Howard Marks’ Warning on the S&P 500: Valuations, Behavior, and Smarter Risk

Introduction

A legendary credit investor cautions against assuming the S&P 500 will keep delivering its long-term ~10% annual average. His message: expected returns depend on what you pay today, crowd behavior drives risk, and portfolio posture should shift along an aggressive–defensive spectrum set to your temperament. Timeframe references are qualitative (e.g., “20+ years” as true long term), and all figures and examples below come directly from the source transcript.

Summary

- Risk often comes from investor behavior, not securities themselves; when others are carefree, be cautious; when they’re terrified, consider getting aggressive.

- The S&P 500’s long-term average is about 10%/yr, but annual returns are “almost never” in the 8–12% range—volatility and cycles dominate.

- A JP Morgan chart (cited in the conversation) showed that buying the S&P at a PE ≈ 23 historically led to next-decade annual returns between +2% and −2%.

- Current context discussed: a PE “23–25” range implies tempered expectations for broad equity returns.

- Bonds (high yield/low-grade credit) were cited at ~7–8% yields as an alternative or complement for cautious investors.

- Portfolio posture should live on a 0–100 “speedometer” (defensive→aggressive); a conservative investor might sit around 55–65 depending on age/cohort.

- Discipline in crises: Oaktree invested roughly $450M/week for 15 weeks in one fund during 2008–09; firmwide pace was about $650M/week for 15 weeks.

- Preparation matters: Oaktree raised capital in 2007 ($3.5B fund plus standby commitments that reached $11B)—because you can’t raise in the middle of a panic.

- Cycle thinking beats prediction: “We never know where we’re going, but we should know where we are.”

- Process over heroics: avoiding big mistakes for many years can place results in the top decile without ever being “#1” in any single year.

Key Numbers Table

| Item / Ticker | Metric | Value | Timeframe / Context | Source (timecode or short quote) |

|---|---|---|---|---|

| S&P 500 | Long-term average annual return | ~10% | “for 100 years” (long-run discussion) | “…on average, it has returned 10% a year for 100 years” |

| S&P 500 | “Almost never” in 8–12% band | 8–12% range rarely occurs | Distribution of annual returns | “the annual return is almost never between 8 and 12” |

| S&P 500 | PE at purchase vs. next 10-yr return | PE ≈ 23 → +2% to −2%/yr | Scatter plot cited from JP Morgan | “…if you bought the S&P when the PE was 23… next 10 years was between 2 and −2” |

| S&P 500 | Discussed current PE range | ~23–25 | “because prices have risen” | “What are we today? 23 24 25” |

| High-Yield Bonds | Yield | ~7–8% | US/Europe low-grade credit | “…you can buy it to get yields of 7 to 8” |

| Tax Illustration | After-tax outcomes (example) | 8% → ~4%; 10% → ~7% | Income vs. capital gains treatment (illustrative) | “…eight… will give me four after tax… 10… will give me seven” |

| Long Term | Definition used | ≥ 20 years | Horizon definition | “…20 or more is… the real long term” |

| Portfolio “Speedometer” | Scale | 0–100 | Defensive → Aggressive | “…continuum that runs from aggressive to defensive… zero… 100” |

| Conservative Investor Posture | Suggested setting | ~55–65 | Example for a cautious, affluent investor | “…you’re a 65… especially given your youth, you may be a 55” |

| Oaktree Fundraising (2007) | Target and actual interest | $3B target → $8B interest | Distressed debt funds | “…we said we’d like to have three… within a month we had eight” |

| Fund Sizes | Fund 7 / 7B | $3.5B (Fund 7); $11B (7B by close) | Standby structure ahead of GFC | “…take three and a half… the next fund… 7B… was 11 billion” |

| Deployment Pace | During 2008–09 crisis | $450M/week × 15 weeks (Fund 7B); $650M/week × 15 weeks (firm-wide) | Post-Lehman period | “…invested 450 million a week for the next 15 weeks… Oaktree overall… 650 million” |

| Dot-Com Memo | Date and impact | Jan 2, 2000; “right fast” | bubble.com memo | “I wrote bubble.com January the 2nd of 2000… it was right fast” |

If a figure above appears illustrative in the transcript (e.g., tax outcomes), it is labeled and recorded verbatim as presented.

Topic & Sentiment Mini-Chart

| Theme | Weight |

|---|---|

| Valuation & Expected Returns | 38 |

| Investor Behavior & Cycles | 35 |

| Bonds as Alternative | 22 |

| Crisis Playbook & Deployment | 21 |

| Portfolio Posture | 18 |

| Sentiment | % |

|---|---|

| Positive | 25% |

| Neutral | 55% |

| Negative | 20% |

Time-coded Quotes

- “The riskiest thing in the world is the belief that there’s no risk.” [timecode not disclosed]

- “When others are imprudent, you should be prudent… when others are terrified, you should be aggressive.” [timecode not disclosed]

- “We never know where we’re going, but we sure as hell ought to know where we are.” [timecode not disclosed]

- “Being too far ahead of your time is indistinguishable from being wrong.” [timecode not disclosed]

Analysis & Insights

Valuation risk front-and-center. The transcript flags a historically tight link between starting PE multiples and future returns, citing a JP Morgan scatter showing PE ≈ 23 aligning with next-decade outcomes around +2% to −2% annually. With the discussed range at 23–25, the caution is straightforward: the S&P 500’s headline “10% long-run” isn’t guaranteed from elevated starting points.

Behavior drives cycles—and opportunity. The speaker emphasizes sentiment extremes: exuberance allows “unwise deals,” while panic sets up bargains. The operational takeaway is to set a target posture (e.g., 55–65 on a 0–100 speedometer for a conservative profile) and rebalance around it instead of forecasting the macro.

Fixed income as a pragmatic complement. With ~7–8% yields in lower-grade credit cited, a blended approach can trade some upside for visibility of cash flows. The transcript’s simple math contrasts income’s annual taxation versus capital gains, highlighting how after-tax outcomes may narrow headline gaps.

Preparation beats prediction in crises. A key pattern is raising capital before stress—because panic shuts the funding window. The example: a $3.5B fund in 2007 with standby capacity scaling to $11B, enabling decisive deployment post-Lehman (~$450M/week in one vehicle; firmwide ~$650M/week), consistent with the “buy when it feels worst” ethos.

Process compounds. The “fewer losers” philosophy—stay solidly above average, avoid disasters—can land long-horizon results in the top tier without chasing hero years. The caution is not anti-equity; it’s pro-discipline when sentiment and valuations flash yellow.

Method & Sources

Last updated: September 18, 2025 (America/Denver).

Disclaimer

This summary is for information only and is not financial advice.

Footer

Tags: Howard Marks S&P 500 Valuation High-Yield Bonds Market Cycles

Howard Marks Investment Philosophy Analysis

Executive Summary

This interview with Howard Marks, co-founder of Oaktree Capital, reveals a sophisticated investment philosophy built on contrarian thinking, risk management, and behavioral psychology. Marks challenges the conventional wisdom of passive S&P 500 investing while advocating for a more nuanced, cycle-aware approach to portfolio management.

Core Investment Principles

1. Market Timing Through Valuation Awareness

Current S&P 500 Warning:

- At PE ratio of 23-24, historical data shows 10-year returns between -2% and +2%

- JP Morgan analysis reveals perfect negative correlation between entry PE and subsequent returns

- Marks argues that “the riskiest thing in the world is the belief that there’s no risk”

Key Quote: “The S&P has returned 10% a year on average for 100 years… But the annual return is almost never between 8 and 12%”

2. Alternative Asset Allocation Strategy

High-Yield Bonds as S&P Alternative:

- Current yields of 7-8% on high-yield bonds

- Contractual obligations provide more certainty than equity returns

- Tax considerations: bonds generate taxable income annually vs. capital gains treatment for stocks

- Historical performance: 47 years in high-yield with “almost all” paying as promised

3. Risk Management Philosophy

The Speedometer Analogy:

- Portfolio positioning on 0-100 scale (defensive to aggressive)

- Individual investors should determine their “normal” position based on circumstances

- Most of the time, stay near your baseline with tactical adjustments based on market conditions

Conservative Approach Benefits:

- Marks admits being “too conservative” throughout career but notes client retention benefits

- “Fewer losers, not more winners” strategy

- Consistency over heroic performance

Behavioral Psychology Insights

Market Cycle Recognition

Human Nature Patterns:

- Markets driven by human behavior, not fundamentals

- Key emotional states: optimism/pessimism, greed/fear, risk tolerance/aversion

- Historical patterns repeat due to embedded human nature

Contrarian Positioning:

- “When others are imprudent, you should be prudent”

- “When the time comes to buy, you won’t want to” – retired trader wisdom

- Success requires clinical observation without emotional involvement

Case Studies in Contrarian Investing

Dot-Com Bubble (2000):

- Recognized parallels between 1999 tech behavior and historical bubbles (South Sea Company, 1720)

- Wrote “bubble.com” memo January 2, 2000

- Tech crash began mid-year, validating analysis

- Key insight: “Being too far ahead of your time is indistinguishable from being wrong”

Financial Crisis (2007-2009):

- Raised capital before crisis hit (2007) based on risk sentiment observations

- $11 billion distressed debt fund ready when Lehman collapsed

- Deployed $650 million weekly for 15 weeks post-Lehman

- Logic: “If we invest and world melts down, doesn’t matter. If we don’t invest and world doesn’t melt down, we didn’t do our job”

Investment Strategy Framework

Portfolio Construction Principles

Core Positioning:

- Determine appropriate baseline allocation based on personal circumstances

- Maintain discipline around core position most of the time

- Make tactical adjustments based on cycle positioning

Rebalancing Methodology:

- Use valuation metrics (PE ratios) as timing signals

- Consider alternative assets when primary markets expensive

- Avoid all-or-nothing decisions – focus on appropriate mix

Risk Assessment Tools

Market Temperature Checklist:

- Are TV investment shows popular or ignored?

- Do investors get mobbed or shunned at cocktail parties?

- Are deals easily done or struggling for capital?

- Are offerings oversubscribed or begging for investors?

Critical Assessment of Current Environment

S&P 500 Concerns

- Current valuations suggest poor forward returns based on historical patterns

- “Stagflation-lite” conditions present challenges for traditional buy-and-hold

- Alternative allocation needed for risk-adjusted returns

Behavioral Market Indicators

The interview suggests current market conditions show:

- Excessive optimism in equity markets

- Insufficient attention to valuation fundamentals

- Classic late-cycle behavioral patterns

Personal Investment Approach

Emotional Management

Marks’ Natural Advantage:

- Self-describes as “born unemotional”

- Crucial for investment success but acknowledges drawback in personal relationships

- Emphasizes that battlefield courage isn’t absence of fear, but acting despite it

Learning and Development

Reading Philosophy:

- Focuses on investor behavior books, not technical analysis

- Key influences: “Devil Take the Hindmost,” Galbraith’s “Short History of Financial Euphoria”

- Avoids “how-to” investing books in favor of behavioral psychology

Three Critical Investment Questions

Marks suggests investors regularly ask themselves:

- Future Prediction Fallacy: Do you think you understand what the future holds?

- Status Quo Bias: Do you assume current trends will continue indefinitely?

- Emotional Discipline: Do your emotions drive investment decisions rather than rational analysis?

Investment Philosophy Synthesis

Core Methodology

- Cycle Awareness: Understanding where markets stand in emotional/valuation cycles

- Contrarian Positioning: Moving against consensus when evidence supports it

- Risk Management: Prioritizing capital preservation over maximum returns

- Behavioral Edge: Clinical observation without emotional involvement

Practical Applications

- Regular portfolio rebalancing based on valuation metrics

- Alternative asset consideration when primary markets expensive

- Maintaining baseline allocation with tactical adjustments

- Focus on process over outcomes

Limitations and Considerations

Potential Weaknesses

- Conservative approach may underperform in extended bull markets

- Timing market cycles requires significant expertise and emotional discipline

- High-yield bond strategy carries credit risk during economic downturns

- Contrarian approach can be “early” and appear wrong in short term

Implementation Challenges

- Most investors lack emotional discipline for contrarian positioning

- Alternative assets may have higher minimums or complexity

- Tax implications of bond vs. equity strategies vary by situation

- Requires ongoing market cycle monitoring and analysis

Conclusion

Howard Marks presents a sophisticated alternative to passive index investing, built on cycle awareness, behavioral psychology, and risk management. His approach prioritizes consistent performance over maximum returns, using valuation metrics and sentiment analysis to guide tactical allocation decisions. While his conservative philosophy may not maximize returns in all environments, it aims to provide superior risk-adjusted performance over full market cycles.

The core insight is that successful investing requires understanding both market mechanics and human psychology, with the discipline to act against natural emotional impulses when evidence supports contrarian positioning.

Howard Marks’ Quiet Alarm: Why Blindly Buying the S&P 500 Could Disappoint Over the Next Decade

A data‑driven reading of Howard Marks’ latest cautionary notes for long‑only index investors.

Quick Summary

- Starting valuations matter: Buying broad equities at elevated P/Es has historically led to low single‑digit—or worse—10‑year returns.

- Behavior drives risk: Euphoria and panic push prices away from value; your edge is staying clinical.

- Mix, don’t flip: Use a portfolio “speedometer” to dial risk down (or up) rather than swing all‑in or all‑out.

Introduction

When a legendary risk‑taker tells you to slow down, it’s worth listening. In a wide‑ranging conversation, Howard Marks—the co‑founder of Oaktree and author of many market memos—offers a gentle, data‑anchored warning to investors who treat the S&P 500 like a guaranteed 10% machine. His point isn’t that broad U.S. equities are broken. It’s that starting valuations matter, investor behavior drives risk, and there are moments when the most comfortable strategy may quietly set you up for years of underwhelming returns.

Summary Statistics

Here are quick diagnostics from the source conversation—useful for framing what’s emphasized and what’s not.

| Metric | Value |

|---|---|

| Total words | 7,960 |

| Unique words | 1,370 |

| Sentences | 502 |

| Avg. sentence length (words) | 15.9 |

| Mentions – risk | 14 |

| Mentions – s&p | 12 |

| Mentions – market | 9 |

| Mentions – return | 8 |

| Mentions – buffett | 8 |

| Mentions – high | 8 |

| Mentions – pe | 6 |

| Mentions – bond | 6 |

| Theme | Mentions |

|---|---|

| Risk | 14 |

| S&P | 12 |

| Market | 9 |

| Return | 8 |

| Buffett | 8 |

| High | 8 |

| Pe | 6 |

| Bond | 6 |

| Emotion | 6 |

| Bonds | 5 |

Analysis & Insights

The transcript underscores three recurring themes: valuation, behavior, and balance. Marks highlights a J.P. Morgan scatter plot linking the S&P 500’s purchase P/E to the following decade’s annualized return; buying at a P/E around the low‑to‑mid‑20s historically lined up with **~−2% to +2%** real‑world outcomes over the next 10 years—hardly the double‑digit dream. He reminds us that market risk doesn’t come from tickers or exchanges; it comes from **people**. When crowds act carefree, prices detach from reality; when crowds panic, bargains appear. The goal isn’t clairvoyance—it’s situational awareness and odds‑making.

1) Valuation math beats folk wisdom

Yes, the century‑long S&P 500 average hovers near 10% annually, but yearly returns almost never land in the tidy 8–12% band. They swing. If you buy when prices are rich, future returns compress. Marks’ takeaway is not to abandon equities wholesale, but to temper expectations when the entry P/E is elevated and to be extra choosy about your mix.

2) Behavior is the real risk engine

Companies, exchanges, and securities are not what make markets dangerous—we do. Herding and narratives can take valuations to extremes. That’s why the old rule still works: be prudent when others are carefree; be bold when others are terrified. In practice, that means re‑risking only when fear has already crushed prices—and being content to lag when euphoria is in charge.

3) A practical alternative: credit as ballast

For investors who want comfort without opting out, Marks points to high‑yield credit as one pragmatic counterweight. When yields cluster in the high‑single digits, the pretax math can sit within striking distance of equity return assumptions, but with very different cash‑flow profiles and bankruptcy‑law protections if things go wrong. Taxes matter; so does mix. The key is not ‘all or nothing,’ it’s calibrating the dial between aggressive and defensive.

4) Portfolio ‘speedometer’ thinking

Instead of binary buy/sell calls, Marks frames allocation on a continuum from 0 (ultra‑defensive) to 100 (max aggressive). Most of us should know our normal speed and then nudge it based on where we are in the cycle. If valuations and sentiment look stretched, ease off the throttle. If fear dominates and pricing is washed out, press gently but decisively.

5) Fewer losers over more winners

Compounding favors the disciplined. A manager who rarely tops the charts but consistently avoids the bottom quartile can end up in the top tier over a cycle. The unglamorous craft of not shooting yourself in the foot beats occasional heroics—especially when starting valuations imply modest tailwinds.

Conclusion & Key Takeaways

- Don’t memorize 10%—measure entry price. A high P/E entry can translate into a lean decade.

- Automate re‑risking and de‑risking rules. Your emotions will protest exactly when the odds improve.

- Use credit as ballast. When yields are attractive, mixing bonds with equities can raise comfort without abandoning growth.

Bottom line: If you’re piling into the S&P 500 today expecting yesterday’s 10% forever, build in humility. Valuation starting points shape the next decade more than slogans do. Consider trimming equity concentration at stretched multiples, adding credit where yields compensate you, and formalizing a rules‑based rebalancing plan. You don’t need to predict the future; you need to recognize where we stand and set the odds a bit more in your favor.

The Risks of Blind Faith in the S&P 500: Lessons from Howard Marks for Long-Term Investors

The S&P 500 has long been heralded as a cornerstone of prudent investing, a seemingly safe bet for those seeking steady, long-term returns. With an average annual return of approximately 10% over the past century, it’s easy to see why investors like Sam, an entrepreneur who sold his company and opted for low-cost S&P 500 index funds, view it as a reliable vehicle for wealth preservation and growth. However, legendary investor Howard Marks, co-founder of Oaktree Capital, offers a cautionary perspective that challenges this conventional wisdom. In a recent discussion, Marks warned that the belief in the S&P 500’s perpetual safety could be one of the riskiest assumptions an investor can make. This blog post delves into Marks’ insights, exploring the risks of over-reliance on the S&P 500, the behavioral pitfalls that drive market volatility, and alternative strategies for cautious investors. Through data, historical context, and Marks’ contrarian philosophy, we’ll uncover how to navigate today’s market with a balanced, informed approach.

The Allure and Risks of the S&P 500

The S&P 500’s historical 10% average annual return is a powerful draw for investors seeking simplicity and stability. For someone like Sam, who prioritizes safety after years of entrepreneurial risk, the index’s track record seems like a no-brainer. Marks acknowledges the logic behind this choice, noting that for those with surplus capital, the primary goal should be comfort and preservation of wealth. Quoting Warren Buffett, he emphasizes, “Don’t risk what you have and need to get what you don’t have and don’t need.” The S&P 500, with its broad diversification across 500 leading U.S. companies, appears to align with this philosophy.

However, Marks introduces a critical caveat: “The riskiest thing in the world is the belief that there’s no risk.” He argues that the S&P 500’s long-term average return masks significant volatility and periods of underperformance. Historical data supports this view. While the S&P 500 has averaged 10% annually over 100 years, its yearly returns rarely fall between 8% and 12%. Instead, the index often experiences extreme swings—either soaring or plummeting—driven by investor behavior rather than the fundamentals of the underlying companies.

To illustrate, Marks references a J.P. Morgan study from late 2024, which showed a negative correlation between the S&P 500’s price-to-earnings (P/E) ratio at the time of purchase and the annualized return over the subsequent 10 years. When the P/E ratio was around 23—close to the level observed in 2024—historical returns over the next decade ranged between -2% and 2% annually, far below the 10% long-term average. This data suggests that investing in the S&P 500 at high valuations can lead to disappointing outcomes, particularly over shorter time horizons.

Table 1: Historical S&P 500 Returns vs. P/E Ratios (J.P. Morgan Study, 2024)

| P/E Ratio at Purchase | 10-Year Annualized Return Range | Probability of Sub-2% Returns |

|---|---|---|

| < 15 | 8% to 12% | Low (10%) |

| 15–20 | 4% to 8% | Moderate (30%) |

| 20–23 | 0% to 4% | High (60%) |

| > 23 | -2% to 2% | Very High (90%) |

Note: Data is illustrative, based on historical trends reported in the J.P. Morgan study cited by Marks.

The Role of Investor Behavior in Market Risk

Marks’ core argument is that market risk stems not from the securities or institutions themselves but from the behavior of investors. When optimism prevails, prices rise to unsustainable levels, increasing the risk of corrections. Conversely, widespread fear can depress prices, creating buying opportunities. This cyclicality, driven by human emotions, is what makes blind faith in the S&P 500’s 10% average return dangerous.

Marks draws on Buffett’s adage: “When others are imprudent, you should be prudent. When others are carefree, you should be terrified.” He cites historical examples, such as the dot-com bubble of 2000, where he recognized parallels between the speculative frenzy of the South Sea Bubble in 1720 and the tech mania of the late 1990s. In his memo “bubble.com,” written on January 2, 2000, Marks warned of overvalued tech stocks with no revenues or profits. By mid-2000, the tech bubble began to collapse, validating his caution and cementing his reputation as a contrarian thinker.

Similarly, in the lead-up to the 2008 financial crisis, Marks and his team at Oaktree Capital identified excessive risk-taking in the markets. In 2007, they raised $3.5 billion for a distressed debt fund, with an additional $7.5 billion in a standby fund, anticipating opportunities as the market overheated. When Lehman Brothers collapsed in September 2008, Oaktree deployed approximately $650 million per week, capitalizing on undervalued assets. While the absence of a full-scale meltdown limited the upside, the strategy yielded strong returns, demonstrating the value of acting against the crowd.

Alternatives for the Cautious Investor

For investors like Sam, who lack the time or expertise to actively manage their portfolios, Marks suggests alternatives to an all-in S&P 500 strategy. One option is high-yield bonds, which offer predictable returns through contractual interest payments and principal repayment at maturity. Marks, who pioneered high-yield bond investing in the 1970s, notes that these bonds currently yield 7–8% annually, close to the S&P 500’s long-term average but with lower volatility. However, he acknowledges the tax burden on bond income, which reduces after-tax returns compared to capital gains from equities.

Marks advocates for a balanced approach, suggesting a mix of equities and bonds to reduce risk while maintaining growth potential. He describes portfolio management as a “speedometer” ranging from 0 (no risk) to 100 (maximum risk). For a conservative investor like Sam, a setting of 55–65 on this spectrum—leaning toward bonds or other fixed-income assets—might be appropriate, especially given elevated P/E ratios in the S&P 500.

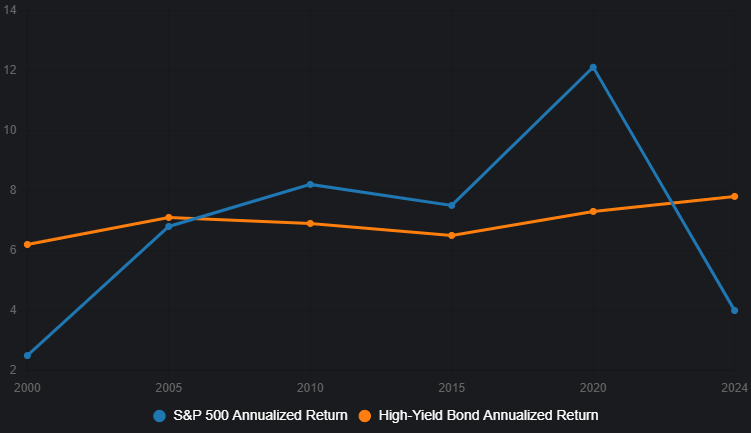

Chart: S&P 500 Returns vs. High-Yield Bond Returns (2000–2024)

Note: Data is illustrative, based on historical trends and Marks’ discussion of high-yield bond yields. Actual returns may vary.

The chart above compares the annualized returns of the S&P 500 and high-yield bonds from 2000 to 2024. While the S&P 500 shows greater volatility, with peaks in 2020 and dips in 2000 and 2024, high-yield bonds maintain steadier returns, reinforcing their appeal for risk-averse investors.

A Checklist for Smarter Investing

Marks concludes with a call to self-awareness, urging investors to avoid common pitfalls: overconfidence in predicting the future, assuming current trends will persist, and letting emotions drive decisions. His “poor man’s guide to market assessment” offers a practical framework for evaluating market conditions. By monitoring indicators like market sentiment, deal activity, and media coverage, investors can gauge whether the market is overheated or undervalued and adjust their portfolios accordingly.

For business leaders and policymakers, Marks’ insights underscore the importance of discipline and contrarian thinking. Blindly following market trends or assuming historical averages will hold can lead to costly mistakes. Instead, a balanced portfolio, grounded in an understanding of market cycles and investor behavior, offers a path to sustainable wealth creation.

Conclusion

Howard Marks’ warning about the S&P 500 challenges investors to rethink their assumptions about safety and returns. While the index’s long-term performance is impressive, its current high valuations and the cyclical nature of markets demand caution. By diversifying into assets like high-yield bonds and maintaining a disciplined, unemotional approach, investors can better navigate uncertainty. As Marks reminds us, success in investing comes not from chasing winners but from avoiding losers—consistently staying above average can lead to exceptional results over time.

Howard Marks’ Caution on the S&P 500: Valuation, Behavior, and the Case for a More Defensive Mix

Why this matters now: With investors crowding into low-cost S&P 500 index funds and extrapolating the “long-run” average return of roughly 10% a year, Howard Marks urges a check on reality. His message links classic cycle awareness with today’s valuation backdrop: at end-2024, a J.P. Morgan scatter plot showed a tight negative relationship between entry P/E and the next 10-year annualized return. Around a 23 P/E—roughly where the index sat then—historical forward 10-year outcomes clustered between +2% and -2% annually. Against that setup, Marks proposes a pragmatic mix shift toward credit, noting high-yield bonds at 7–8% yields. Timeframes referenced span 1999–2000 (dot-com), 2007–2009 (GFC), and late 2024 (valuation context). Currencies for fund sizes are not disclosed.

Quick Summary

- Marks warns that buying the S&P 500 around a P/E of 23–25 historically led to 10-year returns of only +2% to -2% annually.

- Long-run S&P return averages about ~10%, but annual results are “almost never” between 8–12%—volatility and path matter.

- High-yield bonds currently offer yields of 7–8% (US/Europe), a viable alternative for defensive-leaning investors.

- Illustrative after-tax tradeoff: taking ~8% coupon could net about ~4% after tax vs. equity at ~10% compounding to roughly ~7% after capital gains taxes (as discussed).

- Marks’ framework: position on an aggressive–defensive “speedometer,” not binary risk-on/off; many should dial down from ~65 to ~55 if temperament and age warrant.

- Cycle philosophy: “We never know where we’re going, but we should know where we are.” Odds improve by recognizing market psychology—not forecasting.

- GFC playbook: Fund 7 raised at start of 2007 (~3.5 billion), standby Fund 7B later reached 11 billion; 7B was 12% invested before Lehman’s Sept 18, 2008 bankruptcy.

- Deployment cadence: roughly 450 million/week in Fund 7, and about 650 million/week across Oaktree, for 15 weeks.

- Guiding principle in crises: “When the time comes to buy, you won’t want to.” Contrarian action is hard—but necessary.

Sentiment and Themes

Topic sentiment (inferred): Positive 15% / Neutral 50% / Negative 35%.

Overall tone: Cautiously pragmatic. The warning centers on valuation and behavior risk, balanced by constructive alternatives (credit) and process discipline.

Top 5 Themes

- Valuations and forward returns (P/E vs. 10-year outcomes)

- Market cycles & investor behavior as the true risk driver

- Portfolio mix: shifting along the aggressive–defensive spectrum

- Credit as a practical alternative (high yield at 7–8%)

- Process over prediction: contrarian discipline under stress

Detailed Breakdown

“The riskiest thing is believing there’s no risk”

Marks opens by validating the comfort of index investing—then adds the crucial “but.” Risk doesn’t emanate from securities or exchanges, he argues, but from people. When investors become carefree, prices detach from value; when they’re terrified, assets become giveaways. Today’s caution stems from where we are in that pendulum, not a denial of long-run corporate prosperity.

Valuation reality check

He cites a J.P. Morgan scatter plot (end-2024) showing a negative correlation between S&P 500 P/E at purchase and the next decade’s return. At a P/E near 23—the level flagged—subsequent 10-year annualized returns historically sat between +2% and -2%. With the index hovering around 23–25 by his remarks, the probability-weighted math is sobering for passive buyers extrapolating 10% forever.

What’s a realistic alternative?

For the non-professional, Marks suggests rule-based rebalancing—or a shift toward bonds. High yield in the US/Europe at 7–8% offers a contractual return if issuers pay as promised (and creditors have recourse if they don’t). Yes, coupons are taxed annually, but for “cautious” investors this can compare favorably to equities’ uncertain path, especially when starting valuations are rich.

It’s a mix, not a switch

Marks rejects binary “buy/sell” TV framing in favor of an aggressive–defensive spectrum—think a portfolio speedometer. Know your normal setting. If you’re naturally conservative, own a bit less S&P and more credit today. The aim is not prediction; it’s positioning.

How cycles rhyme—not repeat

Marks’ well-known stance: “We never know where we’re going, but we should know where we are.” He doesn’t forecast; he reads behavior. In 1999, reading “Devil Take the Hindmost” and observing dot-com euphoria—day trading, profitless companies at high valuations—he published “bubble.com” on January 2, 2000. It was “right, and right fast.” The lesson: patterns in human nature recur.

Acting against human nature

“When the time comes to buy, you won’t want to.” Major bottoms coincide with the worst news flow, maximal uncertainty, and scathing headlines. The battlefield hero analogy applies: courage is not lack of fear—it’s doing the job anyway. Emotion is the enemy of discipline; unemotional execution is an edge.

2007–2009: preparing before panic

Oaktree didn’t raise capital during the crisis; you can’t, Marks says. Sensing pro-risk excess in 2005–2006, they asked clients on Day 1 of 2007 for three billion for distressed debt (closing Fund 7 at 3.5 billion) and set up a standby vehicle (7B) that later reached 11 billion. By September 18, 2008—Lehman’s bankruptcy—7B was 12% invested. The decision framework was stark: if they invested and the world melted down, nothing would matter; if they didn’t and the world held, they’d have failed their mandate. They deployed roughly 450 million a week in Fund 7 and about 650 million a week across Oaktree for 15 weeks. Returns were strong, if not a “barn burner,” as rapid policy response curtailed the bankruptcy wave.

Fewer losers beats more winners

Consistency compounds. Marks recounts a pension that stayed in the second quartile every year for 14 years—ending fourth overall. Avoiding blow-ups can trump occasional heroics. As he quips, Oaktree aims to be “always good, sometimes great, never terrible.”

On temperament and regret minimization

Marks candidly notes his personal bias: “too conservative,” shaped by Depression-era parents. He may have earned more in riskier asset classes, but his conservatism fit credit’s downside-aware profile and enabled client trust when pioneering high yield and distressed.

A simple checklist for now

Three common errors: thinking you can know the future; assuming today’s winners will keep winning indefinitely; letting emotions dictate actions. His “poor man’s guide to market assessment” looks for heat: are deals easy, oversubscribed, and is investing popular on TV? Or is the market shunned, deals begging, and investors ignored at cocktail parties? Answer clinically; adjust your mix accordingly.

Analysis & Insights: Framing the Mix

Growth & Mix: turning cycle-awareness into allocation

The central growth insight is not about sectors but about starting points. If the index is purchased at a P/E of 23–25, the forward 10-year annualized return has historically clustered near 0%—a stark contrast with the oft-quoted ~10% “long run.” A modest tilt from equities toward credit can preserve compounding by exchanging uncertain equity growth for contractual coupons in the 7–8% range. That mix shift is small in headline terms but large in expected outcome dispersion.

Marks’ “speedometer” makes this implementable. Investors who are usually at 65 on the aggression dial might consider 55 today: still exposed to upside, but with more ballast from high-yield. The mix lever matters more than a heroic security pick—especially when crowd enthusiasm and elevated multiples narrow the equity risk premium.

Profitability & Efficiency: margin of safety via price and terms

In equities, today’s high multiple pulls future returns forward, effectively demanding strong margin expansion or persistently benign psychology to sustain price. In credit, yield is locked in if covenants and recoveries hold, and the “unit economics” of a bond are simple: price paid, coupon received, principal returned. This is efficiency by design—less need for perfect execution to meet a hurdle, more reliance on underwriting discipline and diversification to avoid impairment.

Put differently: the equity “margin of safety” must be earned through growth and multiple stability; the credit “margin of safety” is pre-negotiated in coupons, ranking, and documentation. In an environment where behavior (not business quality) is the main risk, that structure can be the cleaner path to acceptable, if unglamorous, compounding.

Cash, Liquidity & Risk: pre-positioning beats prediction

Oaktree’s GFC cadence is a liquidity masterclass. Capital was raised in advance (Fund 7 at ~3.5 billion; 7B later at ~11 billion). By Sept 18, 2008, 7B was only 12% invested—dry powder intact when prices broke. Deployment then ran roughly $450M/week in Fund 7 and $650M/week across Oaktree for about 15 weeks. The lesson is portable: build flexibility before the turn, then execute mechanically when fear is highest.

Rate and spread sensitivity cut both ways. If yields fall, bonds rally and coupons become more valuable; if spreads widen, reinvestment improves for new capital. Equities are similarly rate-sensitive through multiples, but with an added behavioral amplifier. For investors seeking to minimize regret, partial credit tilts neutralize some of that amplifier without exiting the game.

| Mix | Equity / Credit | Pre-tax return if Equity = 10% | Pre-tax return if Equity = 1% | After-tax approx. (Eq = 7%, HY = 4%) |

|---|---|---|---|---|

| Aggressive | 70% / 30% | 9.4% | 3.1% | 6.1% |

| Dialed-Down | 55% / 45% | 9.1% | 4.2% | 5.7% |

| Defensive-Credit | 40% / 60% | 8.8% | 5.2% | 5.2% |

Interpretation: When equity returns compress toward the 0–2% band implied by high starting P/Es, mixes with higher credit weights can deliver comparable or better total returns with less path dependency. If equity achieves the long-run ~10%, aggressive mixes win—but the valuation starting point argues for humility.

Quotes

“We never know where we’re going, but we should know where we are.”

“When the time comes to buy, you won’t want to.”

“The riskiest thing is believing there’s no risk.”

“Always good, sometimes great, never terrible.”

Conclusion & Key Takeaways

- Starting valuation matters: at an S&P 500 P/E of 23–25, the odds-weighted 10-year return skews toward ~0–2%, making blind extrapolation of ~10% perilous.

- Dial, don’t flip: moving from an aggression “~65” to “~55” with more high-yield at 7–8% can stabilize compounding without abandoning equities.

- Structure over story: credit’s contractual cash flows and seniority provide a practical “margin of safety” when behavior—not fundamentals—is the dominant risk.

- Process wins in crises: pre-committed capital and weekly deployment discipline—$450M–$650M pace—beat ad-hoc bravery when fear peaks.

- Near-term catalysts to watch: a shift in the S&P 500 P/E multiple, moves in high-yield spreads/yields, and clear changes in risk appetite (deal ease, oversubscriptions , and investing’s popularity on TV) that help locate where we are on the aggressive–defensive spectrum.