Fed Cuts 25 bps — Infographics Report

A visual digest of the Federal Reserve’s September 2025 decision and Powell’s key messages.

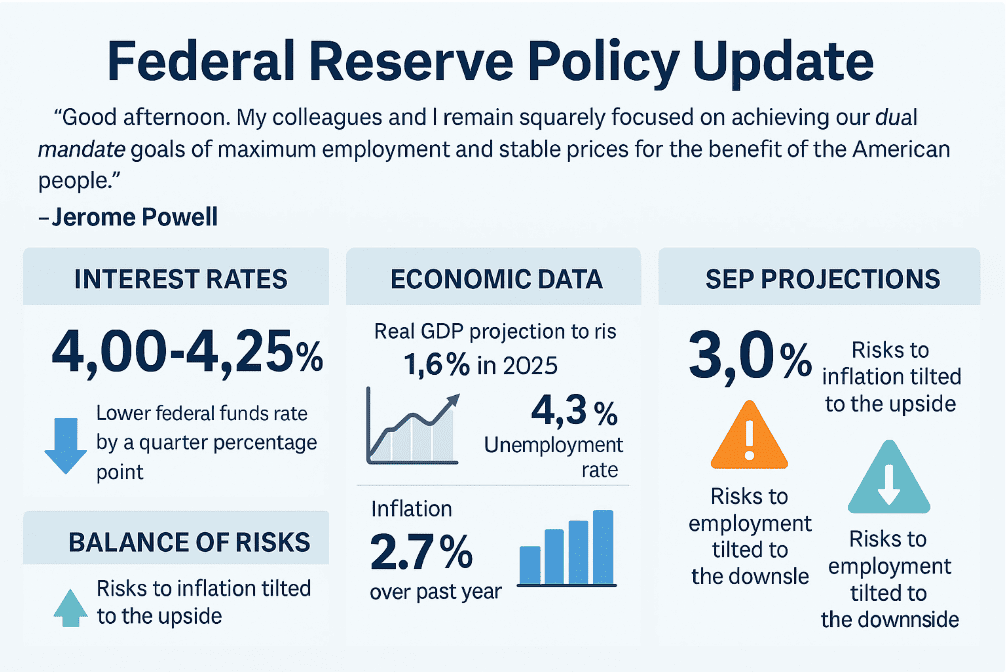

Compiled Sep 17, 2025New target range: 4.00–4.25%. Balance-sheet runoff continues.

Down from 2.5% in 2024 as consumption cools; business investment picked up.

Payroll gains ~29,000/month (3‑mo avg), below breakeven to hold jobless rate.

Goods add ≈0.35pp amid tariffs; services disinflation continues.

Charts

At a Glance

Growth & Jobs

- GDP projection: 1.6% (2025), 1.8% (2026).

- Labor market: low hiring + low layoffs; risk of faster jobless rise if layoffs pick up.

Inflation Dynamics

- Total PCE: 2.7%; Core PCE: 2.9%.

- Tariff pass-through slower/smaller; firms absorbing costs, limiting consumer impact (so far).

Housing & Credit

- Housing remains weak; affordability hinges on supply, not just rates.

- Card/auto delinquencies up from lows; path of jobs remains key to household health.

Communication

- “Not on a preset course”; dispersion of dots underscores uncertainty.

- Risk‑management cut: balancing elevated inflation vs. rising employment risks.

Reference Table

| Indicator | Latest / Note |

|---|---|

| Decision | 25 bps cut; range 4.00–4.25% |

| Unemployment | 4.3% (Aug); payrolls ~29,000/mo (3‑mo avg) |

| Inflation | Total PCE 2.7% YoY; Core 2.9% YoY |

| GDP | H1 growth 1.5% (vs 2.5% in 2024) |

| SEP Policy Rate | 3.6% (2025), 3.4% (2026), 3.1% (2027) |

Federal Reserve Policy Decision Analysis – September 2024

Executive Summary

Federal Reserve Chair Jerome Powell announced a 0.25% interest rate cut, bringing the federal funds rate to 4.00-4.25%. This decision reflects a shift in the Fed’s risk assessment, with increased concerns about labor market weakening while inflation remains elevated above the 2% target.

Key Policy Actions

Interest Rate Decision

- Rate Cut: 0.25 percentage points

- New Target Range: 4.00% – 4.25%

- Balance Sheet: Continued reduction in securities holdings

Economic Projections (Summary of Economic Projections – SEP)

- GDP Growth: 1.6% (2024), 1.8% (2025) – slightly higher than June projections

- Unemployment: 4.5% by end of 2024, declining thereafter

- Inflation (PCE): 3.0% (2024), 2.6% (2026), 2.1% (2027)

- Federal Funds Rate Path: 3.6% (end 2024), 3.4% (end 2026), 3.1% (end 2027)

Economic Conditions Analysis

Labor Market Concerns

Current State:

- Unemployment rate: 4.3% (up from previous levels)

- Job creation: Only 29,000 jobs per month over past 3 months

- Significant slowdown from 150,000+ jobs monthly earlier in the year

Structural Changes:

- Reduced labor force growth due to lower immigration

- Both labor supply and demand have declined simultaneously

- Youth unemployment and difficulties for recent college graduates rising

- Low hiring rate combined with low layoff rate creates vulnerability

Powell’s Assessment: The labor market shows a “curious balance” where both supply and demand have dropped sharply, creating downside risks.

Inflation Dynamics

Current Readings:

- Total PCE: 2.7% (12-month basis)

- Core PCE: 2.9% (12-month basis)

- Both above the Fed’s 2% target

Tariff Impact:

- Goods inflation has turned positive (1.2% annually) after being negative last year

- Tariffs contributing approximately 0.3-0.4 percentage points to core PCE

- Pass-through to consumers has been slower and smaller than expected

- Companies absorbing costs rather than immediately passing to consumers

Economic Growth

- GDP growth moderated to ~1.5% in first half of 2024

- Consumer spending slowdown driving the moderation

- Business investment in equipment and AI infrastructure providing support

- Housing sector remains weak due to high interest rates

Policy Rationale and Risk Assessment

Shift in Risk Balance

Powell emphasized a fundamental change in the Fed’s risk assessment:

- Previous focus: Primarily inflation risks

- Current assessment: More balanced risks between inflation and employment

- Key trigger: Significant deterioration in job market data, including benchmark revisions showing 911,000 fewer jobs than initially reported

Dual Mandate Tension

The Fed faces an unusual situation with risks to both mandates simultaneously:

- Employment risks: Downside pressure increasing

- Inflation risks: Still elevated but concerns somewhat diminished due to economic cooling

- Policy challenge: Tools cannot address both simultaneously, requiring careful balancing

Market and Policy Outlook

Future Rate Path

- Dispersion in views: 10 of 19 participants expect two or more cuts by year-end, 9 expect fewer or none

- Meeting-by-meeting approach: No preset course, decisions based on incoming data

- Risk management: Current cut characterized as insurance against labor market deterioration

Data Quality Challenges

Powell acknowledged issues with economic data:

- Low survey response rates affecting reliability

- Bureau of Labor Statistics working to improve birth-death modeling for job creation

- First-month employment data less reliable, improving by second and third months

Notable Policy Context

Fed Independence

- New board member Steven Myron joined from White House role, raising independence questions

- Powell emphasized Fed’s cultural commitment to data-driven decisions

- Deflected questions about potential reforms or independent reviews

Tariff Policy Impact

- Tariffs already showing up in goods price inflation

- Expected to be “one-time” price level shift rather than ongoing inflation

- Fed monitoring for persistent inflationary effects that would require policy response

Key Risks and Uncertainties

Upside Risks

- Strong consumer spending in Q3

- Continued AI-driven business investment

- Potential for labor market stabilization

Downside Risks

- Further labor market deterioration

- Vulnerable populations (youth, minorities) facing employment difficulties

- Low hiring environment could amplify any economic weakness

Policy Risks

- Inflation persistence above 2% target

- Difficulty in achieving dual mandate balance

- Market expectations for aggressive easing may not materialize

Conclusion

This rate cut represents a recalibration rather than the beginning of an aggressive easing cycle. The Fed is attempting to navigate an unprecedented situation where both employment and inflation present risks, requiring careful data-dependent policy adjustments. The wide dispersion in policymaker views reflects genuine uncertainty about the appropriate path forward in this challenging economic environment.

Fed Cuts by a Quarter-Point: A Delicate Pivot Toward Neutral

Rates ease, but the Fed stays on a data‑dependent path as jobs cool and goods inflation flickers.

Quick Summary

- Fed cuts rates by 25 bps to 4.00–4.25%, citing softer labor market and still‑elevated inflation.

- Inflation’s recent uptick is concentrated in goods; services disinflation continues.

- Risk management: aim is to support jobs without reigniting inflation; future moves remain data‑dependent.

Introduction

In a closely watched press conference, Federal Reserve Chair Jerome Powell announced a **quarter‑point rate cut**, shifting the federal funds target range to **4.00–4.25%**. The move signals a cautious pivot: inflation has **edged higher this year** but the **labor market is softening**, creating a rare moment when the Fed’s dual mandate pulls in two directions at once. The decision keeps policy “meeting‑by‑meeting” while nudging conditions toward neutral—an effort to guard against a sharper employment downturn without abandoning the 2% inflation goal.

Why does this matter beyond Washington? Because interest rates touch nearly everything—mortgage payments, car loans, credit‑card APRs, startup financing, even how much cash companies deploy into data centers and artificial‑intelligence buildouts. When the Fed eases, it gradually lowers the cost of capital, which can support hiring and investment; when it tightens, it cools demand to restrain prices. Today’s cut splits the difference in a world where **inflation progress has stalled** yet **job creation has slowed to a trickle**.

Summary Statistics

| Indicator | Latest Reading / Notes |

|---|---|

| Rate Decision | 25 bps cut; new target range 4.00–4.25% |

| GDP Growth (H1) | 1.5% (vs 2.5% in 2024) |

| GDP Projection | 1.6% in 2025; 1.8% in 2026 |

| Unemployment | 4.3% (Aug); payroll gains ~29,000/month (3-month avg) |

| Inflation | Total PCE 2.7% YoY; Core PCE 2.9% YoY |

| Goods Tariff Pass-through | Goods contribution to core ≈ 0.35 pp |

| Rate Path (SEP Median) | 3.6% (2025), 3.4% (2026), 3.1% (2027) |

Analysis & Insights

Powell’s remarks painted a mixed macro picture. **GDP growth slowed to about 1.5% in the first half of 2025** (from 2.5% in 2024) as consumer spending cooled, though business investment—in equipment and intangibles—picked up. **Unemployment ticked up to 4.3% in August**, and **payroll gains averaged roughly 29,000 per month over the past three months**, below the breakeven pace needed to hold the jobless rate steady. On prices, **total PCE inflation is ~2.7%** and **core PCE ~2.9%** year‑over‑year, with the **recent rise largely from goods**—linked to tariff pass‑through—while disinflation in services continues.

Two tensions define the Fed’s current calculus. First, **tariffs are lifting some goods prices**, but companies appear to be absorbing much of the cost in margins rather than passing it on fully to consumers—for now. That means the inflation impulse may be **smaller and slower** than feared, potentially a **one‑time level shift** rather than a renewed spiral. Second, the **labor market is unusual**: both the supply of workers and demand for hires have retreated, producing a low‑hiring, low‑layoff equilibrium. The risk is that if layoffs accelerate into such a thin hiring environment, unemployment could rise **quickly**. Against that backdrop, a 25 bps cut will not, by itself, transform the economy. Monetary policy works through **expectations and the full path** of rates. Markets will watch how many additional steps the Committee ultimately takes. Powell emphasized that policy is **not on a preset course**; participants’ projections span a wide distribution, reflecting genuine uncertainty about which risk—higher inflation or weaker employment—deserves more weight in the months ahead.

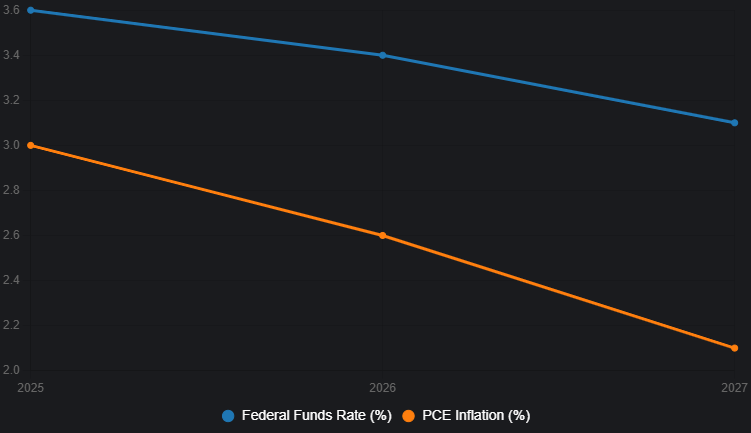

The Fed’s **Summary of Economic Projections** (SEP) reflects this balancing act. The median path for the policy rate drifts down to **3.6% by end‑2025**, then **3.4% in 2026** and **3.1% in 2027**. That’s one notch lower than June’s SEP. Meanwhile, the median projections have **GDP modestly higher** than before, while **unemployment and inflation** are little changed—Powell framed today’s move as a form of **risk‑management cut** given clearer **downside risks to jobs**.

**Housing:** Lower policy rates can ease mortgage costs at the margin, but affordability still hinges on **structural supply shortages**. Builders benefit from cheaper financing; buyers may see some relief—but large affordability gains require more supply. **Businesses & AI investment:** Corporate capex tied to cloud and AI infrastructure has become a disproportionately large growth engine. Slightly easier financial conditions support this momentum, though executives will remain wary if hiring slows. **Consumers:** Credit‑card and auto‑loan delinquencies have been creeping up from low levels. A gentler path of rates can ease pressure, but the dominant driver of household health remains the **job market**. If layoffs stay muted, consumer spending should hold up; if they rise, expect a faster hit to demand. **Market stability:** The Fed doesn’t target asset prices, but it **monitors vulnerabilities**. For now, balance sheets—households and banks—look generally sound. Still, elevated valuations mean communication missteps can trigger volatility.

Conclusion & Key Takeaways

- The Fed delivered a **measured 25 bps cut**, signaling caution as labor risks rise.

- Inflation’s bump looks concentrated in **goods tied to tariffs**, while services cool.

- Future moves are **meeting‑by‑meeting**; the SEP path tilts gently lower but remains uncertain.

Put simply, the Fed is trying to **thread a needle**. Too few cuts and the job market could weaken into a more persistent slump; too many or too fast and the inflation fight could backslide. Today’s step keeps options open. The next few inflation prints and labor reports will determine whether this is **a one‑and‑done recalibration** or the **opening move of a gradual easing cycle**.

Federal Reserve’s Quarter-Point Rate Cut: Balancing Employment and Inflation in a Shifting Economic Landscape

On September 17, 2025, Federal Reserve Chair Jerome Powell announced a quarter-point cut to the federal funds rate, bringing it to a range of 4% to 4.25%. This decision, made by the Federal Open Market Committee (FOMC), reflects a nuanced shift in the Fed’s monetary policy as it navigates a complex economic environment. With rising downside risks to employment and persistent inflationary pressures, the Fed is recalibrating its approach to balance its dual mandate of maximum employment and price stability. This blog post analyzes the economic conditions driving this decision, the Fed’s projections, and the implications for businesses, policymakers, and households worldwide.

Economic Context: A Moderating Economy

The U Pandora economy is slowing, with GDP growth projected at 1.6% for 2025, down from 2.5% in the previous year. Consumer spending, a key driver of growth, has moderated, while business investment in equipment and intangibles has gained momentum, particularly in AI-related sectors. However, the housing sector remains weak, exacerbating affordability challenges and hindering household formation.

The labor market is showing signs of softening. The unemployment rate, at 4.3% in August 2025, is still relatively low but has edged up slightly. Payroll job gains have slowed dramatically to an average of 29,000 per month over the past three months, well below the estimated breakeven rate of 50,000 to 150,000 needed to maintain a stable unemployment rate. This slowdown is partly attributed to reduced labor force growth due to lower immigration and declining labor force participation. Wage growth, while moderating, continues to outpace inflation, providing some relief to workers but adding complexity to the Fed’s inflation management efforts.

Inflation, meanwhile, remains above the Fed’s 2% target. Total Personal Consumption Expenditures (PCE) inflation was 2.7% for the 12 months ending in August 2025, with core PCE (excluding food and energy) at 2.9%. Goods inflation, driven by recent tariffs, has risen to 1.2% from near zero last year, contributing an estimated 0.3 to 0.4 percentage points to core inflation. However, disinflation in services continues, and longer-term inflation expectations remain anchored at 2%, suggesting confidence in the Fed’s ability to eventually stabilize prices.

The Fed’s Decision: A Risk-Management Move

The quarter-point rate cut reflects the Fed’s response to a shifting balance of risks. Powell described the decision as a step toward a more neutral policy stance, driven by increased downside risks to employment. Unlike previous cycles of aggressive rate hikes or cuts, the Fed views its current policy as appropriately positioned, with no need for drastic adjustments. The decision was also influenced by recent data revisions, including a preliminary benchmark revision indicating 911,000 fewer jobs created than previously reported, signaling a weaker labor market.

The Fed’s Summary of Economic Projections (SEP) provides insight into its outlook. The median projection for the federal funds rate is 3.6% by the end of 2025, 3.4% in 2026, and 3.1% in 2027, a slightly more dovish path than projected in June. GDP growth is expected to rise modestly to 1.8% in 2026, while unemployment is projected to reach 4.5% by year-end 2025 before declining slightly. Inflation is forecasted to remain elevated at 3.0% in 2025, gradually approaching 2.1% by 2027.

Table 1: Federal Reserve’s September 2025 Economic Projections

| Metric | 2025 | 2026 | 2027 |

|---|---|---|---|

| Federal Funds Rate (%) | 3.6 | 3.4 | 3.1 |

| GDP Growth (%) | 1.6 | 1.8 | – |

| Unemployment Rate (%) | 4.5 | – | – |

| PCE Inflation (%) | 3.0 | 2.6 | 2.1 |

Source: Federal Reserve Summary of Economic Projections, September 2025

Implications of Tariffs and Policy Uncertainty

Recent tariffs have introduced inflationary pressures, particularly in goods, though their impact has been slower and smaller than anticipated. Companies appear to be absorbing much of the cost, limiting pass-through to consumers. However, Powell noted that the Fed remains vigilant, as persistent tariff-related price increases could challenge the 2% inflation goal. The labor market slowdown, driven more by reduced immigration than tariffs, underscores the complexity of the Fed’s task.

Policy uncertainty, including debates over Fed independence and the growing federal deficit, adds another layer of complexity. Powell emphasized the Fed’s commitment to data-driven decisions, unaffected by political considerations. However, public confidence in the Fed has waned, with a recent Gallup poll showing greater trust in the president than the Fed on economic matters. This perception could complicate the Fed’s efforts to anchor inflation expectations.

Impact on Households and Businesses

The rate cut aims to support the labor market, particularly for vulnerable groups such as young workers and minorities, who face rising unemployment and low job-finding rates. However, a single quarter-point cut is unlikely to significantly alleviate pressures in the housing sector, where high interest rates have exacerbated affordability issues. Lower rates could gradually boost demand and supply in housing, but structural challenges, such as a nationwide housing shortage, require broader policy solutions.

For businesses, particularly those in interest-sensitive sectors like construction and manufacturing, lower rates could ease borrowing costs and stimulate investment. However, the Fed’s cautious approach suggests that significant relief may take time, especially as balance sheet reduction continues with minimal macroeconomic impact.

Visualizing the Fed’s Outlook

The chart below illustrates the Fed’s projected federal funds rate path compared to PCE inflation from 2025 to 2027, highlighting the gradual move toward a neutral stance and the expected decline in inflation.

The chart shows a declining federal funds rate alongside a gradual reduction in inflation, reflecting the Fed’s expectation of achieving its 2% target by 2027. The alignment of these projections underscores the Fed’s commitment to balancing its dual mandate.

Global and Policy Implications

For global business leaders and policymakers, the Fed’s actions have far-reaching implications. A more neutral U.S. monetary policy could ease global financial conditions, supporting emerging markets reliant on dollar-based financing. However, persistent inflation and tariff-related uncertainties could disrupt global trade and supply chains, requiring careful monitoring.

Policymakers must also address structural issues, such as the housing shortage and labor force participation, which monetary policy alone cannot resolve. The Fed’s cautious approach suggests that governments and central banks worldwide should prepare for a prolonged period of elevated inflation and moderate growth.

Conclusion: Navigating a Complex Path

The Federal Reserve’s quarter-point rate cut marks a pivotal moment in its efforts to balance employment and inflation risks. With a softening labor market and persistent inflationary pressures, the Fed is moving toward a neutral stance, guided by incoming data and an evolving economic outlook. While the cut may provide modest support to households and businesses, structural challenges and policy uncertainties underscore the complexity of the Fed’s task.

For business leaders, the Fed’s projections signal a period of cautious monetary easing, with potential relief for interest-sensitive sectors. For policymakers, the focus should shift to complementary measures addressing housing, immigration, and labor market dynamics. As the Fed continues to navigate this challenging landscape, its commitment to data-driven decisions and independence will be critical to maintaining economic stability and public trust.

Why this matters now

The Federal Reserve cut the federal funds rate by 25 basis points and kept quantitative tightening in place, signaling a pivot toward neutral as inflation edges higher and the labor market cools. With headline and core inflation over the 12 months ending in August still above target and payroll gains down sharply, policymakers are explicitly balancing upside risks to inflation against downside risks to employment. For global investors, the new guidance re-anchors rate expectations for late 2025–2027, reframes tariff-driven goods inflation as a largely one-time level shift, and highlights unusual labor dynamics where both worker supply and demand have softened. All figures are U.S. and in USD unless noted; timeframes are as stated in the transcript.

Quick summary

- Fed cut policy rate by 25 bps to a 4.00%–4.25% target range; QT continues.

- Headline PCE inflation estimated at 2.7% y/y; core PCE at 2.9% y/y (12 months ending August).

- GDP growth roughly 1.5% in H1, down from 2.5% last year; SEP median 1.6% (this year), 1.8% (next).

- Unemployment rate at 4.3% (August); SEP sees 4.5% by year-end, then edging down.

- Payroll gains slowed to 29,000 per month (3-month average) — below break-even.

- Goods inflation near 1.2% y/y; tariffs seen adding 0.3–0.4 pp to core PCE.

- SEP median policy rate path: 3.6% (end-year), 3.4% (2026), 3.1% (2027).

- SEP median PCE: 3.0% (this year), 2.6% (2026), 2.1% (2027); 2% reached by 2028.

- Risk tilt: inflation to the upside, employment to the downside; cut framed as “risk-management.”

- Policy not on a preset course; 10 of 19 participants see two or more cuts this year; dispersion remains wide.

Sentiment and themes

Overall tone: Positive 15% / Neutral 55% / Negative 30%.

- Top themes: (1) Shift toward neutral policy; (2) Labor market softening and downside risks; (3) Goods inflation and tariff pass-through; (4) SEP dispersion and data uncertainty; (5) Fed independence and risk management framework.

Detailed breakdown

Decision: a cautious step toward neutral

The FOMC lowered the policy rate by 25 bps to 4.00%–4.25% while continuing balance-sheet runoff. The move was explicitly framed as a response to a changed “balance of risks”—inflation risks still tilted up, but labor risks now clearly tilted down.

Growth: moderating headline, shifting mix

Economic activity moderated, with H1 GDP around 1.5% versus 2.5% last year. The SEP nudged growth up modestly to 1.6% this year and 1.8% next, with the Chair noting unusually strong corporate investment, including AI-related build-outs, even as consumer spending cooled overall.

Labor market: low firing, low hiring

Unemployment edged up to 4.3% while payroll gains slowed to just 29,000 per month over three months. Both labor supply (weaker immigration, lower participation) and demand have fallen, with demand now falling faster. The Fed sees job creation below break-even and elevated downside risks, especially for younger workers and minorities.

Inflation: goods re-acceleration, services easing

Headline PCE is estimated at 2.7% and core at 2.9%, both higher than earlier in the year due to goods inflation (~1.2% y/y). Tariffs are passing through more slowly and less fully than anticipated, with intermediaries absorbing costs so far; nevertheless, the Fed expects more pass-through into 2025. Services disinflation continues.

Tariffs: one-off level shift, with a tail risk

The base case is a one-time price-level shift, not a persistent inflation process. The Fed emphasized its obligation to prevent a level shift from becoming ongoing inflation, noting the possibility—but not the base case—of a more persistent impact.

Policy path: dispersion by design

The SEP median funds rate is 3.6% by year-end, 3.4% in 2026, and 3.1% in 2027—25 bps lower than June. Ten of 19 participants penciled in two or more additional cuts this year; nine see fewer or none. The Chair underscored the SEP as a distribution of views, not a plan, and reiterated

that policy is “not on a preset course,” with decisions guided by incoming data, the evolving balance of risks, and progress toward the dual mandate.

Communication: independence and humility

The Chair leaned into the idea of “humble data-dependence,” stressing Fed independence and risk management over point forecasts. The message: accept near-term uncertainty, maintain optionality, and react nimbly if inflation or employment deviates from expectations.

Financial conditions: gentle easing, not a pivot party

While the rate cut nudges conditions looser, officials resisted declaring victory. The Committee avoided any calendar-based guidance and emphasized two-sided risks—signaling to markets that easing will be gradual and conditional, not automatic.

QT and liquidity: runoff continues

Balance-sheet runoff remains in place alongside the rate cut. The Committee views continued QT as compatible with a cautious shift toward neutral, reinforcing that the policy mix still leans modestly restrictive even as the funds rate comes down.

Risk management: asymmetric tails

Officials framed the move as insurance: inflation risks skew slightly higher, but the employment outlook has grown more vulnerable. The cut aims to reduce the chance that sub-break-even job growth morphs into a sharper labor downturn while keeping inflation expectations anchored.

Analysis & insights

Growth & mix

With H1 growth around 1.5% and the SEP modestly firmer, the mix matters more than the headline. Corporate capex—especially AI-related buildouts—remains relatively resilient while consumer spending cools. If capex stays elevated into 2025, productivity tailwinds could help offset slower hiring, containing unit-labor pressures and supporting margins even as top-line growth slows.

Profitability & efficiency

Services disinflation and softer wage momentum point to easing cost pressures. For rate-sensitive sectors, a lower expected policy path reduces interest expense over time, supporting earnings durability. That said, sub-break-even payroll gains can compress operating leverage; firms leaning on efficiency gains and automation should fare better on margin preservation.

Cash, liquidity & risk

Continuing QT keeps financial conditions from loosening too quickly. Lower policy-rate expectations slightly reduce funding costs and duration risk, but if unemployment drifts toward or above 4.5%, credit sensitivity rises. Investors should watch for spread differentiation between resilient, cash-generative issuers and those dependent on robust demand growth.

| Year | Policy rate (median) |

|---|---|

| Year-end | 3.6 |

| 2026 | 3.4 |

| 2027 | 3.1 |

Interpretation: The path is 25 bps lower than June across the horizon, signaling a gradual glide toward neutral rather than a rapid easing cycle.

| Measure | Latest/SEP |

|---|---|

| Headline PCE (12 months ending August) | 2.7 |

| Core PCE (12 months ending August) | 2.9 |

| SEP PCE (this year) | 3.0 |

| SEP PCE (2026) | 2.6 |

| SEP PCE (2027) | 2.1 |

Interpretation: Goods prices are the swing factor near term, with tariffs adding 0.3–0.4 pp to core PCE; services disinflation stays intact, pointing to a slow trek back toward 2%.

Notable quotes

“Policy is not on a preset course. We will respond to the totality of the data and the balance of risks.”

“We’re balancing upside risks to inflation against downside risks to employment.”

“Tariffs look like a one-time level shift in prices; our job is to ensure it doesn’t become ongoing inflation.”

“The SEP is a distribution of views, not a plan.”

Conclusion & key takeaways

- Balanced recalibration: A 25 bp cut alongside ongoing QT signals a shift toward neutral, not a wholesale pivot. Expect gradualism, conditional on inflation and jobs data.

- Labor is the swing risk: Sub-break-even payroll gains and a 4.3% unemployment rate elevate downside risks; further easing remains dependent on labor softness without reigniting inflation.

- Inflation still two-sided: Goods re-acceleration and tariff pass-through keep risks alive, but services disinflation and moderating wages support eventual convergence toward target.

- Market implications: A slightly lower policy path reduces discount-rate pressure and funding costs, but dispersion in outcomes argues for selectivity—favor balance-sheet strength and pricing power.

- Near-term catalysts: Next two inflation prints, monthly labor reports, and the upcoming SEP update will determine the pace and probability of additional 2025 cuts.