Quick Summary

- **3,600** expected HNWI arrivals in 2025, with about **$21B** in private capital (≈ **$5.83M** per person).

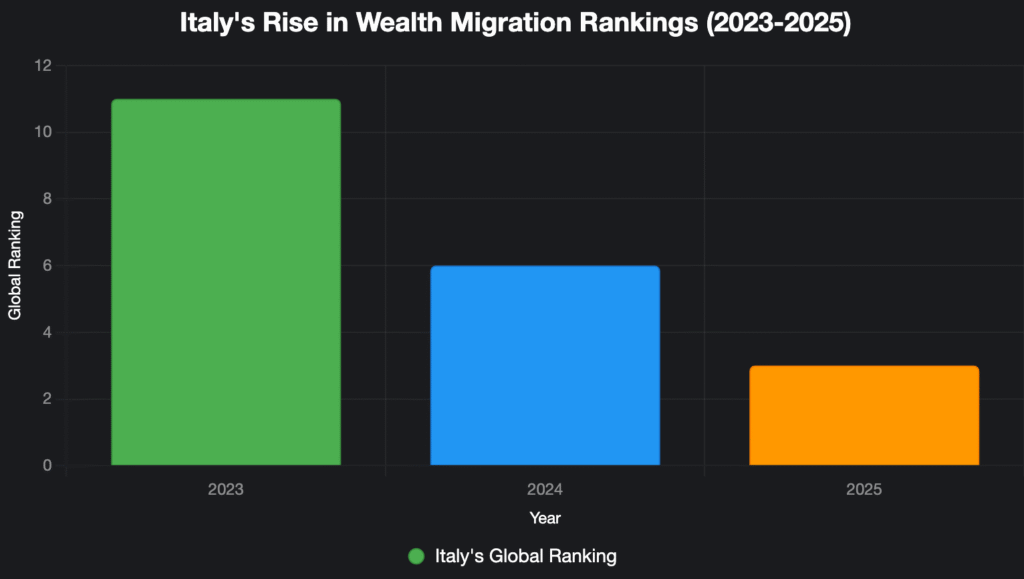

- Italy’s destination rank jumped from **11 → 6 → 3** in 2023–2025.

- **Milan prices +49.0%** since 2017 (vs **+10.9%** elsewhere); **3.5%** prime growth expected in 2025.

- Flat tax raised from **€100,000** to **€200,000** in 2024; UK **non‑dom abolished** in 2025 (projected **£12.7B** in 5 years).

Introduction

Lake views, alpine backdrops, and espresso at dawn—Italy’s allure is timeless. But beyond the romance lies a modern migration story: a new wave of high‑net‑worth individuals (HNWIs) relocating for tax simplicity, lifestyle, and investment opportunities.

In 2025, Italy ranks among the world’s top destinations for mobile wealth. The country’s package—clear tax rules, vibrant city life, and enviable geography—has drawn the attention of entrepreneurs, investors, and family offices. This report connects the policy choices to the numbers and the neighborhood impacts, from Milan’s design‑forward districts to the villas above Lake Como.

Summary Statistics

| Metric | Value |

|---|---|

| Estimated HNWI arrivals (2025) | 3,600 individuals |

| Estimated capital inflow | $21 billion |

| Avg capital per HNWI | $5.83 million |

| Destination rank by Henley & Partners | 2023: 11 → 2024: 6 → 2025: 3 |

| Flat tax regime | €100,000 (2017–2023) → €200,000 (2024+) |

| Milan home prices since 2017 | +49.0% (vs +10.9% across other big cities) |

| Prime Milan price forecast (2025) | +3.5% |

| Lake Como price outlook | +3–4%/yr (near-term) |

| UK non‑dom abolished (Apr 2025) | Projected +£12.7B over 5 years |

| Greece alternative regime | €100,000 flat tax + €500,000 investment |

Note: Figures reflect estimates from the provided brief and industry commentary. Values reconcile with the analysis below.

Analysis & Insights

Over the past decade, the global rich have become far more mobile. In 2024, cross‑border relocations by millionaires reached record highs, and the momentum is set to continue into 2025 and 2026. Italy has emerged as Europe’s standout beneficiary—climbing investor‑migration rankings from **11th in 2023** to **6th in 2024**, and **3rd in 2025**. In practical terms, analysts expect **about 3,600 HNWIs** to establish residence in Italy this year, potentially bringing **roughly $21 billion** in private capital—an average of about **$5.83 million per person**. Those inflows may not reshape a G7 economy overnight, but they matter for select sectors, from luxury real estate and private equity to hospitality and high‑end retail.

A major catalyst is the **flat tax regime** introduced in 2017. The policy offers eligible new residents a straightforward, annual levy on foreign income: **€100,000** originally, then raised to **€200,000** in 2024 after public debate. For prospective movers facing much higher marginal tax rates elsewhere, the appeal is clear—clarity and simplicity. While the increase doubled what an individual pays, its effect was more like raising the price of an everyday staple: painful in theory, negligible in behavioral terms for those already contemplating a move. Demand persisted, and government receipts rose.

Policy, of course, is only part of the draw. Italy’s economic development strategy—evolving from **Industria 4.0** to **Transizione 5.0**—has layered in generous tax credits and accelerated depreciation for investments in green and digital infrastructure. The narrative of return is as compelling as arrival: entrepreneurs with Italian roots who built global brands abroad are opening hubs in Milan, Florence, and Venice, connecting local talent with international deal flow. The result is a reinforcing loop: more capital, more projects, more visibility.

Real estate is where the story becomes most tangible. Since 2017, **Milan’s home prices are up about 49%**, far outpacing the **~11%** increase across Italy’s other major cities. Prime property in Milan is expected to climb another **3.5% in 2025**, reflecting deep local demand, limited supply, and the city’s status as Italy’s financial and creative hub. Just up the road, **Lake Como** has reached all‑time highs; brokers expect **3–4%** annual gains in the near term as buyers chase one‑of‑a‑kind views. These are not purely investment decisions—many buyers are choosing homes that fit a vision of life first, and doing the math second.

Italy’s rise occurs as other countries **tighten** rules on the ultra‑rich. France has debated a tougher wealth tax; Switzerland has floated changes to inheritance taxation. The most dramatic shift happened in the United Kingdom in **April 2025**, when the centuries‑old **non‑dom regime** was abolished and replaced with a new residency framework, projected to raise **£12.7 billion** over five years. Advocates argue this will broaden the tax base; critics warn it could accelerate capital outflows and dampen investment. Either way, the policy shock has put Italy on the shortlist for mobile capital looking for a new European home.

Globally, investor migration programs have multiplied: between 1980 and 2022, **citizenship‑by‑investment (CBI)** and **residence‑by‑investment (RBI)** schemes roughly **quadrupled**. Italy stands out because its approach is administratively simple—no mandatory real‑estate purchase or large capital lock‑up. By contrast, **Greece’s** flat‑tax framework combines a **€100,000** levy with a **€500,000** investment requirement (property or local equities), which changes the calculus for some families.

What does this mean for the Italian economy? The benefits are concentrated but real. Luxury hospitality, design, legal and financial services, wellness, and premium retail all see uplift as new residents settle into routines. High‑profile events can inject meaningful—if temporary—spend into specific cities. Yet the gains also bring trade‑offs. In tight local housing markets, fresh demand can price out residents—especially where wages lag. The **distribution** of benefits matters: Milan and Lake Como may boom while other regions see less of the pie.

Critics also worry about the **long‑run tax base**. A flat levy on foreign income helps attract mobile wealth, but it risks the perception of a two‑tier system and may deliver only modest revenues relative to Italy’s broader fiscal needs. Policymakers can mitigate this by nudging capital into productive channels—streamlined permitting for energy retrofits, incentives for R&D, or co‑investment vehicles for mid‑market firms. The more that foreign capital funds **new capacity**—not just passive asset appreciation—the stronger the case for the regime.

For other countries, Italy’s experience offers a design lesson. **Simplicity** is an edge: clear rules and predictable treatment often beat complex, conditional schemes. But pairing attractiveness with **shared‑prosperity guardrails** is essential. Requiring—or at least strongly incentivizing—investments that create jobs and raise productivity can help align the interests of new residents with those of locals. The most durable regimes will balance openness with fairness, and growth with inclusion.

Conclusion & Key Takeaways

- Simplicity sells: A clear, predictable flat tax has propelled Italy to the top tier of global relocation destinations—even after the levy doubled.

- Real estate concentrates gains: Milan and Lake Como capture disproportionate benefits; complementary policies can help spread investment beyond a few hotspots.

- Design for durability: To keep public support, regimes should steer capital toward productive investment that expands capacity and jobs, not just asset prices.

Why Millionaires Are Flocking to Italy: A Deep Dive into Wealth Migration

In recent years, Italy has emerged as a magnet for the world’s ultra-wealthy, drawing millionaires and billionaires with its picturesque landscapes, investor-friendly policies, and a tax regime that’s hard to beat. From the serene shores of Lake Como to the bustling financial hub of Milan, the country is experiencing a surge in high-net-worth individuals (HNWIs) relocating to its borders. According to investment migration consultancy Henley & Partners, Italy is set to welcome approximately 3,600 HNWIs in 2025, bringing an estimated $21 billion in private capital. This influx is reshaping the country’s economy, real estate market, and societal dynamics, but it also raises critical questions about sustainability, inequality, and the long-term implications of such policies. This blog explores why Italy has become a top destination for the wealthy, the economic impacts of this trend, and what it means for the future.

Italy’s Flat Tax Regime: A Game-Changer for the Ultra-Wealthy

The cornerstone of Italy’s appeal lies in its flat tax regime, introduced in 2017 by the center-left government. This policy allows wealthy individuals to pay a flat annual tax of €100,000 (increased to €200,000 in 2024 for new arrivals) on their foreign income, regardless of its size. Unlike other countries with complex residency-by-investment programs, Italy’s system is remarkably simple: move your tax domicile to Italy, pay the flat fee, and your overseas income and gains are exempt from Italian taxes. This simplicity, coupled with the relatively low cost compared to tax burdens elsewhere, has made Italy a standout destination.

For context, countries like France and the UK have recently tightened their tax policies. In April 2025, the UK abolished its 200-year-old non-domiciled (non-dom) tax regime, which previously allowed residents with a permanent tax home abroad to avoid UK taxes on foreign earnings for up to 15 years. The new residency scheme is projected to generate £12.7 billion over five years, but critics argue it may drive wealthy individuals away. Similarly, France is debating an expansion of its wealth tax, and Switzerland is considering changes to its inheritance tax. Against this backdrop, Italy’s flat tax stands out as a haven for the super-rich.

The data underscores Italy’s growing appeal. According to Henley & Partners, Italy has climbed the global rankings for wealthy migration, moving from 11th in 2023 to 6th in 2024, and now 3rd in 2025, surpassing traditional favorites like Singapore, Australia, and Switzerland. Over the past decade, the number of HNWIs relocating globally has nearly tripled, with 2024 marking a record high, and Italy is capitalizing on this trend.

Economic Impacts: A Double-Edged Sword

The influx of wealthy individuals is transforming Italy’s economy, particularly in its real estate and business sectors. Milan, Italy’s financial hub, has seen property prices soar by 49% since the flat tax was introduced in 2017, compared to a modest 10.9% increase across other major Italian cities, according to real estate group Tecnocasa. Prime real estate in Milan is expected to grow by an additional 3.5% in 2025, per global property consultancy Knight Frank. Lake Como, a favorite among celebrities and billionaires, has also experienced double-digit price increases over the past five years, with projections of a steady 3-4% annual growth moving forward.

This wealth influx has tangible economic benefits. For example, high-profile events like Jeff Bezos’s wedding in Venice reportedly added $1.1 billion to the city’s economy. The presence of HNWIs has spurred growth in finance, private equity, hospitality, and other service sectors, creating jobs and boosting local economies. The flat tax regime itself has generated hundreds of millions of euros in government revenue, doubling after the 2024 tax hike.

However, these benefits come with challenges. Rising property prices, particularly in sought-after regions like Tuscany, the Italian Riviera, and cities like Rome, Venice, Florence, and Bologna, are pricing out locals, exacerbating wealth inequality. Wages have struggled to keep pace with housing costs, leaving many residents unable to afford homes in their own communities. Critics also note that much of this wealth is concentrated in specific areas, failing to trickle down to the broader economy. The Italian Court of Auditors has warned that the flat tax regime risks turning Italy into a tax haven, potentially undermining the country’s tax base without requiring HNWIs to invest locally.

Table: Italy’s Flat Tax Regime vs. Other Countries

| Country | Tax Policy for HNWIs | Key Features | Impact on Wealth Migration |

|---|---|---|---|

| Italy | €200,000 flat tax on foreign income (2024) | Simple, no investment required, exempts overseas income | Top European destination, 3rd globally in 2025 |

| UK | Abolished non-dom regime (April 2025) | New residency scheme taxes foreign income after 4 years | Potential outflow of HNWIs to countries like Italy |

| France | Proposed wealth tax expansion | Targets high-net-worth individuals to address inequality | Discourages wealthy residents, pushing them to Italy |

| Greece | €100,000 flat tax + €500,000 investment (2019) | Requires property or equity investment alongside flat tax | Attracts HNWIs but less competitive than Italy |

| Switzerland | Proposed inheritance tax changes | Historically low taxes but increasing scrutiny on wealth | Losing ground to Italy in global rankings |

A Broader Trend: The Global Race for Wealthy Migrants

Italy’s success is part of a broader global trend. Between 1980 and 2022, the number of citizenship-by-investment (CBI) and residency-by-investment (RBI) programs quadrupled, with countries like Malta, Grenada, Antigua, and Turkey leading the charge. These programs offer residency or citizenship in exchange for financial contributions, such as real estate purchases or tax payments, ranging from a few thousand dollars to $8-9 million. Italy’s flat tax system, while not requiring investment, aligns with this trend by offering a low-cost entry point for HNWIs.

Other countries are taking note. Greece introduced a €100,000 flat tax regime in 2019, but its additional €500,000 investment requirement makes it less attractive than Italy’s model. In the UK, lobbyists are advocating for an Italian-style flat tax to stem the outflow of wealth following the non-dom regime’s abolition. However, critics warn of a “race to the bottom,” where countries compete to offer the lowest taxes, potentially eroding public budgets and exacerbating inequality.

Chart: Italy’s Rise in Global Wealth Migration Rankings

The Allure of Italy: Beyond Taxes

While taxes are a primary driver, Italy’s appeal extends beyond financial incentives. The country’s lifestyle—epitomized by Lake Como’s serene views, world-class cuisine, and cultural heritage—attracts HNWIs seeking a blend of luxury and tranquility. Milan’s evolution from an industrial city to a global hub for finance, fashion, and creativity further enhances its draw. The city’s proximity to Lake Como and its role as a gateway to the Alps make it a prime destination for the wealthy.

Businesses are also capitalizing on this trend. For instance, Anna Cipriani, whose family founded the iconic Harry’s Bar in Venice, returned to Italy to establish a hub for entrepreneurs in Milan. The city’s transformation, fueled by policies like the Transition 5.0 plan (formerly Industria 4.0), offers tax credits and incentives for investments in digital and green infrastructure, further enticing HNWIs to relocate and invest.

Challenges and the Road Ahead

Despite its success, Italy’s flat tax regime is not without controversy. The policy’s simplicity, while attractive, has drawn criticism for failing to mandate local investment, potentially limiting its broader economic impact. The Italian Court of Auditors has cautioned that the country risks becoming a tax haven, with revenue from the flat tax—while significant—representing only a fraction of Italy’s public debt and deficit.

Moreover, the concentration of wealth in specific regions raises concerns about inequality. As property prices skyrocket, locals face housing affordability challenges, particularly in cities like Milan and tourist hotspots like Venice. The economic benefits of wealthy migration, such as job creation, are undeniable, but they must be balanced against these social costs.

Looking ahead, Italy’s model may inspire other nations, but it also highlights the delicate balance between attracting wealth and maintaining equitable growth. As global competition for HNWIs intensifies, countries must weigh the benefits of tax incentives against the risks of eroding their tax base and exacerbating inequality.

Conclusion

Italy’s rise as a top destination for the world’s ultra-wealthy is a testament to its strategic tax policies, vibrant lifestyle, and economic opportunities. The flat tax regime has positioned the country as a leader in the global race for wealthy migrants, driving significant economic activity in real estate, hospitality, and beyond. However, the challenges of rising inequality and concentrated wealth underscore the need for careful policy design. As Italy continues to attract millionaires and billionaires, its experience offers valuable lessons for other nations seeking to balance economic growth with social equity in an increasingly mobile world of wealth.