Nvidia has been a darling of Wall Street, riding the wave of artificial intelligence (AI), gaming, and data center growth to become one of the most valuable companies in the world. In a recent YouTube video titled “Nvidia’s stock can double from here, if not more, says Melius’ Ben Reitzes”, Melius Research analyst Ben Reitzes makes a bold claim: Nvidia’s stock price, already at stratospheric levels, could double or more. This assertion has sparked intense debate among investors, business leaders, and policymakers. Is this optimism grounded in reality, or is it speculative hype? Let’s break down the factors driving Nvidia’s meteoric rise, evaluate Reitzes’ bullish case, and assess whether such growth is sustainable, all while weaving a compelling narrative for a global audience.

The Nvidia Phenomenon: A Snapshot of Growth

Nvidia’s transformation from a niche graphics processing unit (GPU) manufacturer to a cornerstone of the AI revolution is nothing short of remarkable. Founded in 1993, the company initially focused on GPUs for gaming but has since expanded into data centers, automotive, and AI applications. By September 2025, Nvidia’s market capitalization has soared past $3 trillion, making it one of the world’s most valuable companies, rivaling giants like Apple and Microsoft. Its stock price, which hovered around $50 (split-adjusted) in early 2020, has climbed to over $120 per share by mid-2025, reflecting a staggering 140% annualized return over five years.

This growth is fueled by Nvidia’s dominance in AI chip design. Its GPUs, particularly the H100 and upcoming Blackwell architecture, are the gold standard for training large language models (LLMs) and other AI workloads. The global AI market is projected to grow at a compound annual growth rate (CAGR) of 37.3% from 2023 to 2030, reaching $1.8 trillion by the end of the decade, according to industry estimates. Nvidia commands an estimated 80-90% market share in AI chips, positioning it to capture a significant portion of this growth. Additionally, its CUDA software ecosystem creates a moat, locking developers into its platform.

The Bullish Case: Why Reitzes Sees Doubling Potential

Ben Reitzes, a seasoned analyst at Melius Research, argues that Nvidia’s stock could double from its current levels, implying a market cap approaching $6 trillion or more. His optimism hinges on several key drivers:

- AI Demand Explosion: The proliferation of generative AI, autonomous vehicles, and edge computing is driving insatiable demand for Nvidia’s chips. Companies like OpenAI, Google, and Amazon rely heavily on Nvidia’s GPUs to power their AI infrastructure. Reitzes believes this demand will accelerate as AI applications expand into healthcare, finance, and industrial automation.

- New Product Cycles: Nvidia’s upcoming Blackwell architecture, expected to ship in volume in 2026, promises significant performance improvements over the H100. Early estimates suggest Blackwell chips could be 2-3 times more efficient, further entrenching Nvidia’s lead. Additionally, Nvidia’s expansion into software (e.g., DGX Cloud) and AI-optimized systems positions it as a full-stack AI provider.

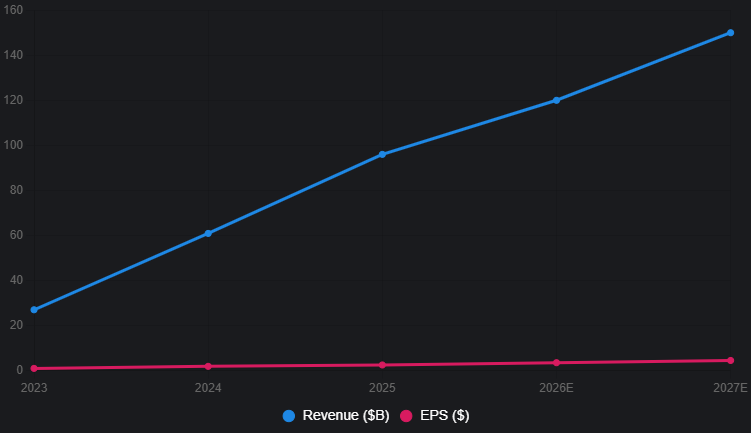

- Valuation Justification: Despite trading at a forward price-to-earnings (P/E) ratio of approximately 50x, Nvidia’s growth trajectory justifies premium valuations. Analysts project Nvidia’s revenue to grow from $96 billion in fiscal 2025 to $150 billion by fiscal 2027, with earnings per share (EPS) rising from $2.50 to $4.50. If Nvidia maintains its current P/E multiple, a doubling of EPS could naturally lead to a doubled stock price.

- Network Effects and Ecosystem: Nvidia’s CUDA platform and partnerships with cloud providers create a virtuous cycle. As more developers adopt Nvidia’s tools, its ecosystem becomes harder to disrupt, ensuring long-term dominance.

Reitzes’ bullish outlook is not isolated. Other analysts, such as those at Bank of America and Goldman Sachs, have raised price targets, citing similar drivers. However, Reitzes’ call for a doubling is among the most aggressive, implying a stock price exceeding $240 by 2027.

The Counterargument: Risks and Challenges

Despite the bullish case, skeptics argue that Nvidia’s valuation already prices in much of its growth potential. Several risks could derail the doubling thesis:

- Competition Intensifying: AMD, Intel, and emerging players like Cerebras and Grok (developed by xAI) are investing heavily in AI chips. AMD’s Instinct MI300 series, for example, offers competitive performance at lower costs. If Nvidia loses even a small portion of its market share, revenue growth could slow significantly.

- Market Saturation: The AI chip market may face supply-demand imbalances. As Nvidia ramps up production, a potential oversupply could pressure pricing power, especially if enterprise adoption of AI slows due to economic headwinds.

- Macro Risks: Rising interest rates, geopolitical tensions (e.g., U.S.-China trade restrictions), and supply chain disruptions could impact Nvidia’s growth. China, a key market, accounted for 15% of Nvidia’s revenue in 2024, but export controls limit its ability to sell advanced chips there.

- Valuation Concerns: At 50x forward earnings, Nvidia’s stock is vulnerable to corrections if growth disappoints. A historical comparison to Cisco during the dot-com bubble—when its stock crashed after failing to sustain hypergrowth—raises caution.

Data-Driven Insights: Nvidia’s Financial Trajectory

To assess Reitzes’ claim, let’s examine Nvidia’s financial performance and projections. The table below summarizes key metrics from fiscal 2023 to projected fiscal 2027, based on consensus analyst estimates.

| Year | Revenue ($B) | EPS ($) | Forward P/E Ratio | Market Cap ($T) |

|---|---|---|---|---|

| 2023 | 27.0 | 0.98 | 60x | 1.2 |

| 2024 | 60.9 | 1.89 | 55x | 2.5 |

| 2025 | 96.0 | 2.50 | 50x | 3.1 |

| 2026E | 120.0 | 3.50 | 48x | 4.0 |

| 2027E | 150.0 | 4.50 | 48x | 5.8 |

Source: Consensus analyst estimates, compiled from Bloomberg and FactSet as of September 2025.

The chart below visualizes Nvidia’s revenue and EPS growth from 2023 to 2027, highlighting the trajectory that could support Reitzes’ doubling thesis.

The Bigger Picture: Implications for Business and Policy

Nvidia’s trajectory has profound implications beyond its stock price. For business leaders, Nvidia’s dominance underscores the importance of investing in AI infrastructure. Companies that fail to adopt AI risk falling behind, as industries from healthcare to logistics integrate machine learning. Nvidia’s partnerships with cloud giants like AWS and Microsoft highlight the need for collaborative ecosystems to scale AI adoption.

For policymakers, Nvidia’s rise raises questions about market concentration and technological sovereignty. With Nvidia controlling the AI chip market, regulators may scrutinize its dominance, especially as AI becomes critical to national security and economic competitiveness. Export controls on advanced chips, already impacting Nvidia’s China business, could expand, affecting global supply chains.

Can Nvidia Double? A Balanced Perspective

Reitzes’ prediction that Nvidia’s stock could double is plausible but not guaranteed. The company’s leadership in AI, robust financials, and innovative pipeline support a bullish outlook. If Nvidia achieves $150 billion in revenue and $4.50 in EPS by 2027, maintaining a 48x P/E ratio could push its market cap to $5.8 trillion, nearly doubling from today’s $3.1 trillion. However, competition, macroeconomic risks, and valuation concerns pose significant hurdles.

For investors, the key is balancing optimism with caution. Nvidia’s growth story is compelling, but diversification remains critical in a volatile market. For business leaders, Nvidia’s success signals the urgency of embracing AI. For policymakers, it’s a call to address the implications of concentrated technological power.

In conclusion, Nvidia’s potential to double its stock price hinges on sustaining its AI dominance and navigating competitive and economic challenges. Whether it achieves Reitzes’ bold vision, Nvidia’s journey will shape the future of technology and markets for years to come.