Fed Cut, Mixed Signals: An Infographics Brief for Busy Readers

A crisp, graphic-led summary of what the Fed’s 25 bps cut could mean for jobs, prices, and markets.

At a Glance

- 25 bps cut with a lone dissent for 50 bps.

- Stocks: Dow up, S&P & Nasdaq down slightly; yields and dollar up.

- Fed signals a lean toward employment while services inflation remains sticky.

- Independence watch: optics of politics vs. policy loom over the dot plot.

#Fed #Inflation #Jobs #Markets

Signal Board

| Item | What it means |

|---|---|

| Decision | Cut by 25 bps (first cut in 9 months) |

| Dissent | New member favored 50 bps; others aligned at 25 bps |

| Jobs vs Prices | Statement leaned toward jobs; inflation still ‘somewhat elevated’ |

| Markets | Relief pop faded as caution in projections set in |

| Risks | Sticky services inflation; overheating → re-hike tail risk |

| What to Watch | Core services ex-housing, initial claims, quits rate, long yields |

Visuals

Why It Matters

Transmission is slow, signaling is fast. A 25 bps trim won’t instantly lower mortgages, but it can lift business and consumer sentiment. The upside: softer labor-market risk is cushioned. The downside: if animal spirits run hot while services inflation stays sticky, the Fed could be forced to push back—potentially unsettling risk assets.

Global spillovers. Calmer long-end yields could ease pressure on emerging-market currencies and financing, but a re-acceleration in inflation would tighten global conditions abruptly.

What to track next: core services ex-housing, initial claims, quits rate, financial-conditions indices, and the term premium at the long end.

Fed Rate Cut and TikTok Deal

Executive Summary

This episode of Prof G Markets covers two major financial/political topics: the Federal Reserve’s recent rate cut and the emerging TikTok deal. The hosts and guests present critical perspectives on both developments, highlighting concerns about Fed independence, economic stagflation risks, and potential cronyism in the TikTok acquisition.

Part 1: Federal Reserve Rate Cut Analysis

Guest Expert: Robert Armstrong (Financial Times)

Key Points Discussed:

Fed Decision Context

- Rate Cut: 25 basis points (as expected)

- Rationale: Weakening labor market cited as primary concern

- Market Reaction: Initial rally followed by decline during Powell’s press conference

Fed Independence Concerns

The “Dot Plot” Revelation:

- 19 Fed committee members submit rate projections

- One “lonely dot” at bottom of chart clearly from Steven Myron (White House representative)

- Myron dissented for 50bp cut on his second day

- Armstrong notes this as unprecedented – Fed board member with active White House employment

Political Dynamics:

- Previous Trump appointees (Bowman, Waller) did NOT join Myron’s dissent

- Armstrong interprets this as institutional defense: “You don’t own me” message to Trump

- Suggests Fed trying to maintain independence despite political pressure

Economic Assessment: Stagflation Concerns

Host Ed’s Analysis:

- Fed statement acknowledges: “Job gains have slowed…inflation has moved up and remains somewhat elevated”

- This meets technical definition of stagflation (slow growth + rising inflation)

- Questions whether rate cuts are appropriate in this environment

Armstrong’s Response:

- Powell attributes inflation to tariffs (temporary effect)

- Claims services disinflation continuing (Armstrong disagrees with this assessment)

- Fed betting tariff impact is “pig passing through snake” – temporary price level shift

Market Risk Assessment

Armstrong’s Concerns:

- Supports “hawk” position – keeping rates unchanged

- Primary worry: “Resurgent inflation is the scariest risk right now”

- Low probability but high impact scenario: rate cuts fuel asset bubbles leading to market crash

- Fed decision may be correct at “center of probability curve” but creates dangerous tail risks

Transmission Mechanisms

How Rate Cuts Work:

- Direct Channel: Lower borrowing costs for businesses and consumers

- Signaling Effect: Fed as “high priest of economy” – vibes matter more than actual rate change

- Wealth Effects: Market enthusiasm flows into real economy

- Mortgage Channel: Refinancing provides consumer spending power

Part 2: TikTok Deal Analysis

Deal Structure Overview

- US Ownership: ~80% controlled by US consortium (Oracle, Silverlake, Andreessen Horowitz)

- ByteDance Stake: 19.9% (below 20% threshold required by law)

- Algorithm Control: Critical question – reportedly still licensed from ByteDance/China

Scott Galloway’s Critique

Cronyism Allegations:

- Describes deal as “carving up company for Republican friends”

- Key investors all have Trump connections:

- Larry Ellison (Oracle) – close Trump associate

- Marc Andreessen – publicly supported Trump

- Jeff Yass (Susquehanna) – donated $100M to Trump campaign

Legal/Constitutional Concerns:

- TikTok was legally banned by Congressional action

- Trump simply refusing to enforce law

- Galloway: “Let’s just send senators and Congress home…this is pure dictatorship”

- Compares to Russian-style oligarch capitalism

National Security Assessment

Persistent Risks:

- Algorithm reportedly still controlled by China (licensing arrangement)

- Core security concern unaddressed: Chinese influence over US youth

- Two-thirds of American youth spend 1.5 hours daily on TikTok

- Galloway analogy: “Would we let Kremlin own CBS, NBC, ABC in 1960s Cold War?”

Generational Impact:

- Claims stark generational divide in American patriotism

- Older generation: 50% positive about America

- Younger generation: 10% positive about America

- Suggests TikTok algorithm engineered to “enrage American youth”

Financial Analysis

Valuation Opportunity:

- ByteDance trading at ~2x sales (due to geopolitical overhang)

- Comparable tech companies: 40-60x sales

- Operating margins: 30% (vs Home Depot’s 12-15%)

- Galloway: “Most undervalued company in the world”

- Forced sale creates massive profit opportunity for connected investors

Deal Probability Assessment

Skeptical Outlook:

- Galloway predicts deal won’t materialize

- Believes Xi Jinping “playing Trump like a fiddle”

- Extended deadline to December provides China negotiating time

- Historical pattern: deals announced but never completed

Key Themes and Analysis

Theme 1: Institutional Capture vs. Independence

Both segments highlight tension between political pressure and institutional independence:

- Fed: Maintaining monetary policy independence despite White House influence

- TikTok: National security institutions bypassed for political/financial gain

Theme 2: Cronyism in American Capitalism

Strong critique that both deals represent departure from merit-based capitalism:

- Fed positions potentially influenced by political loyalty

- TikTok deal exclusively benefiting Trump allies

- Comparison to Russian oligarch model

Theme 3: Economic Risk Management

Different approaches to tail risks:

- Fed: Focus on employment risks, downplaying inflation dangers

- TikTok: Focus on immediate profits, ignoring long-term security risks

Theme 4: Market vs. Political Logic

Tension between what makes financial sense vs. what serves broader public interest:

- Rate cuts may boost markets but fuel inflation

- TikTok deal creates windfall profits but maintains security vulnerabilities

Critical Assessment

Strengths of Analysis

- Armstrong provides sophisticated Fed interpretation with insider knowledge

- Galloway offers historical context and geopolitical perspective

- Both guests acknowledge complexity rather than offering simple answers

Potential Biases

- Strong anti-Trump sentiment may color TikTok deal interpretation

- Armstrong’s “markets person” perspective may overweight crash risks

- Limited discussion of potential benefits from either policy

Unanswered Questions

- How will algorithm licensing actually work in practice?

- What specific Fed independence safeguards exist?

- Are there legitimate national security benefits to US TikTok ownership even without algorithm control?

Conclusion

The podcast presents both developments as symptoms of broader institutional decay in American governance. The hosts argue that short-term political and financial incentives are overriding both economic prudence (Fed policy) and national security priorities (TikTok deal). Whether these concerns prove prophetic or overstated will depend on implementation details and long-term economic/geopolitical outcomes.

After the Cut: What the Fed’s 25 bps Move Signals for Jobs, Prices, and Markets

The first rate cut in nine months is here—but the real story is the tug‑of‑war between jobs and inflation, and whether the Fed can manage markets’ ‘vibes’ while keeping policy independent.

Quick Summary

- The Fed cut **25 bps**, leaning toward its employment mandate while acknowledging persistent inflation.

- Markets cheered, then cooled—sentiment (‘vibes’) may matter more than the single cut.

- Institutional independence and services inflation stickiness loom as the next big tests.

Introduction

The Federal Reserve’s first rate cut in nine months is the kind of headline that moves tickers—and tempers. A **25‑basis‑point** trim won’t change mortgage math overnight, but it does change the **message**: the central bank is tilting toward jobs, even as inflation lingers. What makes this moment globally relevant isn’t just the basis‑points math; it’s the challenge of steering a $27 trillion economy where **confidence and narrative** can amplify (or undermine) policy. In other words, the Fed isn’t just setting the price of money—it’s managing the **vibes**.

Summary Statistics

Numbers matter, but so does context. The discussion around the decision highlights three overlapping realities: 1) labor markets are softening at the margin, 2) inflation is still **above target**, especially in services, and 3) the committee is **not monolithic**—dot‑plot dispersion and a lone dissent tell us there’s real debate over the path ahead. Below is a quick reference table that translates the meeting’s big signals into plain English.

| Signal | What it means |

|---|---|

| Decision | Cut 25 bps (first cut in 9 months) |

| Vote Color | Single dissent favoring 50 bps; others aligned at 25 bps |

| Market Reaction | Initial pop, then mixed as caution sank in |

| Key Theme | Fed leaning toward employment side of mandate |

| Risk Flag | Services inflation sticky ~3% (qualitative); over‑heating risk tail |

| Independence Watch | Dot‑plot dynamics and White House ties raise scrutiny |

Analysis & Insights

Jobs vs. Prices: The Tug‑of‑War

The Fed’s dual mandate—maximum employment and stable prices—is in open tension. The cut suggests a **deliberate lean toward employment**, a signal that labor‑market slippage carries more near‑term risk than a single quarter‑point’s contribution to inflation. That aligns with a pragmatic read of how rate changes transmit: a 25 bps move rarely filters directly into mortgage rates, and any growth impulse may be modest. But the **signaling effect** can be powerful: when the Fed shifts into easing mode, households and businesses often interpret it as a green light to hire, invest, and spend. Animal spirits aren’t policy—but they’re policy‑adjacent.Services Inflation: The Sticking Point

Goods disinflation may ebb if tariffs or supply quirks fade, but **services inflation remains sticky** around the mid‑3% zone in many categories. That’s the crux: if wages and shelter‑adjacent costs keep pressure on services, an extended easing cycle risks re‑accelerating prices. Think of the risk not as the base case, but as a **fat‑tail scenario**—low probability, high impact. If inflation pops, the Fed could be forced back into hiking just as risk assets have levitated, a setup that historically **ends badly for markets**.Independence Watch and the Dot Plot Signal

Policy independence is more than a talking point—it’s a stabilizer of expectations. The optics of political proximity, a **lone dot calling for a deeper cut**, and chatter about blocs can dent that stabilizer. Yet there was also a **reassurance signal**: previous hawkish dissenters aligned with the 25 bps decision this time, suggesting the committee isn’t splintering into camps. The broader dot plot reads as **cautious** for the remainder of the year: roughly half of participants don’t see a need for additional near‑term cuts. Translation: the bar for further easing is not low.Markets: The Pop, the Pause, and the Path

The knee‑jerk rally followed by a cool‑off is textbook. First comes relief—rates down!—then reality—**easing with caution** and sticky services inflation are not full‑throttle risk‑on signals. Over the next few weeks, positioning will hinge on incoming labor prints and services‑price data. Credit markets and small‑cap financing conditions bear watching: if spreads stay tame and refinancing windows open, growth risk recedes. If, however, an easing cycle collides with re‑accelerating inflation, expect the **policy put** to move further out of the money.Global Ripples: Why the World Should Care

Dollar liquidity, term‑premium dynamics, and the U.S. growth outlook set the tone globally. A measured easing path can **support EM currencies** and risk assets, especially where imported inflation has been punitive. But a Fed that has to pivot back to hawkishness would tighten global financial conditions abruptly. Exporters into the U.S. services ecosystem—from cloud and software to travel and higher ed—will read the tea leaves differently than goods exporters: **services‑heavy exposures** remain most sensitive to wage and shelter inputs, not shipping rates.What to Watch Next (Practical Dashboard)

- Core services ex‑housing: If it bends lower, more cuts are feasible without rekindling inflation expectations.

- Initial claims & quits rate: Early warnings on labor softening; a quick downdrift strengthens the case for gentle easing.

- Financial conditions index: If easing + animal spirits loosen conditions too fast, watch for Fed pushback in speeches.

- Term premium & long yields: If the long end backs up despite cuts, mortgage relief stays muted and growth effects lag.

Investor Playbook (Principles, Not Picks)

- Respect the tails: Position sizing should acknowledge the **overheating → re‑hike → risk‑off** tail, even if base‑case is benign.

- Quality bias: Balance sheets with term‑out debt and durable margins can outlast a bumpy glide path.

- Duration balance: Moderate equity duration with real‑asset or cash‑flow plays in case long rates don’t cooperate.

- Data‑driven agility: Let services‑inflation and labor‑market prints—not vibes—govern risk add‑ons.

Conclusion & Key Takeaways

- The cut is a nudge, not a jolt: A quarter‑point mostly moves expectations. Its real power is the signal, not the math.

- Services inflation is the swing vote: Without relief there, the easing runway shortens—and the tail risk of a policy reversal grows.

- Independence sustains credibility: Clear, apolitical communication keeps the “vibes” aligned with long‑term stability.

The Fed’s Rate Cut and TikTok’s Uncertain Future: A Tale of Economic Signals and Geopolitical Games

On September 18, 2025, the Federal Reserve made headlines by cutting interest rates by 25 basis points, a move anticipated by markets but fraught with complexity. Simultaneously, a potential deal to keep TikTok operational in the U.S. emerged, raising questions about national security, cronyism, and economic implications. These two developments, discussed in depth on the Prof G Markets podcast with host Edson and guests Robert Armstrong and Scott Galloway, offer a window into the intricate interplay of monetary policy, market dynamics, and geopolitical maneuvering. This blog post unpacks these events, analyzing their implications for the economy, markets, and global business landscape.

The Fed’s Rate Cut: Balancing Inflation and Employment

For the first time in nine months, the Federal Reserve, led by Chair Jerome Powell, reduced interest rates by 25 basis points. This decision, announced on September 17, 2025, was driven by a weakening labor market, with Fed officials signaling additional cuts at the two remaining meetings of the year. However, the decision was not unanimous—Steven Myron, the Fed’s newest member and a White House representative, dissented, advocating for a more aggressive 50-basis-point cut. This dissent, coupled with the Fed’s “dot plot” revealing significant disagreement among members about future rate paths, underscores the delicate balance the Fed is attempting to strike between its dual mandate of price stability and maximum employment.

The Fed’s statement highlighted a troubling economic backdrop: “Job gains have slowed, and the unemployment rate has edged up. Inflation has moved up and remains somewhat elevated.” This description evokes mild stagflation—a scenario where economic growth slows while inflation persists. Robert Armstrong, a Financial Times commentator, noted on Prof G Markets that the Fed is leaning toward prioritizing employment over inflation, a shift that markets initially welcomed with a rally, though the S&P 500 and Nasdaq later closed lower as investors digested the cautious tone.

Why cut rates in the face of rising inflation? Powell attributed persistent inflation to temporary factors, notably tariffs, which he believes will subside. However, Armstrong expressed skepticism, arguing that services inflation remains sticky at around 3% and may even be rising. He highlighted a tail risk: if markets overheat and inflation accelerates, higher rates could trigger a market crash. This concern is reflected in the Fed’s dot plot, where nearly half the committee believes no further cuts are necessary this year, signaling internal divisions about the path forward.

The economics of rate cuts are straightforward but nuanced. Lower interest rates reduce borrowing costs for businesses and households, encouraging investment and consumption. For companies, cheaper debt facilitates expansion, equipment purchases, or hiring. For households, lower rates can translate to cheaper mortgages, freeing up disposable income. However, as Armstrong pointed out, a single 25-basis-point cut is unlikely to significantly alter mortgage rates or economic behavior. Instead, the Fed’s actions carry a powerful signaling effect, influencing market “vibes” or sentiment. Powell’s role, likened to a “high priest of the economy,” involves not just setting rates but managing expectations and confidence, which can amplify or dampen economic activity.

The Fed’s independence also came under scrutiny. Myron’s dissent, represented by a lone dot in the Fed’s projections, raised questions about political influence, especially given his White House ties. Armstrong noted that while one dissenter cannot sway the committee, the potential for multiple politically aligned members could undermine the Fed’s autonomy. Notably, two previous dissenters, Trump appointees Bowman and Waller, aligned with the majority this time, possibly signaling resistance to forming a political bloc. This dynamic underscores the Fed’s challenge in maintaining credibility amid political pressures.

TikTok’s U.S. Future: A Deal Steeped in Controversy

Parallel to the Fed’s decision, a potential deal to keep TikTok in the U.S. emerged, involving a consortium of American companies—Oracle, Silverlake, and Andreessen Horowitz—set to control roughly 80% of U.S. operations. ByteDance, TikTok’s Chinese parent, would retain a 19.9% stake, complying with a 2024 law mandating a sale or ban unless ByteDance’s ownership falls below 20%. However, the deal’s centerpiece—the algorithm—remains contentious. Initial reports suggest U.S. TikTok operations would license the algorithm from ByteDance, leaving control in Chinese hands, a move that undermines the deal’s national security rationale.

Scott Galloway, a vocal critic of TikTok’s Chinese ownership, decried the deal as “cronyism” on Prof G Markets. He pointed out that the investors involved—Oracle’s Larry Ellison, Andreessen Horowitz’s Marc Andreessen, and Susquehanna’s Jeff Yass—are close Trump allies, with Yass having donated $100 million to Trump’s campaign. Galloway argued that the deal rewards political loyalists while failing to address the core issue: the algorithm’s potential to manipulate content and influence American users. He likened it to allowing the Kremlin to control major U.S. broadcasters during the Cold War, emphasizing the geopolitical risks of a Chinese-controlled algorithm serving content to two-thirds of American youth for 1.5 hours daily.

Economically, the deal is a windfall for investors. TikTok, described by Galloway as “the most undervalued company in the world,” trades at roughly two times sales, compared to Tesla’s 60 times or Open AI’s 40 times. Its 30% operating margins dwarf those of comparable firms like Home Depot (12–15%). A forced sale, driven by legal mandates, strips ByteDance of pricing power, allowing investors to acquire a high-growth asset at a steep discount. However, if the algorithm remains with ByteDance, the national security concerns that prompted the ban persist, rendering the deal symbolically hollow.

Galloway expressed skepticism about the deal’s completion, suggesting Chinese authorities, led by Xi Jinping, are “toying” with Trump, delaying negotiations to maintain leverage. The White House has called reports speculative, and a Trump-Xi call scheduled for September 19, 2025, may clarify the deal’s fate. Regardless, the saga highlights the intersection of geopolitics and business, where economic opportunities collide with strategic concerns.

Economic and Market Implications

The Fed’s rate cut and the TikTok deal reflect broader themes shaping the global economy in 2025. The Fed’s cautious approach signals a pivot toward supporting growth, but persistent inflation and internal divisions suggest uncertainty. Markets, as Armstrong noted, often take days to digest Fed decisions, and the initial mixed reaction—S&P and Nasdaq dipping, Dow hitting a record—reflects this uncertainty. Treasury yields and the dollar rose slightly, while Nvidia’s shares fell nearly 3% due to China’s ban on its chips, highlighting global trade tensions.

The TikTok deal, if consummated, could reshape the social media landscape. U.S. investors stand to gain from a high-margin, undervalued asset, but the failure to secure the algorithm raises doubts about the deal’s strategic value. Moreover, it underscores the risks of cronyism, where political connections influence economic outcomes, potentially eroding trust in institutions.

Data Snapshot: Fed Rate Expectations and TikTok Valuation

To contextualize these developments, consider the following data:

| Metric | Value |

|---|---|

| Fed Interest Rate Cut (Sep 2025) | 25 basis points |

| Fed Dot Plot: Members Expecting No Further Cuts in 2025 | ~50% of committee (approx. 9–10 members) |

| U.S. Unemployment Rate Trend | Edging up (exact figure not specified) |

| Services Inflation Rate | ~3%, potentially rising |

| TikTok U.S. Ownership (Proposed) | 80% U.S. consortium, 19.9% ByteDance |

| TikTok Valuation Multiple | ~2x sales (vs. 60x for Tesla, 40x for Open AI) |

| TikTok Operating Margin | 30% (vs. 12–15% for Home Depot) |

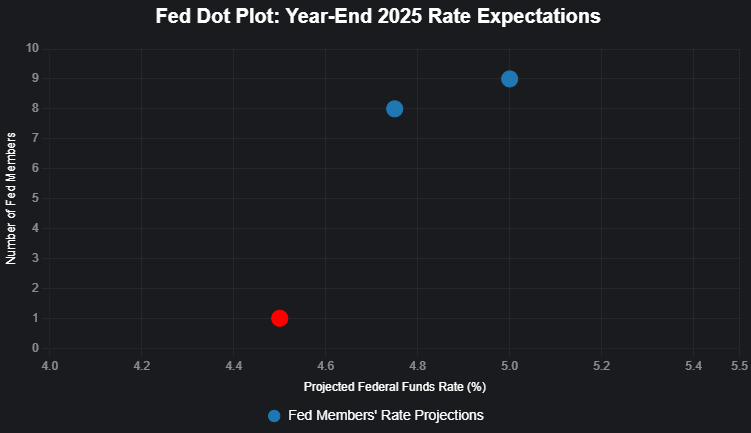

The chart below illustrates the Fed’s dot plot projections for the federal funds rate at year-end 2025, highlighting the split among committee members:

This chart visualizes the clustering of Fed members around 4.75% and 5.00% rates, with Myron’s lone 4.50% projection standing out, reflecting the internal debate over monetary policy.

Looking Ahead

The Fed’s rate cut signals a cautious optimism about growth but leaves open questions about inflation and independence. The TikTok deal, if it proceeds, promises economic gains for select investors but risks perpetuating national security concerns. Both stories highlight the challenges of navigating a complex global economy, where policy decisions, market sentiment, and geopolitical strategies are deeply intertwined. As markets digest the Fed’s moves and the TikTok saga unfolds, business leaders and policymakers must remain vigilant, balancing short-term opportunities with long-term risks.

For now, the Fed’s signaling and TikTok’s uncertain future underscore a broader truth: in 2025, economic and geopolitical “vibes” matter as much as concrete policies, shaping outcomes in unpredictable ways.

Fed cuts, markets wobble, and a TikTok carve-up: why this matters now

Two storylines dominated the tape on September 18: the Federal Reserve’s first rate cut in nine months and a fast-forming deal to keep TikTok operating in the United States. Both hinge on trust—trust in central bank independence and trust in who controls the algorithms shaping attention. For investors, the Fed’s 25 bp cut (USD context, 2024) signals a lean toward employment risks even as inflation “remains somewhat elevated,” while the TikTok framework could create a forced-sale windfall for a connected cohort of U.S. investors—if it actually closes and if national security concerns are credibly addressed.

Quick Summary

- Fed cuts rates by 25 bps, first reduction in 9 months.

- Statement: “Job gains have slowed,” unemployment has “edged up,” inflation has “moved up.”

- Lone dissent favored a 50 bp cut (newest member, Steven Myron).

- Fed officials penciled in cuts at the two remaining meetings this year.

- S&P 500 and Nasdaq ended slightly lower; Dow hit an intraday record; Nvidia fell nearly 3% after a China buying ban.

- Dot plot showed meaningful dispersion; nearly “half” don’t see another cut this year (per discussion).

- TikTok deal framework: U.S. consortium to control roughly 80%; ByteDance at 19.9% (reported).

- Algorithm control unresolved; a Chinese official said it would be licensed to U.S. ops (reported).

- TikTok deadline sits at 242 days past the original date; Trump–Xi call slated for Friday (reported).

- Interviewee claims ByteDance trades near ~2x sales with ~30% operating margins; “forced sale” could enrich insiders.

Sentiment and Themes

Topic sentiment and overall tone (inferred from the script): Negative 55%, Neutral 35%, Positive 10%.

Top 5 themes

- Central bank independence vs. political influence

- Stagflation-lite risk and policy trade-offs

- Market “vibes” and signaling effects of policy

- TikTok ownership, algorithm control, and national security

- Cronyism concerns and “forced sale” investor upside

The Fed’s pivot: leaning into employment risks

Robert Armstrong (Financial Times) framed the meeting starkly: the Fed’s mandate is pulling it in opposite directions. The statement acknowledged slowing job gains and a rising unemployment rate, even as inflation has ticked up and remains “somewhat elevated.” Chair Powell’s emphasis: the Committee is leaning toward the employment side of the mandate, a nuance that came through “more clearly than expected.”

That tilt was paired with a modest move—a 25 bp cut—while officials penciled in additional reductions across the two remaining meetings this year. Markets initially cheered, then faded as investors paged through the Summary of Economic Projections and grew uneasy with the longer-run rate path.

Independence on trial: the lonely dot

The dot plot drew laughs for an unusual reason: one dot sat far below the cluster, interpreted as the new member’s call for a 50 bp cut. Journalists pressed Powell on independence given a White House official on the Committee. Powell argued one member cannot sway the 12 voting participants—but what about two or three? The conversation noted that prior dissenters (Bowman and Waller) did not break ranks this time, which some read as a signal against a perceived “block.”

Stagflation-lite and the tariff thesis

Is this mild stagflation? The hosts called it that—slowing growth alongside elevated inflation. Why cut now? Powell credited goods-side inflation to tariffs and characterized it as temporary. He also suggested services disinflation; Armstrong pushed back, saying he doesn’t see it in the data and suspects services price pressure is stuck around three percent or rising in key categories (specific figures beyond that characterization were not disclosed).

Signaling vs. substance: the power of “vibes”

A 25 bp tweak won’t materially change mortgage rates, Powell acknowledged. The more potent channel is signaling—the “totemic” status of the Fed that can spur wealth effects and animal spirits. That dual role—setting rates and managing expectations—makes independence even more crucial, particularly if conditions deteriorate.

Tail risks: the crash scenario

Armstrong’s risk framing differed from center-of-the-curve economics. He sees a low-probability but high-severity tail: markets overheat, inflation re-accelerates, rates then rise and crack asset prices. The dot plot’s dispersion—nearly half not seeing another cut this year—suggests the Committee shares some of that caution.

| Item | Detail |

|---|---|

| Action | Cut by 25 bps |

| Dissent | 1 vote for a 50 bp cut (newest member) |

| Forward path | Cuts penciled in for remaining 2 meetings in 2024 |

| Inflation language | “Moved up” and “remains somewhat elevated” |

| Labor language | “Job gains have slowed,” unemployment “edged up” |

| Dot plot | Meaningful dispersion; “lonely dot” below the cluster |

| Mortgage channel | 25 bps may not filter through meaningfully (per discussion) |

Interpretation: The Fed is easing while stressing caution, with internal disagreement evident. The cut is as much a signal on employment risk management as it is a mechanical stimulus.

TikTok: a forced sale, or a political carve-up?

Parallel to the Fed chatter, the show dissected a reported framework to keep TikTok in the U.S. A consortium including Oracle, Silver Lake, and Andreessen Horowitz would own roughly 80% of U.S. TikTok operations, while ByteDance would retain 19.9%, satisfying the law’s sub‑20% threshold (as reported). The unresolved center of gravity: who controls the algorithm that shapes content and attention?

According to a Chinese official (per the discussion), U.S. TikTok would license the algorithm from ByteDance. The White House called such details speculative, pending a Trump–Xi call on Friday. If true, algorithm licensing could neuter the national security rationale for the forced divestiture, leaving ownership optics changed but control of core tech intact.

Cronyism claims and national security risk

Scott’s critique was blunt: this is “cronyism,” carving up a valuable asset for political allies. He named Oracle’s Larry Ellison, Andreessen Horowitz’s Marc Andreessen, and a firm linked to Jeff Yas as core participants, arguing the winners list tracks with proximity to power. He further argued that licensing the algorithm from ByteDance leaves the core security concern unsolved.

Valuation upside in a forced sale

Regardless of the politics, the panel agreed on one point: if the deal happens, investors getting in could be “huge winners,” precisely because forced sellers lose pricing power. Scott contended ByteDance is the “most undervalued company in the world,” citing ~2x sales and ~30% operating margins (comparatives mentioned for other firms were part of his argument; independent verification was not disclosed). Whether or not those figures are right, the setup—regulatory deadline, negotiated buyer list, and an algorithm licensing wrinkle—creates an unusually asymmetric outcome for the buyer group.

| Stakeholder | Role | Approx. Share | Algorithm Control | Status |

|---|---|---|---|---|

| U.S. consortium (e.g., Oracle, Silver Lake, Andreessen Horowitz) | Majority owners of U.S. ops | ~80% | Licensee (per Chinese official)td> | Negotiating; subject to U.S. review and China sign-off (per discussion) |

| ByteDance | Minority owner of U.S. ops | 19.9% (reported) | Licensor/owner of core algorithm (reported) | Would retain sub‑20% stake; terms and governance unresolved |

| U.S. Government / CFIUS | National security review and enforcement | 0% | Oversight, not operational control | Details deemed speculative; review ongoing; outcome may hinge on leader‑level diplomacy |

| Chinese authorities | Policy gatekeeper for tech licensing/export | 0% | Signals point to licensing model (per Chinese official) | Position signaled; final stance not formalized |

Interpretation: The draft structure would flip equity control to a U.S. group while potentially leaving algorithmic control with ByteDance via licensing—keeping the core national security debate alive and creating a favorable entry point for the chosen buyer cohort.

Analysis & Insights

Growth and mix

The Fed’s move nudges financial conditions looser at the margin, but the bigger swing factor is narrative. A policy tilt toward employment risk can shift portfolio mix toward cyclicals and duration-sensitive tech—until and unless the “stagflation‑lite” worry reasserts itself. On TikTok, the proposed structure would concentrate growth optionality with a select U.S. consortium; if algorithm access remains licensed rather than transferred, growth execution will also depend on the durability and scope of that license.

Profitability and efficiency

The panel’s claim that ByteDance operates near roughly 30% operating margins, if even directionally true, underpins the “forced‑sale” upside: buyers are paying for scale assets with embedded operating leverage. In the macro backdrop, a shallow easing path and services‑price stickiness point to margin pressure for rate‑sensitive sectors, while mega‑cap tech faces headline and policy risk—evidenced by the semiconductor selloff tied to a China buying ban.

Cash, liquidity, and risk

Powell emphasized that a 25 bp cut won’t translate meaningfully to mortgages, reinforcing that liquidity transmission is more about expectations and asset prices than immediate cash flow relief. The dot‑plot dispersion and the “lonely dot” suggest internal risk heterogeneity: if inflation re‑accelerates, the Fed could be forced to pause or reverse, raising rollover and valuation risk for long‑duration assets. For TikTok, deal risk includes regulatory timing, license scope, and governance guardrails—any of which could delay or fracture the transaction.

Quotes

“Job gains have slowed,” unemployment has “edged up,” inflation has “moved up.”

— Fed statement language, as discussed

“The Committee is leaning toward the employment side of the mandate.”

— Chair Powell’s emphasis, paraphrased in the discussion

“This is cronyism”—a carve‑up of a valuable asset for political allies.

— Scott’s critique of the TikTok framework

ByteDance is the “most undervalued company in the world.”

— Scott, arguing the forced‑sale upside case

Conclusion & Key Takeaways

- The Fed’s 25 bp cut signals a bias toward employment risk, but internal dispersion hints at caution; expect data‑dependent moves at the two remaining 2024 meetings.

- Markets are trading the signal as much as the substance; watch inflation expectations and services‑price prints for the next leg in risk assets.

- The TikTok framework flips equity control but may not transfer algorithm control, leaving the national security rationale contested.

- A “forced sale” could deliver outsized returns to the selected U.S. buyer group if the license is broad and durable; governance and regulatory approvals are the key swing factors.

- Near‑term catalysts: the Trump–Xi call on Friday (reported), formal CFIUS signals, and the Fed’s post‑meeting communications alongside upcoming inflation and labor data.