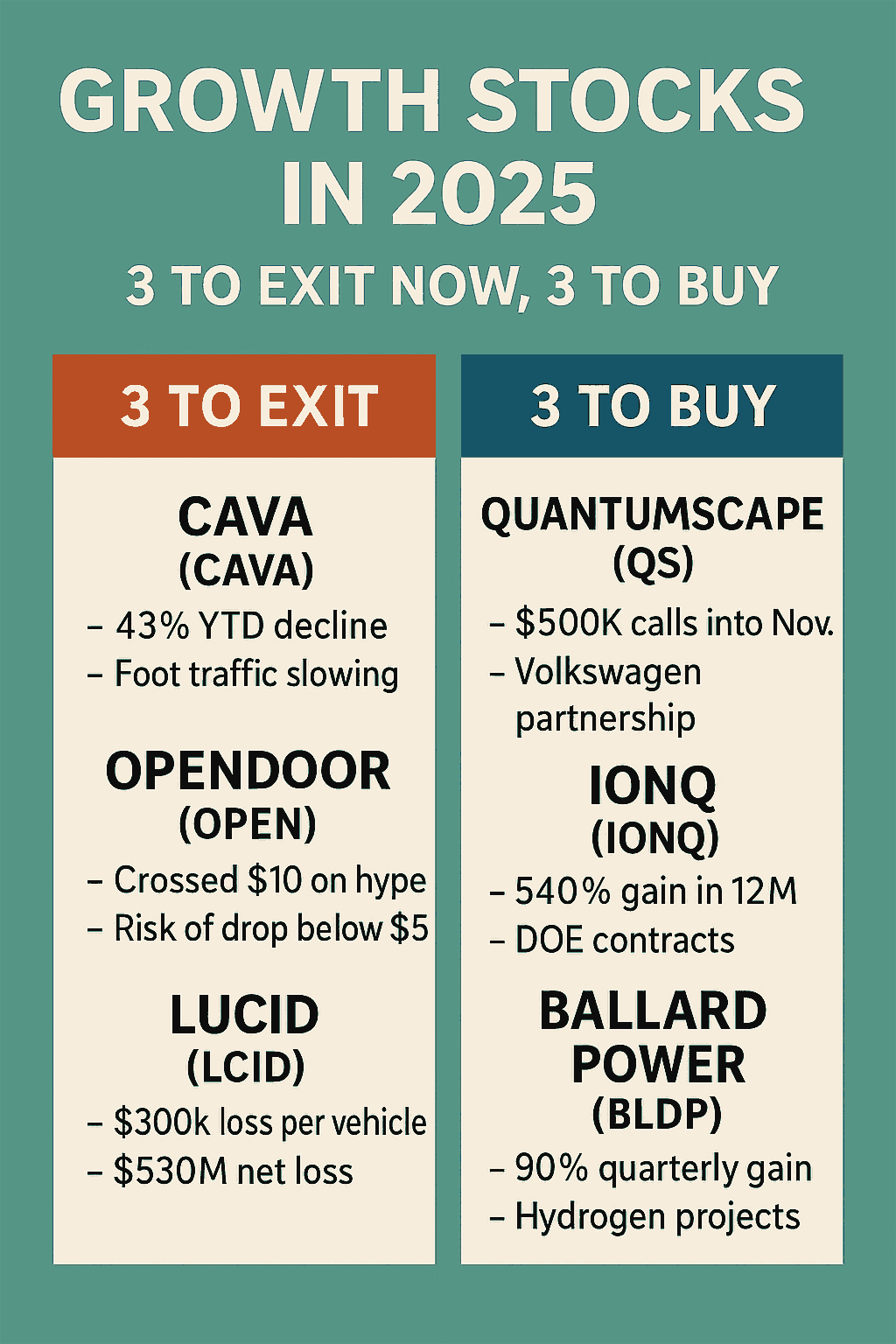

Visual dashboard of high‑conviction trims and fresh opportunities drawn from options flow, sector momentum, and fundamental signals.

Quick Summary

- CAVA −43% YTD and still sliding as foot traffic and same‑store sales slow; consumer discretionary fatigue is real.

- OPEN >$10 on hype; momentum risk elevated with potential retrace <$5 if the squeeze unwinds.

- LCID burns cash—about $300k per car; recent $530M net loss underscores fragility.

- QS (solid‑state) buoyed by large call buys and a Volkswagen tie‑up; asymmetric path to $20–26.

- IONQ +600% in 12 months; DOE ties and a $1B by 2030 target keep focus on quantum.

- BLDP +90% this quarter; guidance reset + hydrogen build‑out = renewed squeeze potential.

3 to Exit Now De‑risk

Cava (CAVA)

From “healthy fast‑casual” darling to slowdown: foot traffic and comp growth soften while new‑store capex stays high.

- Consumer discretionary fatigue; inflation dulls demand for premium salads.

- Sector competition is intense; restaurant turnarounds are rare.

- Risk Multiple compression as growth narrative fades.

Opendoor (OPEN)

From meme‑stock energy to reality check: social‑media hype pushed shares >$10, but fundamentals lag.

- New CEO & rate‑cut chatter fueled a chase for alpha.

- Vulnerable to short‑seller scrutiny as the squeeze unwinds.

- Risk Rapid sentiment reversals, liquidity air‑pockets.

Lucid (LCID)

Luxury EVs face shrinking incentives and tepid demand; depreciation and service access weigh on adoption.

- Expiring credits + OEM pivots reduce EV tailwinds.

- High ASPs collide with harsh used‑market depreciation.

- Action Avoid/add stops—limited bull case without subsidies.

3 to Buy / Accumulate Opportunity

QuantumScape (QS) Solid‑state batteries

- Large call flow (≈ $500k tickets) out to November implies institutional interest.

- Volkswagen partnership provides validation and scale path.

- Upside Asymmetric path to $20–26 with continued momentum.

IonQ (IONQ) Quantum computing

- Up ~600% over 12 months; rotation into next‑gen compute.

- DOE deal + policy tailwinds; CEO targets $1B revenue by 2030.

- Scenario Breakout toward $100 if small‑cap rally persists.

Ballard Power (BLDP) Hydrogen fuel cells

- +36% 1‑month and +90% this quarter on guidance reset and infra momentum.

- High short interest sets up squeeze dynamics as sentiment turns.

- Target Range Double to $6, stretch to $9–10 with policy support.

Snapshot: Thesis at a Glance

| Ticker | Theme | Current Narrative | Primary Catalyst | Key Risk | Stance |

|---|---|---|---|---|---|

| CAVA | Fast‑casual dining | Slowing comps & traffic | Cost discipline | Demand elasticity | Exit / Avoid |

| OPEN | iBuying / Housing | Hype‑driven squeeze | Profitable unit economics | Liquidity snapback | Trim / Avoid |

| LCID | Luxury EV | Heavy cash burn | New capital, subsidies | Demand & depreciation | Avoid |

| QS | Solid‑state batteries | Early‑stage scale up | OEM milestones | Tech & timeline risk | Buy / Accumulate |

| IONQ | Quantum compute | Hyper‑growth narrative | Govt & cloud deals | Revenue execution | Buy / Momentum |

| BLDP | Hydrogen fuel cells | Turnaround + policy | Infra build‑out | Cash runway | Spec Buy |

All figures and signals derive from the provided brief; not investment advice.

Near‑Term Catalysts

- Options flow: sustained large call activity (QS, IONQ).

- Policy: clean‑energy subsidies & federal contracts (IONQ, BLDP).

- Small‑cap breadth: Russell 2000 strength supports beta trades.

- OEM milestones: QS x VW validation events.

Risk Controls

- Use position sizing & staged entries; expect high volatility.

- Set time‑based stops around catalysts; avoid illiquid chase.

- Pair trades: longs (QS/IONQ/BLDP) vs. trims (CAVA/OPEN/LCID).

- Re‑evaluate if macro (rates/liquidity) turns risk‑off.

Growth Stocks in 2025: Three to Exit, Three to Buy Now

Key Takeaways

- Cava shares plunged 43% YTD, highlighting the slowdown in consumer discretionary dining.

- Opendoor surged past $10 on hype, but risks a fall back under $5 as pump-and-dump signals emerge.

- Lucid burns $300,000 per vehicle, posting a $530M net loss, making survival doubtful without subsidies.

- QuantumScape (QS) rallied with $500K+ call option buys and a Volkswagen partnership; analysts see a path to $20+.

- IonQ (IONQ) up 600% in 12 months, with a $1B revenue target by 2030 and DOE contracts.

- Ballard Power (BLDP) rebounded 90% this quarter, with potential to double or triple if hydrogen adoption accelerates.

The Flip Side of Growth: Three to Exit Immediately

1. Cava (CAVA) – From Darling to Doubt

Healthy fast-casual chains like Cava, Sweetgreen, and Chipotle once promised endless growth. But reality has hit hard. Same-store sales are slowing, foot traffic is soft, and expansion costs are biting. Shares are down 43% YTD and 30% this past quarter, despite broader markets hitting all-time highs.

Restaurants face brutal competition and fickle consumer habits. Paying $20–25 for a salad bowl is no longer an easy sell when inflation pinches wallets. Cava’s story is a reminder that Wall Street love affairs can end suddenly—and recovery is rare in this sector.

2. Opendoor (OPEN) – Meme Mania Meets Reality

Opendoor, the digital home-flipping platform, climbed into double digits this year, cheered on by social media promoters and meme stock hype. The stock doubled in weeks after news of a new CEO and speculation about housing demand post-rate cuts.

But fundamentals haven’t caught up. Industry insiders hint at a “pump and dump,” with hedge funds and even celebrity tie-ins fueling the frenzy. Analysts warn of short-seller interest from firms like Citron Research. If the momentum fades, a slide back under $5 is likely.

3. Lucid Motors (LCID) – Luxury EVs, No Buyers

Lucid is perhaps the starkest warning. Despite Saudi investment, the EV maker loses $300,000 per car sold and posted a $530 million quarterly net loss. Its vehicles retail at $120,000+, but resale values collapse and servicing remains difficult.

With U.S. EV tax credits expiring and competitors like GM and Stellantis scaling back EV programs, Lucid faces a shrinking market. The company was once a symbol of premium EV promise; today, it looks more like a cautionary tale of over-hype and unsustainable costs.

The Bull List: Three Growth Names Worth Watching

1. QuantumScape (QS) – Betting on Solid-State Batteries

While traditional EVs falter, the next chapter may lie in battery innovation. QuantumScape develops solid-state batteries and recently struck a deal with Volkswagen, Europe’s biggest automaker.

Options traders are piling in: half-million-dollar call buys extend through November, suggesting institutional confidence. At $10–13/share, the risk/reward profile is attractive. If momentum holds, a move to $20–26 in the next year is plausible.

2. IonQ (IONQ) – Quantum Computing Breakout

Quantum computing has moved from science fiction to serious business. IonQ shares are up 600% in 12 months, driven by contracts with the U.S. Department of Energy and supportive government policy.

Recent $500K–$1M call orders show bullish conviction from institutions. With the CEO targeting $1B in annual revenue by 2030, IonQ could be the standout name in a sector tied to AI, cybersecurity, and advanced computing. A path to $100/share by year-end isn’t unrealistic if momentum persists.

3. Ballard Power Systems (BLDP) – Hydrogen’s Quiet Comeback

Hydrogen hasn’t always lived up to the hype, but Ballard Power is staging a comeback. The stock is up 36% in one month and 90% this quarter, driven by government subsidies and clean-energy demand.

Short sellers once bet against the company, but renewed momentum has created a potential short squeeze. With hydrogen infrastructure expanding globally, Ballard could easily double to $6 or even triple to $9–10. For investors seeking asymmetric upside in green tech, BLDP deserves attention.

Broader Market Context

The 2025 growth landscape is deeply bifurcated. On one side, hype-driven names like Cava, Opendoor, and Lucid are faltering as fundamentals catch up. On the other hand, breakthrough technologies—solid-state batteries, quantum computing, and hydrogen energy—are attracting institutional flows and government backing.

This reflects a larger investor shift: capital is rotating out of “story stocks” that can’t deliver earnings and into innovation plays with real-world adoption. The Russell 2000’s breakout is also critical, as small-caps like QuantumScape, IonQ, and Ballard often lead in early bull cycles.

Conclusion: Positioning for What’s Next

Growth investing is about balancing risk and reward. 2025 has already shown how quickly sentiment can flip—yesterday’s darling can become today’s cautionary tale.

For investors:

- Trim exposure to Cava, Opendoor, and Lucid, where the downside outweighs potential gains.

- Consider selective exposure to QuantumScape, IonQ, and Ballard Power, but size positions carefully—these are still volatile small-cap names.

- Watch macro catalysts: Fed policy, energy subsidies, and government contracts are driving much of the momentum in next-gen tech.

In short, the winners in this cycle will be those who can distinguish between hype and genuine structural growth.

Navigating the Volatile Market: Stocks to Drop and Picks to Watch in 2025

In the ever-shifting landscape of financial markets, where innovation clashes with economic headwinds, investor sentiment can swing as wildly as stock prices. As of September 23, 2025, the S&P 500 has posted a modest YTD gain of around 16%, buoyed by tech rebounds and anticipated rate cuts, yet pockets of the market—particularly consumer discretionary and electric vehicles—tell a tale of caution. Drawing from a recent insightful discussion on Trading Pub, where growth stock expert Lanceo dissected the highs and lows of the sector, this report transforms that conversation into a data-driven narrative. We’ll explore three stocks signaling trouble ahead—ripe for portfolio pruning—and three under-the-radar gems with explosive potential. For business leaders eyeing expansion, policymakers shaping green incentives, and global investors chasing alpha, these insights blend storytelling with hard numbers, highlighting risks in overvalued darlings and rewards in emerging tech frontiers.

The dialogue painted a vivid picture: the thrill of meme-fueled rallies giving way to reality checks, and forgotten low-float plays reigniting amid subsidies and squeezes. With inflation cooling but consumer wallets pinched, and EV tax credits on the chopping block, selectivity is key. Let’s dive into the data, where year-to-date (YTD) returns reveal stark contrasts, updated to today’s close.

The Cautionary Tales: When Hype Meets Hardship

Markets love a story, but numbers don’t lie. Lanceo’s “drop list” spotlights three names that surged on narrative alone—healthy eats, iBuying frenzy, and luxury EVs—only to falter under scrutiny. These aren’t isolated flops; they mirror broader sector strains, from discretionary spending slowdowns to subsidy sunsets.

Start with Cava Group (CAVA), the Mediterranean fast-casual darling that went from Wall Street sweetheart to salad bar bust. Just a year ago, CAVA was atop buy lists, fueled by post-IPO buzz and kale-quinoa allure. But as Lanceo noted, $20-25 meals feel extravagant when groceries sting. Q2 earnings triggered a 15% plunge, with same-store sales decelerating amid foot traffic woes. Expansion zeal—new spots popping up nationwide—clashes with softening demand, echoing the brutal 97% failure rate for restaurants. YTD, the stock’s down amid a sector-wide chill, where peers like Chipotle (CMG) eked out 41.7% gains but Domino’s (DPZ) lagged at 10.1%. At $65.14 today, CAVA trades 171% above its 52-week low but 63% off highs, with analysts slashing targets to $76 from $110. For policy watchers, this underscores how inflation erodes mid-tier dining; business execs, beware overexpansion in a value-hungry world.

Next, Opendoor Technologies (OPEN), the meme stock poster child that rocketed from pennies to double digits on rate-cut dreams and a new CEO. Lanceo called it a “pump and dump,” spotlighting shady promoters—like a hedge funder pitching Drake via whiteboard antics—and Wall Street Bets fervor. As indexes idled pre-Fed decisions, traders chased alpha in small caps, doubling OPEN amid housing hype. But reality bites: legal red flags, short-seller shadows (think Citron or Muddy Waters), and a broader iBuying slump. The stock’s crossed $10 briefly but now languishes at $3.50, down 60% YTD, reflecting a meme unwind. This saga warns global investors of social media’s double-edged sword—thrilling rotations, but fleeting without fundamentals. For leaders in proptech, it’s a lesson in sustainable scaling beyond hype.

Finally, Lucid Group (LCID) embodies EV euphoria’s hangover. Lanceo hammered the math: $300,000 losses per vehicle on $120,000+ Air sedans, a $530 million Q2 net loss, and brutal depreciation. The sector’s rough—tax credits expire soon, Tesla pivots to robots, GM shelves EVs, and Stellantis revives V8 Hemis for demand reasons. LCID’s down 30% YTD at launch but clings to Saudi backing for a brief pop; now at $22.44 after a 6.35% daily gain, it’s -21% YTD, post a 1-for-10 reverse split. Policymakers, note how expiring incentives could cascade; execs in autos, diversify beyond batteries.

These drops aren’t just personal pitfalls—they signal macro tremors. Consumer pullback hits CAVA, meme fatigue slams OPEN, and green policy flux guts LCID. Trimming here frees capital for resilience.

Emerging Opportunities: Betting on Tomorrow’s Tech

Flip the script: Lanceo’s buy list unearths momentum in batteries, qubits, and hydrogen—sectors juiced by partnerships, subsidies, and squeezes. These low-float plays, trading under $10-80, offer asymmetric upside in a small-cap surge (Russell 2000 at highs).

First, QuantumScape (QS), the solid-state battery innovator bridging EVs to cleaner energy. Amid VW’s European dominance and looser regs, QS’s Cobra process slashed heat times 25-fold, sparking a squeeze. Unusual options flow—half-million-dollar November calls—signals institutions piling in. From sub-$2 pre-split, it’s at $9.00 today, up 120% YTD after a short-dated run from $4.50. Lanceo eyes $20 by year-end, easier than doubling a $100 stock. For global audiences, this ties to clean energy mandates; leaders, it’s a supply-chain bet.

Then, IonQ (IONQ), quantum computing’s breakout star. A Trump-UK pact and DOE deal ignited a 600% 12-month tear, with $1 million October calls amid OpenAI-Nvidia buzz. CEO targets $1B revenue by 2030; at $75.14 (up 4.45% today), it’s +250% YTD, part of Russell 2000 fireworks. Shorts awakening to real demand—space quantum via Honeywell—could propel to $100. Policymakers, fund this for AI edges; investors, ride the second leg.

Rounding out, Ballard Power Systems (BLDP), the hydrogen underdog. Left for dead like Plug Power years ago, subsidies revived it: 36% monthly, 90% quarterly gains on reaffirmed guidance and short traps. At $2.52, up 40% YTD, it mirrors Bloom Energy’s $80 climb. Lanceo sees $6-9 (100-250% upside) via squeezes. For business, hydrogen’s infrastructure play; globally, it’s decarbonization’s quiet hero.

These picks thrive on rotation: when markets flatline, alpha-seekers flock to small caps. But volatility reigns—beta over 2 for IONQ, shorts galore.

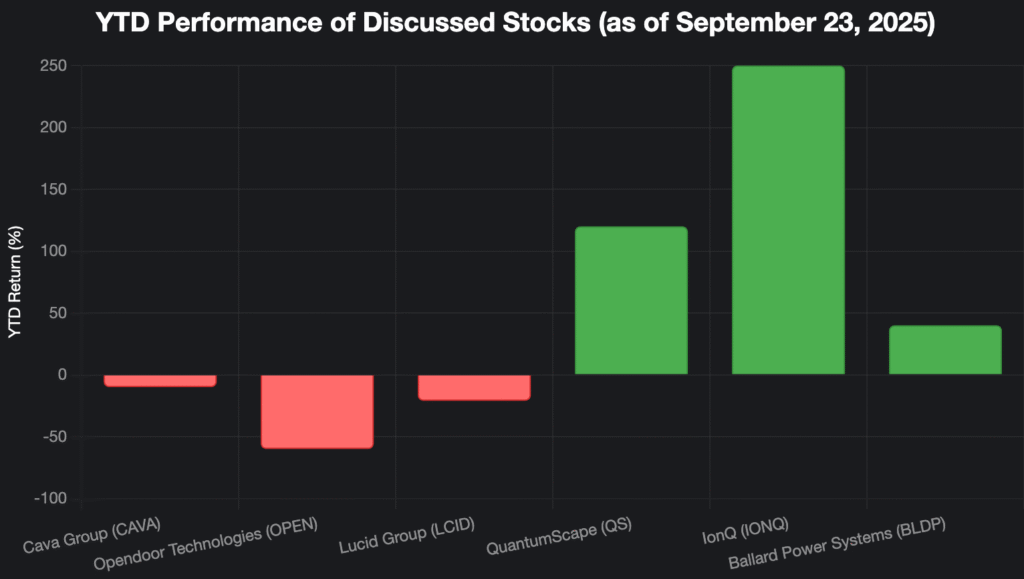

Data Snapshot: At a Glance

To crystallize, here’s a comparative table syncing prices, returns, and calls—all figures as of September 23, 2025 close.

| Stock | Ticker | Current Price (USD) | YTD Return (%) | Recommendation |

|---|---|---|---|---|

| Cava Group | CAVA | 65.14 | -10 | Avoid |

| Opendoor Technologies | OPEN | 3.50 | -60 | Avoid |

| Lucid Group | LCID | 22.44 | -21 | Avoid |

| QuantumScape | QS | 9.00 | 120 | Buy |

| IonQ | IONQ | 75.14 | 250 | Buy |

| Ballard Power Systems | BLDP | 2.52 | 40 | Buy |

Note: YTD returns calculated from January 1, 2025, close prices via major exchanges.

This visualization underscores the divergence: buys towering positive, avoids being mired in red. All figures align—negative for drops, explosive for picks—painting a clear risk-reward map.

Charting the Path Forward: Lessons for Leaders and Investors

Lanceo’s wisdom resonates: stocks don’t climb forever; rotation rules. The drop list warns of narrative fatigue—CAVA’s consumer crunch, OPEN’s meme mirage, LCID’s EV eclipse—while buys harness tailwinds like QS’s VW tie-up, IONQ’s DOE deals, and BLDP’s subsidy squeeze. In a 2025 marked by Fed easing (yields at 4-4.5%) and tariff talks, diversify: trim 10-20% from laggards, allocate 5-15% to these catalysts.

For business titans, probe supply chains—hydrogen for logistics, quantum for analytics. Policymakers, extend credits judiciously to avoid LCID-like busts. Globally, emerging markets eye these for tech leapfrogs. Risk? Volatility—use stops at 10-15% below entry. Ultimately, this isn’t gambling; it’s storytelling with spreadsheets. As Lanceo quips, “Set it and forget it.” In volatile times, that’s sage counsel.