AI Boom or Bubble? How Long‑Term Investors Should Position Now

A one‑page visual brief covering market concentration, Nvidia’s earnings glide path, and undervalued ideas across the AI stack — hardware, platforms, and users.

Quick Summary

- AI capex is red‑hot and still capacity‑constrained; delivered chips are immediately utilized.

- Portfolio concentration is extreme: Top 5 = ~25% of U.S. market cap; Top 10 = ~35%.

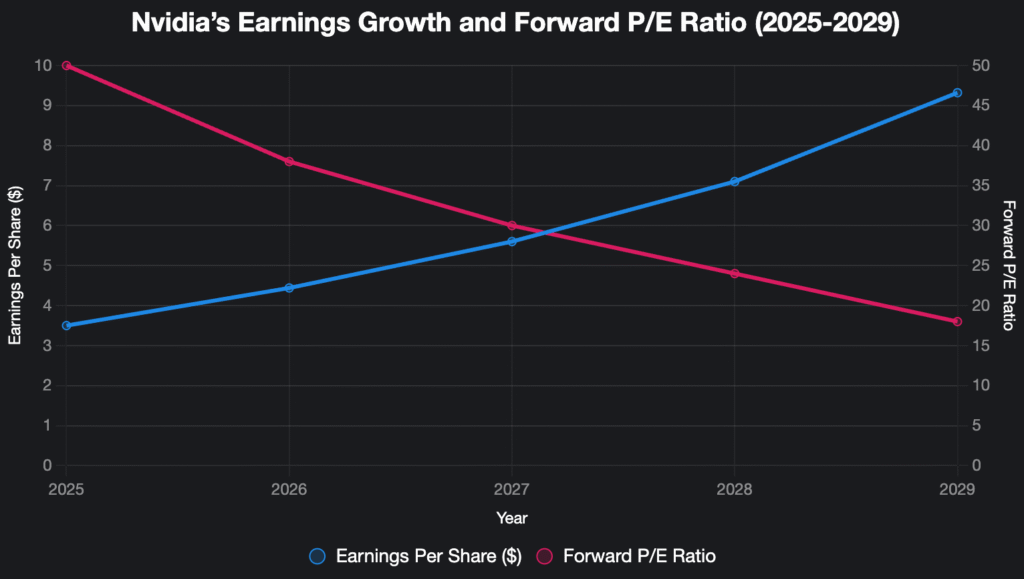

- Nvidia’s valuation normalizes as EPS compounds: fwd P/E stepping toward the high‑teens by out‑years.

- China is a latent upside: management pegs a ~$50B annual opportunity vs. a ~$200B sales base.

- Base case: U.S. market broadly near fair value; expect long‑run ~8–10% equity‑like returns.

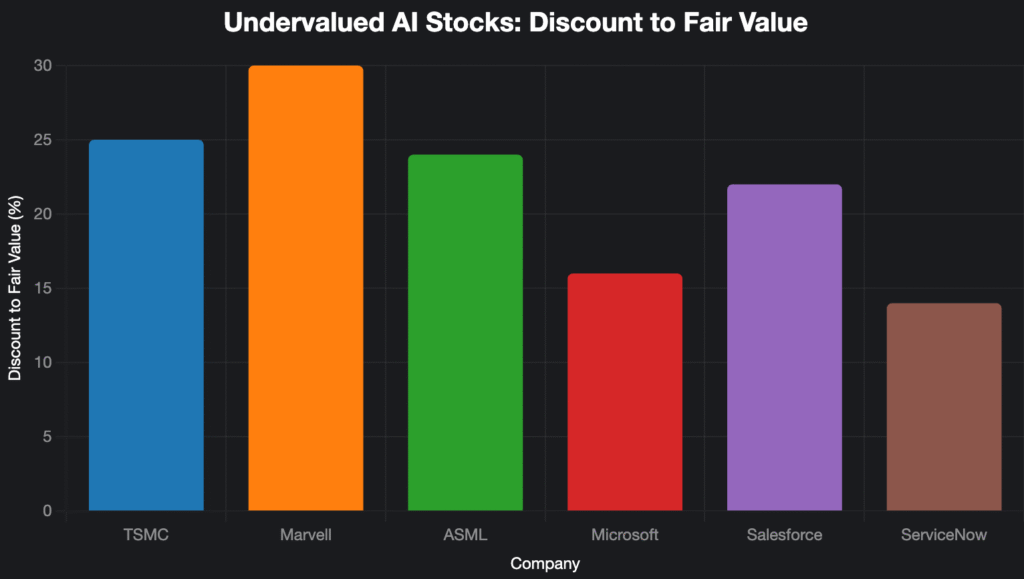

- Undervalued ideas across three buckets: TSMC, Marvell, ASML (hardware), Microsoft (platforms), Salesforce/ServiceNow (users).

Positioning at a Glance

Interpretation: Broad exposure is already meaningful; add selectively and diversify across the stack.

U.S. Market Concentration

Even “broad” index funds are concentrated in AI beneficiaries. Rebalance deliberately.

Nvidia: Earnings vs. Multiple (Illustrative)

| Fiscal Year | EPS (Model) | Forward P/E | Read |

|---|---|---|---|

| Current | $4.44 | ~38× | Rich but supported |

| Next Year | $6.58 | ~26× | Normalizing |

| Out‑Year (’29) | $9.32 | ~18× | Reasonable |

As EPS compounds, valuation compresses into a more typical growth range.

Build Across Three Buckets

1) Picks & Shovels (Hardware)

- TSMC — Wide moat; scale & process leadership. ~25% discount.

- Marvell (MRVL) — Narrow moat; data networking & custom silicon. ~30% discount.

- ASML — EUV monopoly for leading‑edge lithography. ~24% discount.

2) Platforms (Hyperscale Clouds)

- Microsoft — Azure + Copilot flywheel. ~16% discount.

- Note: Alphabet fair‑value gap has narrowed after favorable DOJ ruling.

3) AI Users (Revenue/Margin Expanders)

- Salesforce — Wide moat; AI lifting attach & ARPU. ~22% discount.

- ServiceNow — On 3★/4★ cusp; ~14% discount; workflow automation win‑rates rising.

Risk Radar

- Policy & Exports: China access for AI silicon remains fluid.

- Supply Chain: CoWoS/HBM/High‑NA EUV yields and shipments.

- Utilization/ROI: Hyperscaler attach rates, GPU hours, pricing.

- Competition: Custom accelerators, networking topologies.

- Valuation Drift: With market near fair value, returns hinge on fundamentals.

Near‑Term Catalysts

- Hyperscaler earnings: AI workloads, inference monetization, Copilot/GenAI attach.

- Semicap orders/backlog: EUV/High‑NA shipments, HBM capacity additions.

- Export‑control updates: Timelines for China‑compliant accelerators.

- Enterprise AI case studies: Proof of revenue lift and margin expansion.

Actionable Playbook

- Audit your baseline AI exposure in core index funds; right‑size any overweight.

- Own the stack (hardware, platforms, users) rather than one hero name.

- Favor cash‑return pathways: pricing power, seat/usage growth, cost‑to‑serve reductions.

- Use valuation as a governor: scale positions with discount‑to‑fair‑value.

- Rebalance on strength; add on dislocations as the buildout stays lumpy.

AI Boom or Bubble? How Long-Term Investors Should Position Now

Quick Summary (5–6 takeaways)

- AI capex remains red-hot, fueling earnings across semis, cloud, and software; the “picks-and-shovels” buildout still isn’t done.

- Portfolio concentration is extreme: the top 5 U.S. stocks = ~25% of market cap; top 10 = ~35%—you already own a lot of AI risk even via broad index funds.

- Nvidia is modeled for rapid EPS gains (roughly ~38× → ~26× → ~18× forward P/E as earnings compound), implying high—but not irrational—expectations.

- China is a latent upside: management sees a ~$50B annual opportunity once export permissions settle, versus ~$200B total sales base.

- Morningstar’s fair-value lens sees the U.S. market ~fairly valued, with long-run 8–10% equity-like return expectations rather than outsized AI windfalls.

- Undervalued AI plays span three buckets: hardware (TSMC, Marvell, ASML), platforms (Microsoft), and AI users (Salesforce, ServiceNow)—each flagged at ~14–30% discounts.

The Setup: A Historic Buildout—But Not (Yet) a Bubble

AI excitement has vaulted a handful of firms to colossal market caps, but the more important story is where we are in the adoption curve. We’re still deep in the infrastructure phase: data centers, leading-edge fabs, EUV tools, advanced packaging, and networking. Supply remains the bottleneck, not demand. Chips ship; chips get used—immediately.

That has two implications. First, the spending you see is mostly being funded from current cash flows, not a debt binge. Second, most capacity coming online is intended to meet existing backlogs, not to stuff inventories for a speculative future. Those are classic “boom” signals, not bubble tells.

Morningstar’s equity team frames the market as broadly near fair value. Translation: the easy multiple expansion from AI euphoria is largely behind us. From here, investors should expect cost-of-equity-type returns (think 8–10% annually over a long horizon), with stock-picking alpha coming from identifying businesses that (1) supply AI’s buildout, (2) operate the platforms that monetize AI usage, or (3) use AI to expand revenues or margins.

Concentration Risk: You Already Own AI—A Lot of It

Even if you haven’t bought a single “AI stock,” passive exposure has done the work for you. In the U.S. market index, the top five names account for about a quarter of the total market cap; the top ten stretch to roughly a third. Nvidia alone is about ~7%. For many investors, the question isn’t whether to add AI—it’s whether to rebalance AI.

Actionably, that means two things:

- Know what you own. Your S&P 500 or total-market fund is now a concentrated bet on AI-beneficiaries.

- Diversify within AI. If you add exposure, favor a three-bucket approach (hardware, platforms, users) rather than piling into one ticker.

Nvidia: Fully Valued, Not Fantasy

Calling Nvidia’s run “impressive” undersells it. Morningstar’s base case prices in rapid EPS compounding over the next five years. The important bit isn’t the exact pennies; it’s the trajectory: a high forward P/E today that steps down from ~38× to the mid-20s and then to the high-teens as earnings catch up. That’s what “fully valued” looks like when growth is real—rich, but not necessarily irrational.

Geopolitics remains the wild card. Management pegs a China opportunity near $50B annually, once export permissions and product variants line up. Against an internal sales base modeled around ~$200B, that’s not trivial. Morningstar isn’t baking that upside into base-case fair value yet—but if (or when) it materializes, it’s incremental fuel.

For long-term holders, the takeaway is straightforward: position size with humility, acknowledge the geopolitical optionality, and don’t expect yesterday’s multiple expansion to repeat indefinitely. Expect earnings to do the heavy lifting from here.

Boom vs. Bubble: What Would Tip the Balance?

We’re in a boom because supply is tight, cash is funding buildouts, and delivered silicon is immediately productive. A bubble would likely require a flip in those conditions: capex chasing imagined demand, channel stuffing, or leverage-driven expansion divorced from cash returns. Keep your eye on:

- Utilization rates at hyperscalers and leading coal operators.

- Lead times and pricing power in GPUs, HBM, and EUV toolchains.

- Customer mix shifting from frontier model training to broader enterprise deployments that monetize AI at scale.

So far, the data says we’re not there yet.

The Three-Bucket Playbook (with Undervalued Ideas)

1) Picks & Shovels (Hardware Providers)

These are the arteries of AI. They monetize before software capture broadens.

- Taiwan Semiconductor (TSMC) — Wide moat; scale + process leadership. Morningstar tags it a four-star idea at roughly a ~25% discount to fair value. As 2nm/1.6nm ramps and advanced packaging (CoWoS, SoIC) scales, TSMC remains the critical nexus for leading-edge compute. Key watch items: geopolitics, capacity adds, and pricing.

- Marvell Technology (MRVL) — Narrow moat; switching costs + IP. Also, four-star, around a ~30% discount. Marvell’s data-center networking, custom ASIC, and optical interconnect footprints tie directly into AI cluster growth. Volatility will persist, but secular demand for bandwidth is non-optional.

- ASML — The EUV monopoly. Four-star at roughly a ~24% discount. Every step-function in computing efficiency starts with lithography. As logic and HBM stacks tighten, EUV/High-NA EUV becomes even more pivotal. Backlog durability is the barometer.

2) Platforms (Hyperscale & Operating Clouds)

Where AI is trained, served, and increasingly productized.

- Microsoft — Four-star; ~16% discount. Azure remains a prime beneficiary of AI training and inference, while Copilot and embedded AI expand ARPU across Office, Dynamics, and GitHub. The “picks + platform + product” trifecta is rare—and priced more reasonably than you might guess for its growth algorithm.

3) AI Users (Revenue/Margin Expanders)

Winners will apply AI to expand TAM and fatten margins.

- Salesforce — Wide moat; switching costs + network effects. Four-star around ~22% discount. Early signs show AI driving attach rates, tier upgrades, and seat expansion as customers pay for automation, insights, and agentic workflows.

- ServiceNow — On the three-/four-star cusp at roughly ~14% discount. Now’s platform is built for workflow automation; AI elevates it from ticket routing to true digital co-workers. Watch new logos and expansion in financial services, healthcare, and the public sector.

Positioning note: build across all three buckets to smooth cycle risk: hardware juices near-term earnings; platforms monetize usage growth; application players convert AI into sticky revenue and operating leverage.

Risk Radar & What to Watch

- Policy/Export Controls: China access for AI silicon is a moving target. Delays don’t break the thesis, but they change the slope.

- Supply-Chain Execution: CoWoS capacity, HBM yields, High-NA EUV shipments—any hiccup pinches upside.

- Utilization & ROI: Capex must earn its keep. Track hyperscaler disclosures on AI service attach, GPU hours, and pricing.

- Competitive Dynamics: Custom silicon (TPUs/accelerators), networking topologies, and model-hosting economics can shift margins fast.

- Valuation Drift: With the broad market near fair value, future return stacks will rely more on fundamentals than multiples.

Putting It All Together: A Pragmatic Long-Only Plan

- Acknowledge your baseline AI exposure. If you’re indexed, you already own the theme—size any “overweight” deliberately.

- Own the stack, not the hero. Diversify across hardware, platforms, and users; avoid single-name fragility.

- Favor cash-return pathways. Look for businesses where AI visibly raises prices, expands seats/usage, or shrinks cost to serve.

- Use valuation as your governor. Morningstar’s star ratings/discounts are practical tools for scaling position size.

- Rebalance on strength, add on dislocations. The buildout will be lumpy; let volatility be your friend.

Conclusion: From Euphoria to Execution

We are living through a genuine technology boom, not a speculative mirage. The near-term winners are those selling the tools (TSMC, Marvell, ASML) and renting the platforms (Microsoft). The durable compounders will be those that embed AI into products and processes to pull forward revenue and margin (Salesforce, ServiceNow, and others that pass the same test).

For buy-and-hold investors, the play is measured participation: keep core index exposure, complement it with selectively undervalued names across the AI stack, and let the earnings curve—not the headline multiple—do the compounding. Expect equity-like 8–10% long-run returns for the market, with upside for patient stock-pickers who insist on moats, cash conversion, and sensible entry prices.

Booms turn into bubbles when capital outruns cash flow. We’re not there—yet. Stay focused on utilization, pricing power, and ROI. If those three stay healthy, the AI story has plenty of runway—and your portfolio, thoughtfully constructed, should benefit from lift, not turbulence.

The AI Boom: Navigating Investment Opportunities in a Tech-Driven Market

Artificial Intelligence (AI) is reshaping industries, economies, and investment portfolios worldwide. From Nvidia’s dominance in AI chip production to hyperscalers like Microsoft building AI-driven platforms, the market is buzzing with excitement. But is this a sustainable boom or an overheated bubble? For buy-and-hold investors, understanding the AI landscape is critical to making informed decisions. This article explores the current state of AI investing, evaluates whether valuations are justified, and highlights undervalued stocks with strong potential, drawing on insights from Morningstar’s chief US market strategist, Dave Sekera, and CEO Kunal Kapoor.

The AI Surge: Boom or Bubble?

The AI sector has driven a significant portion of the recent tech-led stock market rally. Companies like Nvidia, part of the “Magnificent Seven” (Apple, Microsoft, Alphabet, Amazon, Meta, Tesla, and Nvidia), have seen explosive growth due to robust AI spending. Nvidia alone accounts for nearly 7% of the Morningstar US Market Index’s market capitalization, underscoring its outsized influence. The top five stocks in the index represent 25% of the market, and the top ten account for 35%, highlighting the concentration of AI-driven growth in mega-cap tech.

Morningstar’s outlook leans firmly toward an AI boom rather than a bubble—at least for now. Sekera notes that current capital expenditure (capex) is driven by immediate demand for AI infrastructure, not speculative overinvestment. Companies are deploying existing cash flows to build AI capabilities, avoiding excessive leverage, a key differentiator from past tech bubbles. For instance, Nvidia’s AI GPUs are snapped up as soon as they’re produced, reflecting an undersupplied market. However, Sekera cautions that while the sector is not yet in bubble territory, history suggests that prolonged exuberance could eventually lead to one.

Kunal Kapoor echoes this sentiment, emphasizing that while AI-related earnings growth has justified significant investments, the key question is whether the massive capex will deliver long-term value. For investors, the challenge lies in distinguishing between companies with sustainable AI-driven growth and those whose stock prices already reflect lofty future expectations.

Valuations: Are Expectations Too High?

Are investor expectations for AI giants like Nvidia unreasonably high? Sekera argues they are not, though valuations are “fully priced.” For Nvidia, Morningstar’s financial model projects a compound annual growth rate (CAGR) for earnings of 25% over the next five years. Their 2026 earnings estimate is $4.44 per share, implying a forward price-to-earnings (P/E) ratio of 38, which drops to 26 for 2027 ($6.58 per share) and 18 by 2029 ($9.32 per share). While these multiples are rich, they align with Nvidia’s growth trajectory, making the stock “pretty fully valued” but not overinflated. At a three-star rating, it trades slightly below Morningstar’s fair value estimate.

Other mega-cap tech firms face similar scrutiny. Many have already priced in significant AI-driven growth, reducing the potential for outsized future returns. Kapoor warns that while the underlying businesses may thrive, their stock prices may not deliver the same upside due to high valuations. For buy-and-hold investors, this suggests a need for caution and a focus on diversification to mitigate concentration risk in AI-heavy portfolios.

Geopolitical Risks and Opportunities

Nvidia’s position at the center of US-China geopolitical tensions adds complexity to the AI investment narrative. The company reported no sales of its advanced AI chips to China in its latest quarter due to export restrictions, yet it sees a $50 billion annual opportunity if tensions ease. This potential is significant, considering Nvidia’s projected 2025 sales of $200 billion. However, uncertainty around regulatory approvals means this upside is not yet factored into Morningstar’s valuation models. Should restrictions loosen, Nvidia’s fair value could see further upside, but investors must weigh this against geopolitical unpredictability.

Strategies for Buy-and-Hold Investors

For long-term investors, the AI boom presents both opportunities and risks. Sekera advises that the broader market, as represented by the Morningstar US Market Index, is trading at fair value, suggesting expected returns of 8–10% annually—aligned with historical equity market averages. The era of excess AI-driven returns may be waning, making broad market exposure through mutual funds or ETFs a prudent starting point. These vehicles already provide significant exposure to AI leaders, given their weight in major indices.

However, for those seeking targeted AI investments, Sekera identifies three categories with undervaluation potential:

- Picks and Shovels (Hardware Providers):

- Taiwan Semiconductor Manufacturing Company (TSMC): A four-star rated stock trading at a 25% discount to fair value, TSMC benefits from a wide economic moat driven by cost advantages and intangible assets. As a key supplier of AI chips, it is well-positioned for sustained growth.

- Marvell Technology: Also a four-star stock, trading at a 30% discount, Marvell has a narrow economic moat due to switching costs and intangibles. Despite recent volatility, its long-term prospects in AI infrastructure are strong.

- ASML Holding: Trading at a 24% discount with a four-star rating, ASML manufactures equipment critical for producing AI GPUs. The ongoing buildout of semiconductor fabs, particularly in the US, supports its growth outlook.

- Hyperscalers (AI Platform Providers):

- Microsoft: A four-star stock trading at a 16% discount, Microsoft’s AI hosting platforms benefit from a massive total addressable market. Its diversified business lines and strong execution make it a compelling choice.

- AI Adopters (Efficiency and Product Enhancers):

- Salesforce: A four-star stock with a 22% discount and a wide economic moat from switching costs and network effects, Salesforce is leveraging AI to enhance its products and attract new clients.

- ServiceNow: Hovering between three and four stars with a 14% discount, ServiceNow is integrating AI to boost sales and operational efficiency, positioning it as a beneficiary of the AI adoption wave.

Table: Undervalued AI Stocks (as of September 3, 2025)

| Company | Star Rating | Discount to Fair Value | Economic Moat | Key AI Role |

|---|---|---|---|---|

| Taiwan Semiconductor | 4 | 25% | Wide | AI chip manufacturing |

| Marvell Technology | 4 | 30% | Narrow | AI infrastructure components |

| ASML Holding | 4 | 24% | Wide | Semiconductor equipment for AI |

| Microsoft | 4 | 16% | Wide | AI hosting platforms |

| Salesforce | 4 | 22% | Wide | AI-enhanced products and services |

| ServiceNow | 3–4 | 14% | Narrow | AI-driven efficiency and sales |

Chart: Discount to Fair Value for AI Stocks

Below is a bar chart illustrating the discount to fair value for the highlighted AI stocks, emphasizing their investment appeal.

Navigating the AI Future

For buy-and-hold investors, the AI boom offers a wealth of opportunities, but discipline is key. The market’s current valuations suggest that the explosive returns of the past few years may not persist, but steady, long-term growth remains achievable. By focusing on undervalued stocks with strong fundamentals—such as TSMC, Marvell, ASML, Microsoft, Salesforce, and ServiceNow—investors can position themselves to benefit from the ongoing AI transformation. These companies span the AI ecosystem, from hardware to platforms to adoption, providing diversified exposure.

Kapoor’s perspective on AI’s role at Morningstar highlights its broader impact: reducing friction in investment processes and enhancing efficiency. This mirrors the potential for AI to drive value across industries, making it a compelling theme for long-term investors. However, caution is warranted. Avoid chasing stocks with “AI” in their name without due diligence, and consider the risks of geopolitical uncertainties and potential bubble formation.

In conclusion, the AI boom is far from over, but the market is at an inflection point. By focusing on undervalued opportunities and maintaining a diversified portfolio, buy-and-hold investors can harness AI’s transformative potential while managing risks. The picks and shovels, hyperscalers, and AI adopters highlighted here offer a balanced approach to capturing value in this dynamic sector.

AI Boom or Bubble? Navigating the Artificial Intelligence Investment Landscape

Meta Description: Is the AI market a boom or a bubble? Explore undervalued AI stocks, market trends, and strategies for buy-and-hold investors in this data-driven analysis of the AI investment landscape.

Introduction: Why AI Investing Matters Globally

Artificial intelligence (AI) is reshaping industries, economies, and investment portfolios worldwide. From Nvidia’s dominance in AI chip production to hyperscalers like Microsoft powering AI platforms, the technology is driving a tech-led stock market rally. But with sky-high valuations and geopolitical tensions, is AI a once-in-a-generation opportunity or a speculative bubble? For buy-and-hold investors, understanding the data behind AI’s growth and identifying undervalued opportunities is critical. This blog dives into Morningstar’s insights, shared by Chief US Market Strategist Dave Sakar and CEO Kunal Kapoor, to unpack the AI investment landscape, offering a global perspective on navigating this transformative trend.

The Numbers Behind the AI Surge

The AI market is booming, driven by massive capital expenditure (capex) and soaring demand for AI infrastructure. Let’s break down the key figures:

- Nvidia’s Market Dominance: Nvidia alone accounts for 7% of the Morningstar US Market Index’s market capitalization, with the top five stocks (including Nvidia, Apple, Microsoft, Alphabet, and Amazon) comprising 25% and the top ten making up 35%. This concentration highlights AI’s outsized influence on broader markets.

- Earnings Growth Projections: Morningstar analysts forecast Nvidia’s earnings to grow at a 25% compound annual growth rate (CAGR) over the next five years, with earnings per share rising from $4.44 in 2026 to $9.32 by 2029. At current prices, this translates to a forward price-to-earnings (P/E) ratio of 38x for 2026, dropping to 18x by 2029, suggesting a richly valued but reasonable long-term outlook.

- China’s $50 Billion Opportunity: Nvidia Sees a Potential $50 Billion Annual Market for AI Chips in China, Pending Regulatory Approvals. This represents a significant upside, given Nvidia’s projected $200 billion in total sales for the current year.

- Market Valuation: The Morningstar US Market Index, covering over 700 US stocks, is trading at fair value, with expected long-term returns of 8-10% annually for broad market investors, tempering expectations of AI-driven excess returns.

These figures underscore AI’s transformative potential but also highlight the risks of overvaluation and market concentration.

Chart: Nvidia’s Earnings Growth vs. Forward P/E Ratio

Below is a chart illustrating Nvidia’s projected earnings growth and its impact on forward P/E ratios, highlighting the stock’s valuation trajectory.

Caption: This chart shows Nvidia’s projected earnings per share (EPS) growing steadily from $3.50 in 2025 to $9.32 in 2029, alongside a declining forward P/E ratio, indicating improving valuation over time. However, the high 2026 P/E of 38x reflects current optimism baked into the stock price.

In-Depth Analysis: Boom, Bubble, or Both?

AI Boom: Strong Fundamentals

Morningstar’s analysts, including Dave Sakar, argue that the AI market is in a boom phase, not a bubble. Key evidence includes:

- Undersupply of AI Infrastructure: Demand for AI chips, particularly GPUs, far outstrips supply. Companies are deploying chips immediately, with no excess inventory, unlike past tech bubbles where speculative stockpiling was common.

- Cash-Flow Funding: Unlike the dot-com era, where companies took on heavy debt, today’s AI investments are largely funded by existing cash flows, reducing financial risk.

- Geopolitical Opportunities: Nvidia’s potential $50 billion market in China, though uncertain due to US-China tensions, represents significant upside not yet priced into models.

- Broad Applications: AI is moving beyond hardware (the “picks and shovels” phase) to software and services, with companies like Salesforce and ServiceNow leveraging AI to enhance products and boost efficiency.

Bubble Risks: Valuation Concerns

Despite the boom, risks loom:

- High Valuations: Many AI stocks, including Nvidia, trade at premium multiples. While Nvidia’s long-term P/E of 18x by 2029 seems reasonable, its near-term 38x P/E signals caution.

- Market Concentration: The top 10 stocks’ 35% weight in the Morningstar US Market Index increases portfolio risk if AI momentum falters.

- Geopolitical Uncertainty: Restrictions on AI chip exports to China could delay or derail Nvidia’s $50 billion opportunity, impacting growth projections.

- Speculative Hype: Kunal Kapoor warns against chasing stocks with “AI” in their names, as short-term gains may not reflect fundamentals.

Global Implications

AI’s impact extends beyond the US. For instance, Taiwan Semiconductor (TSMC) benefits from global chip demand, while Microsoft’s AI platforms serve businesses worldwide. However, geopolitical tensions, particularly between the US and China, could disrupt supply chains and market access, affecting investors globally. Conversely, AI’s productivity gains could drive economic growth in regions adopting the technology, creating opportunities for long-term investors.

Table: Undervalued AI Stocks Recommended by Morningstar

| Company | Star Rating | Discount to Fair Value | Economic Moat | Key AI Role |

|---|---|---|---|---|

| Taiwan Semiconductor | 4 Stars | 25% | Wide | AI chip manufacturing |

| Marvell Technology | 4 Stars | 30% | Narrow | AI chip design and production |

| ASML | 4 Stars | 24% | Wide | Equipment for AI chip production |

| Microsoft | 4 Stars | 16% | Wide | AI platform hyperscaler |

| Salesforce | 4 Stars | 22% | Wide | AI-enhanced CRM solutions |

| ServiceNow | 3-4 Stars | 14% | Wide | AI-driven workflow automation |

Caption: This table highlights Morningstar’s top undervalued AI stocks, spanning hardware providers, hyperscalers, and AI adopters. Discounts to fair value range from 14% to 30%, offering opportunities for buy-and-hold investors.

Strategies for Buy-and-Hold Investors

For long-term investors, navigating the AI landscape requires balancing opportunity and risk:

- Diversify Exposure: Given the 25-35% concentration in AI-heavy stocks within broad market indices, investors already have significant exposure through ETFs or mutual funds. Avoid over-allocating to individual AI stocks.

- Focus on Undervalued Names: Stocks like TSMC, Marvell, and Salesforce offer discounts to fair value and strong fundamentals, making them attractive for long-term growth.

- Monitor Geopolitical Risks: Keep an eye on US-China relations, as easing tensions could unlock significant upside for companies like Nvidia.

- Look Beyond Hardware: The next wave of AI growth lies in companies integrating AI into products and operations, such as Salesforce and ServiceNow, which could deliver sustainable returns.

- Temper Expectations: With the market at fair value, expect 8-10% annual returns rather than the outsized gains of recent years.

Conclusion: A Balanced Approach to AI Investing

The AI market is undeniably in a boom phase, driven by robust demand, cash-flow-funded investments, and transformative potential. However, high valuations and geopolitical uncertainties warrant caution. For buy-and-hold investors, the key is to focus on undervalued opportunities like TSMC, Marvell, and Microsoft, which offer exposure to AI’s growth without excessive risk. By diversifying and staying mindful of market concentration, investors can position themselves to benefit from AI’s long-term potential while avoiding bubble-like pitfalls.

Key Takeaways:

- AI is a boom, not a bubble, but valuations are stretched for some stocks.

- Undervalued stocks like TSMC (25% discount) and Salesforce (22% discount) offer compelling opportunities.

- Expect 8-10% annual returns from broad market investments, reflecting a maturing AI rally.

- Geopolitical developments, particularly US-China relations, could significantly impact AI growth.

- Diversify to mitigate risks from market concentration in AI-heavy stocks.

By approaching AI investing with a data-driven discipline, buy-and-hold investors can harness this transformative technology for long-term success.