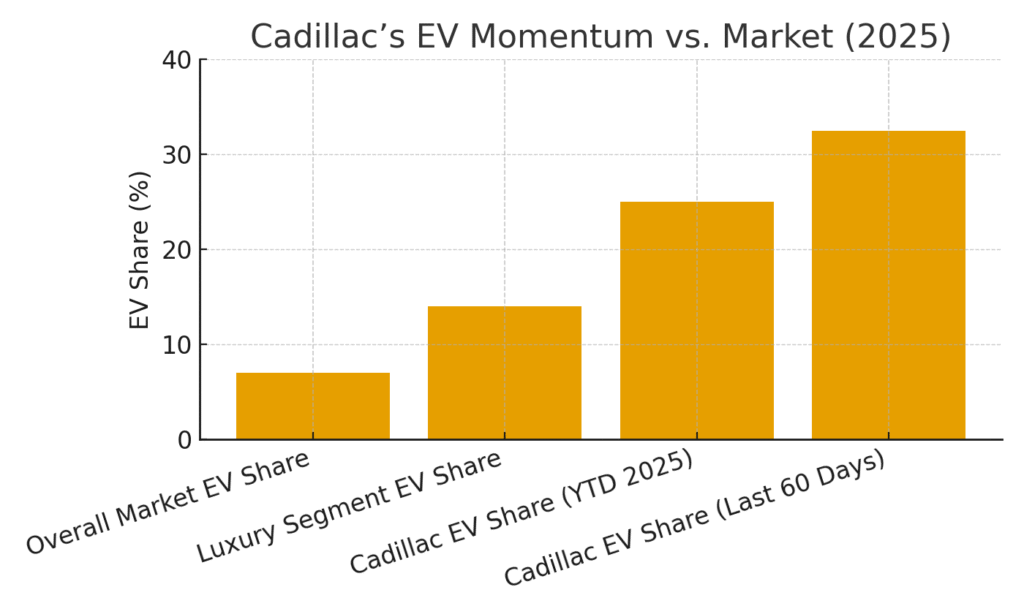

- Cadillac’s EV mix is ~25% year-to-date 2025, rising to ~30–35% in the last 60 days, far above the U.S. market (~6–8%) and luxury average (~14%).

- 80% of Cadillac EV buyers are new to the brand; roughly 10% traded in a Tesla, signaling competitive conquest.

- GM’s EV sales grew in 1H’25 while Tesla’s fell; Cadillac ranked 1st/2nd in luxury EVs in Q2’25, depending on whether Tesla is counted as “luxury.”

- Risks: disappearing incentives, tighter competition, and the no CarPlay/Android Auto decision—offset by a U.S.-built lineup that’s relatively insulated from import tariffs.

Introduction

Once the self-styled “standard of the world,” Cadillac has struggled for decades to recapture its halo. The EV era is giving it another chance. By leaning into SUVs, bespoke design, and high-touch customization—while keeping performance credentials alive—Cadillac has begun to poach buyers from traditional German luxury brands and even from Tesla. This report distills the key figures from recent sales commentary and analyst perspectives to explain why Cadillac is over-indexing in electric vehicles, what’s powering the surge, and what could derail it.

For global readers, Cadillac’s story is a microcosm of the broader EV market transition: product-market fit, distribution alignment, and domestic manufacturing can outweigh sheer scale—especially when incentives are in flux and charging and battery technology are still evolving.

Summary Statistics

| Metric | Value | Context |

|---|---|---|

| Cadillac EV Mix (YTD 2025) | ~25% | Outpaces U.S. market (~6–8%) and luxury (~14%). |

| Cadillac EV Mix (Last 60 Days) | ~30–35% | Tesla fell during the period discussed. |

| Overall U.S. EV Share | ~6–8% | Used midpoint (32.5%) in the chart for visualization. |

| Luxury Segment EV Share | ~14% | Luxury buyers skew more electric than average. |

| New-to-Brand EV Buyers | ~80% | High conquest rate; ~10% reportedly Tesla trade-ins. |

| Luxury EV Rank (Q2 2025) | 1st or 2nd | Depends on classification of Tesla as a luxury brand. |

| GM EV Sales (1H 2025) | Growing | While Tesla fell during the period discussed. |

| Tariff Exposure | Lower | Most Cadillac models are built in the U.S., mitigating import tariffs. |

| Infotainment Risk | No CarPlay/Android Auto | Potential deal-breaker for some buyers. |

Notes: All figures reflect statements summarized from the source material. Where a range is provided in the source (e.g., “6–8%”), the midpoint is used for the visualization below.

Analysis & Insights

Cadillac is outpacing the market in EV adoption. With EVs making up roughly a quarter of its sales year-to-date, and ~30–35% in the most recent two months, Cadillac dramatically outperforms both the overall U.S. market (~6–8%) and the luxury segment (~14%). This isn’t just about one hit model; dealers reportedly are “bought in” on EVs, a critical unlock for inventory turn, education, and delivery experience.

Conquesting is real—and that matters for lifetime value. About 80% of Cadillac EV buyers are new to the brand, including an estimated 10% trading in Teslas. In luxury auto, who you win from is as important as how much you grow: pulling defections from Mercedes, BMW, Audi, Lexus, and Tesla suggests that design, ride quality, and pricing are landing where they need to, especially with SUV-forward lineups and the Escalade’s enduring halo.

Unique product identity over “copycat” positioning. Past critiques of GM’s “badge engineering” are giving way to more bespoke interiors, infotainment setups, and ride/handling that feel distinctly Cadillac. The brand is also exploring the ultra-luxury ceiling with the hand-built Celestiq and extending customization (“Curated by Cadillac”) to enthusiast models like the CT5-V Blackwing—high-margin plays that elevate brand heat and pricing power.

Macro winds are shifting. July EV sales spiked as buyers rushed to capture the $7,500 federal benefit before leasing loopholes closed on October 1. Incentive roll-offs can cool momentum, but they also pull demand forward—useful when scaling production and dealer readiness. Meanwhile, GM says its EVs are “variable profit positive”—a step toward breakeven after factory and R&D overheads—while broader profitability across the industry remains challenging.

Home-field manufacturing is a tariff hedge. With most Cadillac models assembled in the U.S., the brand is less exposed to potential import tariffs that could add five figures to competitors’ vehicles shipped from Europe or Asia. In a price-sensitive EV market, a built-in cost buffer is a strategic advantage—especially if incentives fade and rates stay higher for longer.

Risks and open questions. Two watch-outs stand out. First, software experience: Cadillac’s choice to omit Apple CarPlay and Android Auto could be a non-starter for some buyers who expect their phones to be the primary interface. Second, competitive saturation: as more EV segments fill in, the brand will have to defend share against both legacy luxury rivals and aggressive new entrants—while keeping quality high and costs in check.

Bottom line: Cadillac is executing a classic “move up the value stack” play in a transition market—meeting demand in high-volume SUV segments, using bespoke design to sharpen brand identity, and leveraging U.S.-based production to manage costs. The next test will be sustaining this lead as incentives wane, software expectations rise, and rivals counter with fresh product and aggressive pricing.

Conclusion & Key Takeaways

- Early EV leadership: Cadillac’s EV penetration (~25% YTD; ~30–35% recently) materially outpaces the market and the luxury average.

- High conquest rate: ~80% new-to-brand buyers (with ~10% Tesla trade-ins) indicate successful positioning and design resonance.

- Execution advantages: Dealer buy-in and U.S.-based manufacturing provide distribution and tariff cushions as incentives fade.

- Watch software & competition: No CarPlay/Android Auto could limit appeal; new EV launches will intensify the battle for share.

Source: User-provided transcript summary of recent Cadillac EV performance and market commentary. Compiled on September 02, 2025.