Crypto Rotation, Treasuries, and Policy Tailwinds — Visual Brief

A fast, data-driven take on the Bloomberg Crypto roundtable (Novogratz, Santori, and market on-ramps)

Quick Summary

- Liquidations triggered one of the year’s largest shakeouts, but prices stabilized quickly.

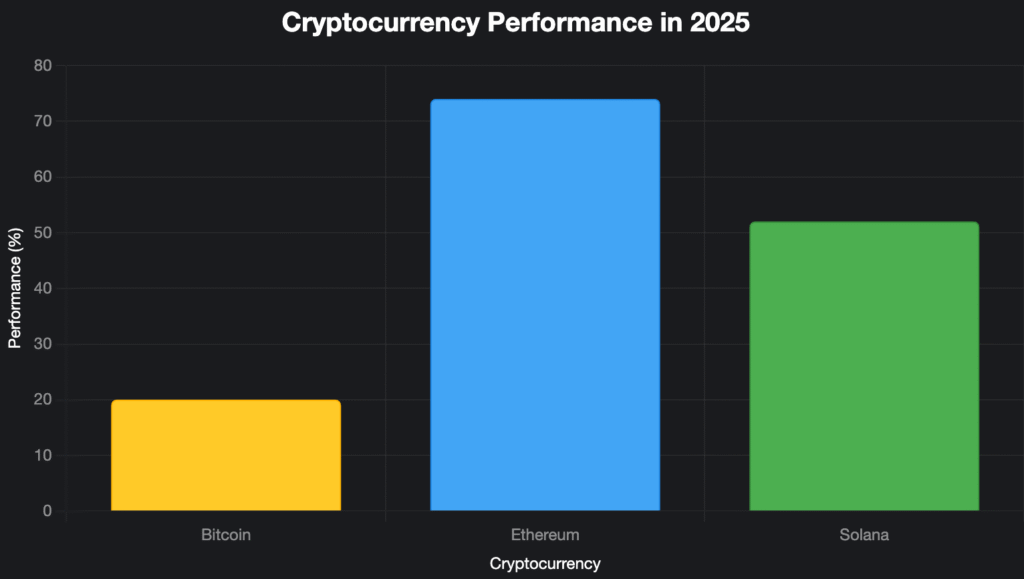

- Rotation persists: Ether (+74%) and Solana (+52%) have outpaced a steadier Bitcoin.

- Institutional on-ramps widen: E*TRADE aims to enable popular coin trading in H1 2026 via Zero Hash.

- Digital-asset treasuries multiply (~85 YTD), including a $1.6B Solana treasury at Forward Industries.

- Staking cash flows: moving from ~7% to 10% on $1.6B implies nine-figure annual income.

- Policy tailwinds: a stablecoin bill passed; a market-structure bill expected mid-November could define securities vs. commodities.

Rotation Snapshot

Ether and Solana have led performance in recent months while Bitcoin remained comparatively steady.

Liquidation Shock vs. Stabilization

Synthetic 48-hour index showing a sharp drawdown followed by stabilization—typical of leverage wipes.

Digital-Asset Treasuries (YTD)

Public token treasuries are scaling rapidly, enhancing access to equity capital.

| Metric | Value |

|---|---|

| Treasuries launched (YTD) | 85 |

| Largest SOL treasury | $1.6B |

| Key driver | Staking income + equity-market capital access |

Staking Yield Sensitivity

Annual income on a $1.6B SOL treasury scales materially with yield.

| Yield | Annual Income (USD, millions) |

|---|---|

| 7% | 112.0 |

| 8% | 128.0 |

| 9% | 144.0 |

| 10% | 160.0 |

Catalysts & Watchlist

| Date / Window | Catalyst | Potential Impact |

|---|---|---|

| Mid-November | U.S. market-structure bill (security vs. commodity; on-chain rails) | Multiple expansion for compliant infra; liquidity conditions improve |

| H1 2026 | E*TRADE popular coin trading (Zero Hash) | New retail on-ramp; tighter spreads, higher depth |

| Quarterly | On-chain fee/MEV updates for ETH/SOL | Supports relative-value tilts and staking policy |

Positioning Cheatsheet

- Core: BTC/ETH as low-beta spine; rebalance to maintain risk budget.

- Satellite: Size SOL and throughput assets with clear fee growth; use options to cap downside.

- Income: Stake selectively; evaluate validator risk, lockups, and insurance.

- Equities: Consider public treasury vehicles; monitor NAV premium/discount and income policy.

- Risk: Watch funding, OI, and perp basis; predefine de-risk triggers.

“Rotation, Regulation, and the Rise of Treasuries”: What Bloomberg’s Crypto Roundtable Signals for Investors

Key takeaways

- Liquidations triggered one of the year’s biggest shakeouts, yet prices stabilized quickly—classic late-cycle volatility, not necessarily trend reversal.

- Rotation is real: over recent months, Ether +74% and Solana +52% versus a steadier Bitcoin, shifting leadership to higher-beta tokens.

- Institutional on-ramps are widening: Morgan Stanley’s E*TRADE plans to enable popular coin trading in H1 2026, partnering with Zero Hash.

- Digital-asset treasuries are multiplying: ~85 launched this year, including a $1.6B Solana treasury at Forward Industries—creating scalable, yield-bearing public vehicles.

- Policy tailwinds: a passed U.S. stablecoin bill (“Genius Act”) plus a mid-November market-structure bill (security vs. commodity) could catalyze mainstream adoption.

- Staking-driven cash flows matter: pushing Solana staking yields from ~7% to 10% can translate into nine-figure annual dividends on billion-dollar treasuries—fuel for further ecosystem growth.

Market snapshot: a fast shakeout that didn’t break trend

The last 48 hours brought a sharp, liquidation-driven selloff across crypto—one of the year’s biggest—followed by a fast pause. Bitcoin stayed relatively calm, hugging green, while Ether and Solana retraced part of their multi-month surge. The setup looks like a classic late-cycle flush: leverage had crept higher, a bearish note about a fast-rising token hit sentiment, miners reportedly sold, and longs got cleared.

Context is crucial. Four months ago, few would complain about Bitcoin near current levels. Meanwhile, the higher-beta leg—Ether and Solana—has outpaced Bitcoin in recent months, a rotation that typically appears once investors gain confidence in the cycle and begin reaching for incremental yield, utility, and throughput.

What to watch: whether leverage rebuilds quickly, and if realized volatility remains contained in Bitcoin while “ETH-beta” and “SOL-beta” drive tactical opportunity.

Rotation dynamics: beyond Bitcoin beta

Bitcoin’s steadiness paired with outsized moves in ETH and SOL tells a simple story: investors are rotating into platforms where on-chain activity, developer traction, and cash-flow proxies (staking yields, MEV, fee burns, priority fees) are more salient.

- Ether: Benefiting from the multi-year shift toward on-chain compute and rollup-centric scaling, plus the narrative of institutional adoption via ETPs and enterprise pilots.

- Solana: Benefiting from base-layer throughput and an application stack optimized for speed, micro-transactions, and consumer UX—attracting market-structure builders and increasingly, Wall Street curiosity.

Rotations don’t move in straight lines. They overshoot, reset, and re-price. But beneath the noise is a structural bid for blockchains where unit economics can be modeled, even roughly.

Institutional on-ramps: Morgan Stanley (E*TRADE) x Zero Hash

Morgan Stanley’s decision to partner with Zero Hash so E*TRADE clients can trade popular coins in H1 2026 is more than a me-too. It is a signal: large, regulated brokerages are now comfortable that the policy climate (and vendor ecosystem) supports offering crypto access without compromising core risk standards.

Two practical implications for investors:

- Incremental demand channel: Self-directed investors gain direct access inside a familiar brokerage UI, broadening the TAM beyond crypto-native exchanges.

- Cross-asset adjacency: E*TRADE customers can now toggle between equities, options, and crypto from a single stack—accelerating multi-asset portfolio construction that includes digital assets as a standard sleeve.

On-ramps don’t immediately change price. They change the elasticity of demand, which matters most in the next pullback, when frictionless re-entry can compress drawdown duration.

The rise of digital-asset treasuries: scale, yield, and equity capital

Roughly 85 digital-asset treasuries launched this year, with Galaxy Digital helping lead Forward Industries’ $1.6B Solana vehicle—now among the largest token-specific public treasuries. Why this matters:

- Equity capital > token capital: Public equity markets can supply larger, cheaper, and more persistent capital than crypto-native venues—especially in risk-on regimes.

- Cash-flow engines: At 7–10% staking yields on multi-billion token baskets, you’re looking at nine-figure annualized income—capital that can be redeployed into ecosystem grants, liquidity programs, venture allocations, or buybacks.

- Network effects: Scale begets better validator terms, better liquidity, tighter spreads, and better deal flow (e.g., protocol allocations, early-stage equity, or token warrants).

The lesson for investors: treasury vehicles are not just directional bets; they are operating businesses with levers (staking, lending, governance rights, strategic partnerships) that can widen NAV premia in bull tape—and cushion discounts in drawdowns.

Policy and market structure: from “if” to “how”

According to the discussion, the U.S. now has a passed stablecoin bill (the “Genius Act”) and is likely to advance a broader market-structure bill by mid-November, defining security vs. commodity boundaries and setting on-chain market rules. Pair that with an SEC leadership tone that favors disclosure and on-chain settlement, and the strategic direction is clear:

- Stablecoin ubiquity: Expect native support inside iOS/Android wallets and consumer apps as legal clarity de-risks integration. That’s a throughput and fee story for L1/L2s.

- On-chain market rails: Broker-dealers, ATSs, and exchanges experimenting with on-chain clearing and settlement can compress cycle times, cut counterparty risk, and open new product design (e.g., 24/7 tokenized funds, T+instant collateral mobility).

For allocators, policy isn’t just headline risk—it’s multiple expansion fuel. Clearer rules lower discount rates applied to future on-chain cash flows and make strategic M&A/partnerships more likely.

Politics, perception, and participation

Crypto’s electoral salience—particularly among younger male voters—has become part of the policy calculus. While partisan narratives will ebb and flow, the investment takeaway is simpler: political competition for “innovation” credentials is bullish for incremental regulatory clarity and agency coordination. Expect more safe harbors, sandbox pilots, and standardized disclosures, all of which contribute to lower structural volatility over a full cycle.

Risks: leverage, over-concentration, and narrative reflexivity

- Leverage rebuild: The same rails that cleared longs this week can refill quickly. Use on-chain metrics (funding, open interest, perp basis) to scale risk.

- Over-thematization: Single-asset or single-ecosystem treasuries will trade at premia/discounts to NAV. Be wary of paying too much for “story” versus repeatable cash-flow levers.

- Execution risk in on-chain market structure: Moving regulated trading fully on-chain is non-trivial; slippage, settlement finality, and compliance tooling must align.

Investment playbook: how to position now

- Core-satellite structure

- Core: Maintain a strategic BTC/ETH allocation as the low-beta spine (macro hedge + programmable cash flows).

- Satellite: Size SOL and high-throughput platforms with a clear path to fee growth and app adoption. Use options to cap downside.

- Treasury exposure via public equities

- Consider token-specific treasuries where staking, governance, and deal flow can add excess return over pure token beta. Watch the discount/premium to NAV and the policy of distributing vs. reinvesting stakeholder income.

- Staking as a cash-flow sleeve

- Direct staking (self-custody or qualified providers) on a portion of holdings can turn directional exposure into yield + optionality. Evaluate validator risk, lockups, and slashing insurance.

- Policy catalysts calendar

- Mid-November: U.S. market-structure bill progress.

- H1 2026: E*TRADE crypto availability; monitor custodial choices, asset lists, and fee schedules.

- Quarterly: Track on-chain revenue (fees, MEV, priority fees) across ETH/SOL; rising take-rates justify relative-value shifts.

- Risk controls

- Use basis trades (spot vs. perps) to harvest funding in overheated tapes.

- Size positions by liquidity and realized vol, not just conviction.

- Pre-define de-risk triggers around policy votes, exchange incidents, or validator outages.

Outlook and near-term catalysts

- Rotation persistence: Expect episodic ETH/SOL leadership while BTC anchors macro sentiment. Watch for spread trades (e.g., SOL/BTC, ETH/BTC) to guide regime changes.

- On-chain market pilots: News of broker-dealers testing on-chain settlement rails can ignite the “everything moves on-chain” narrative—bullish for infra tokens and compliant DeFi.

- Treasury innovation: Vehicles that push staking yields toward ~10%, add governance-as-a-service, or secure protocol allocations could trade at sustained premia.

- Retail re-engagement: E*TRADE’s launch window in H1 2026 can compress the friction between legacy accounts and crypto allocation—particularly if fee schedules mirror equity options simplicity.

Conclusion: The flywheel is starting to hum

The Bloomberg conversation outlines a cohesive arc: wider on-ramps, clearer rules, scalable treasuries, and a shift to on-chain market infrastructure. The immediate backdrop—liquidation whipsaws and alt-leadership—fits the pattern of an advancing cycle finding new footing. But the bigger story is structural. Capital is organizing itself around yield-bearing treasuries, brokerages are preparing to normalize crypto access, and policymakers are moving from “whether” to “how”.

For investors, that suggests leaning into a diversified core (BTC/ETH), expressing selective conviction in high-throughput platforms like Solana, and harvesting staking cash flows via direct participation or public treasury vehicles. Keep an eye on the mid-November policy milestone and the H1 2026 brokerage on-ramp: together, they could widen the demand funnel and raise the ceiling on what this cycle can sustain.

Bottom line: Treat volatility as a feature, not a bug. The market’s plumbing is professionalizing, the policy scaffolding is rising, and the capital base is institutionalizing. Position for that world—measured size, cash-flow bias, and catalysts on your calendar.

The Crypto Revolution: Institutional Adoption, Regulatory Shifts, and the Rise of Digital Asset Treasuries

The cryptocurrency market has undergone a seismic shift in 2025, driven by institutional adoption, favorable regulatory developments, and innovative financial structures like digital asset treasuries (DATs). As highlighted in a recent Bloomberg Crypto broadcast, the market is navigating a period of volatility, opportunity, and transformation. Bitcoin remains a steady anchor, while altcoins like Ethereum and Solana have surged, reflecting a rotation in investor interest. Meanwhile, traditional financial giants like Morgan Stanley are entering the crypto space, and regulatory clarity is fostering optimism. This blog post delves into these trends, analyzing their implications for the future of crypto and the global financial ecosystem.

A Snapshot of the Crypto Market in 2025

The crypto market in September 2025 is a tale of resilience and rotation. After a sharp selloff earlier in the week, described as one of the largest liquidation events of the year, digital assets have stabilized. Bitcoin is slightly up, trading in the green, while Ethereum and Solana remain flat but have significantly outperformed Bitcoin over recent months. Ethereum has surged 74% and Solana 52% in the past few months, compared to Bitcoin’s relatively modest gains. This rotation reflects growing investor interest in altcoins, driven by their technological advancements and institutional backing.

The selloff, as explained by Mike Novogratz, CEO of Galaxy Digital, was triggered by a combination of factors: over-leveraged positions, bearish commentary from thought leaders like Arthur Hayes, and significant selling pressure from miners. Notably, Hyper Liquid, a decentralized exchange token, was hit hardest after Hayes’ bearish outlook, impacting overall market sentiment. Despite this volatility, Novogratz emphasizes the importance of context: Bitcoin at $112,000, though down from recent highs, is still a remarkable achievement compared to four months ago. The market’s year-to-date performance remains robust, with crypto assets up significantly.

Institutional Adoption: Morgan Stanley and Beyond

A pivotal development in 2025 is the entry of traditional financial institutions into the crypto space. Morgan Stanley’s partnership with Zero Hash to allow E*Trade clients to trade popular cryptocurrencies starting in the first half of 2026 is a landmark move. While fintechs like Robinhood have long offered crypto trading, Morgan Stanley’s involvement signals a broader acceptance among established financial players. This move aligns with a more favorable regulatory environment, as noted by Lauren, a guest on *Bloomberg Crypto*. She highlights that banks partnering with crypto trading firms is a novel trend, facilitated by regulatory shifts that reduce barriers to entry.

However, this integration comes with risks. Crypto’s volatility remains a concern, and clients trading on platforms like E*Trade will largely make decisions independently, similar to Robinhood’s model. Financial advisors may guide clients, but the onus is on investors to understand the risks. For Morgan Stanley, offering crypto trading diversifies its product offerings, catering to growing client demand while aligning with the industry’s evolution.

Digital Asset Treasuries: A New Paradigm

One of the most transformative trends in 2025 is the rise of digital asset treasuries (DATs). These entities, which hold significant amounts of cryptocurrencies as part of their balance sheets, are reshaping the crypto investment landscape. According to Bloomberg Crypto, 85 DATs have been announced this year, raising billions from investors across the U.S., Asia, and the Gulf. Galaxy Digital, a leading player, has spearheaded fundraising for Forward Industries’ $1.6 billion Solana treasury, the largest for that token, driving a 500% surge in Forward’s share price.

Mike Novogratz and Marco Santori, CEO of the newly rebranded Solana Holdings (formerly Pereira Holdings), emphasize the permanence of DATs. Santori argues that DATs are not a fad but an evolution, replacing inefficient nonprofit foundation models used by crypto projects. Unlike foundations that sequester coins in jurisdictions like the Caymans or Switzerland, DATs provide access to capital markets, enabling dynamic revenue generation and ecosystem stewardship. For instance, Forward Industries’ Solana treasury could yield 7–10% annually through staking, generating $112–160 million in dividends to fund further innovation.

The success of DATs hinges on scale and creativity. Novogratz notes that scale begets scale, with early movers like MicroStrategy setting the precedent. DATs bring substantial capital into crypto, leveraging equity markets’ infrastructure, which is more developed than crypto’s nascent systems. Partnerships, such as Forward Industries’ collaboration with Jump Capital and Multi-Coin, enhance their ability to innovate, particularly in building financial market architectures on blockchains like Solana.

Regulatory Tailwinds: A Crypto-Friendly SEC

Regulatory clarity is a game-changer for crypto in 2025. The passage of the GENESIS Act, which regulates stablecoins, and anticipated legislation in November defining securities versus commodities, are poised to unleash new participation. Novogratz highlights that these “bookends of legislation” will enable stablecoin integration into mainstream platforms like iPhones and social media apps, previously restricted by legal uncertainties. The SEC, under Chair Pawlak, is adopting a pro-crypto stance, emphasizing disclosure and market-driven innovation. Pawlak’s vision to move markets “on-chain” aligns with the industry’s push for transparency and efficiency.

This regulatory shift has political implications. Novogratz argues that crypto influenced the 2024 U.S. presidential election, with 80 million crypto owners—many young, male, single-issue voters—swaying toward pro-crypto candidates. The crypto PAC’s significant donations to the Trump campaign underscore the industry’s political clout. Democrats, initially anti-crypto, are now recognizing its electoral and technological value, with figures like Senators Mark Warner and Kirsten Gillibrand advocating for pro-innovation policies.

Solana vs. Ethereum: The Scaling Debate

The Bloomberg Crypto discussion also spotlighted the competition between Solana and Ethereum. Marco Santori, a staunch Solana advocate, argues that Solana’s ability to handle hundreds of thousands of transactions per second at the base layer makes it superior for sophisticated financial applications. Ethereum, limited to a small number of transactions per second, relies on second-layer solutions that compromise decentralization. Solana’s scalability positions it as the future for Wall Street’s blockchain ambitions, particularly for high-frequency trading and capital markets.

Novogratz, while bullish on both Ethereum and Solana, acknowledges their distinct roles. Bitcoin remains a unique monetary system, while Ethereum introduced smart contracts, and Solana excels in scalability. The rise of DATs focused on Solana, like Solana Holdings, reflects growing confidence in its ecosystem.

Data Insights: Crypto Performance and DAT Growth

The following table summarizes the performance of key cryptocurrencies and the growth of DATs in 2025:

| Asset/Trend | Performance/Status |

|---|---|

| Bitcoin | Slightly up, stable at ~$112,000 |

| Ethereum | +74% in recent months, flat post-selloff |

| Solana | +52% in recent months, flat post-selloff |

| Digital Asset Treasuries (DATs) | 85 announced in 2025, raising billions |

| Forward Industries (Solana DAT) | $1.6B treasury, shares +500% YTD |

The chart below visualizes the year-to-date performance of Bitcoin, Ethereum, and Solana, highlighting the altcoin surge:

The Road Ahead: Challenges and Opportunities

The crypto market faces challenges, including volatility and valuation concerns. Novogratz draws parallels with the stock market’s AI-driven euphoria, noting that high valuations could lead to corrections. However, crypto’s four-year cycle, historically peaking halfway between Bitcoin halvings, may be disrupted by regulatory clarity and institutional adoption. The integration of stablecoins into everyday platforms and the growth of DATs could sustain momentum beyond the traditional cycle.

Eric Trump’s comments on Bloomberg Crypto highlight crypto’s appeal as a transparent, efficient alternative to traditional finance, driven by his experience with financial institutions’ resistance. This sentiment resonates with the industry’s push to move markets on-chain, aligning with the SEC’s vision.

Conclusion: A New Era for Crypto

The crypto market in 2025 is at an inflection point. Institutional adoption, led by firms like Morgan Stanley, and the rise of DATs are bringing unprecedented capital and legitimacy to the space. Regulatory clarity, particularly in the U.S., is unlocking new opportunities, while Solana’s scalability positions it as a frontrunner for financial applications. Despite volatility, the market’s fundamentals—technological innovation, political influence, and global adoption—suggest a bright future. For business leaders and policymakers, the message is clear: crypto is not just a trend; it’s a transformative force reshaping finance for decades to come.